“Your Token Isn’t a Product Until the Law Says So”

You’ve got traction, tech, and maybe even a Telegram cult. But here’s the truth: your token isn’t a product until the law says it is. In the Web3 world, legal ambiguity doesn’t buy you time, it buys you exposure. For every founder racing to launch utility tokens, few pause to ask: utility for whom? Utility when? In a post-2022 landscape, compliance isn’t a blocker, it’s the backbone. Misclassify your token, and you’re not just risking investor lawsuits. You’re inviting a regulatory sledgehammer.

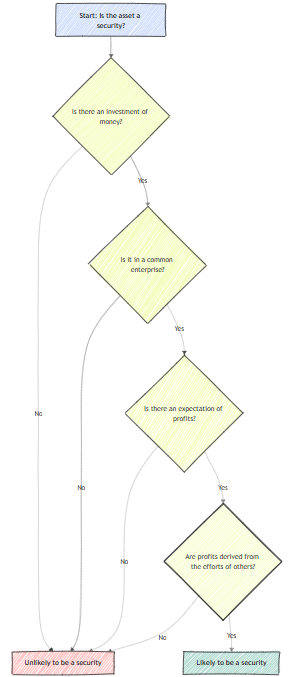

“The Howey Minefield: Are You Accidentally Issuing Securities?”

Here’s the cliff note version of the Howey Test: if people give you money, expect profits, and rely on your team to deliver them, congrats, you may have just issued a security. And no, slapping a governance label on it doesn’t change that.

Most founders trip on the second and third prongs. They confuse access with expectation, and underplay how centralized their roadmap still is. Even the SEC has warned that “ecosystem growth” as a value driver may trigger securities classification.

The fix? Reframe your token narrative early. Avoid future-tense promises in whitepapers. Anchor value creation in user participation, not speculative upside. And yes, a legal opinion letter is non-optional.

Not All Jurisdictions Are Friendly, But Some Are Smart

If your company and foundation are in the same jurisdiction as your user base and you haven’t checked if that jurisdiction has clear crypto guidelines, you’re already behind. Smart founders decouple operations from issuance.

Top jurisdictions like the BVI, Switzerland (via FINMA), and Singapore have published token frameworks. But clarity doesn’t mean immunity. U.S.-based contributors, VC structures, or token sales touching U.S. retail could still trigger SEC scrutiny.

Structuring is more than tax arbitrage. It’s legal surface area minimization. Set up a dual-entity model, separate token ownership from core team incentives, and ensure that your legal setup reflects economic substance, not just legal wrappers.

Designing Utility That Actually Passes Legal Scrutiny

Token utility isn’t what you intend. It’s what users experience.

To pass legal muster, utility must be immediate, functional, and independent of speculation. Think in-app currency, protocol access, or permissions for governance participation. Bonus if it’s non-transferable or soulbound initially.

Airdrops should be earned, not gifted. Participation mining (not liquidity incentives) builds better compliance optics. Use case precedents from projects like Helium or Arweave demonstrate that when tokens mirror actual user behavior, legal scrutiny softens.

The takeaway? If your token’s primary use case is price exposure, you don’t have a utility token. You have a lawsuit waiting to happen.

“KYC Isn’t a Buzzkill, It’s a Launchpad”

Contrary to popular belief, KYC isn’t the enemy of decentralization. It’s the enabler of scale.

Top-tier exchanges won’t list you without regulatory hygiene. Institutional investors won’t touch you without AML assurances. And regulators won’t ignore you just because your Discord thinks you’re a DAO.

Founders should integrate KYC at the infrastructure level: wallet whitelisting, compliance-aware token gating, and jurisdiction filters on participation. Use partners like Blockpass or Fractal ID early to reduce onboarding drag later.

Legal design should parallel UX design. Smooth compliance is a growth hack.

Case Study: How Solana and Filecoin Survived the Gauntlet

When Filecoin raised $257M through a Reg D and Reg S compliant SAFT in 2017, it was seen as a model. Yet its real success lay in patience: token unlocks tied to network utility, meticulous disclosures, and a layered entity structure.

Solana, similarly, built a U.S.-friendly brand while structuring token sales offshore. Their focus on validator onboarding, staking incentives, and early user engagement helped tilt the optics from speculative hype to network growth.

Both projects understood the same thing: compliance is not just about law. It’s about perception. And perception, in capital markets, is everything.

The Law Is Just Another Protocol, Design for It

Too many founders treat law as an afterthought, a cleanup operation post-token launch. But in 2025, the law behaves like code. It enforces, automates, and punishes blindly.

If you’re serious about launching a token, treat compliance like a protocol. Design for it. Test against it. And optimize it.

Because in Web3, legitimacy isn’t just earned through innovation. It’s earned through legality. And those who get that balance right won’t just survive regulatory storms, they’ll be the ones building in clear weather while others are still cleaning up.