What a time to be alive, NYSE just shows green light to Solana, Hedera & Litecoin Spot Crypto ETFs , the New York Stock Exchange (NYSE) is listing the spot exchange-traded funds (ETFs) for Solana (SOL), Hedera Hashgraph (HBAR), and Litecoin (LTC) this week.

This move marks the expansion of regulated crypto investment products beyond Bitcoin and Ethereum, signaling growing mainstream acceptance of altcoins. But, is this really growing the overall acceptance or just reducing the direct investments on altcoins and diverting it into yield generating instruments that leverage altcoins??

In this article we are going to answer this and explain why these are more or less two different things !!

First,

What actually launched:

| ETF (Ticker) | Issuer | Underlying | Features | Custodian(s) |

| Bitwise Solana Staking ETF (BSOL) | Bitwise Asset Mgmt. | Solana (SOL) | 100% SOL exposure; ~7% staking yield via in-house validator. | Bitwise/Helius (staking); custody details not public (likely Coinbase Prime or similar) |

| Canary Hedera ETF (HBR) | Canary Capital | Hedera (HBAR) | Spot HBAR exposure; will hold real HBAR tokens . Potential for staking if enabled (HBAR is PoS). | BitGo & Coinbase Custody |

| Grayscale Solana ETF (GSOL) | Grayscale | Solana (SOL) | Conversion from Grayscale Solana Trust to ETF . Spot SOL exposure (no immediate staking). | Coinbase Custody (for Grayscale products, typically) |

| Canary Litecoin ETF (LTCC) | Canary Capital | Litecoin (LTC) | Spot LTC exposure; first U.S. LTC ETP . No staking (PoW asset). | Not disclosed (standard custodial arrangements) |

Explaining the features,

An ETF(Exchange Trade Fund) is just a regulated wrapper that holds the asset (SOL/ HBAR/ LTC) with a qualified custodian, If the underlying token is PoS (like Solana & Hedera), the Fund can choose to stake the coins it holds.

When it stakes: Rewards flow into the fund, increasing Net Assets Value, which lifts overall yield including the underlying price fluctuations. Some funds even go one step further and setup their own validators and delegate tokens on them to earn an extra % Commissions, on PoS model.

Short-Term Price Reactions for the Tokens

The price chart for the token in this time period,

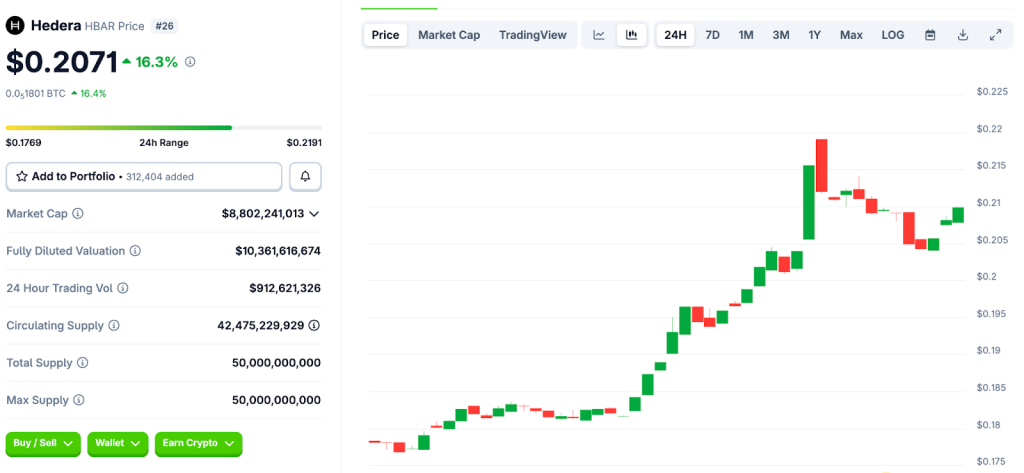

Hedra: $HBAR sees a 16.3% jump in just 24hr framework.

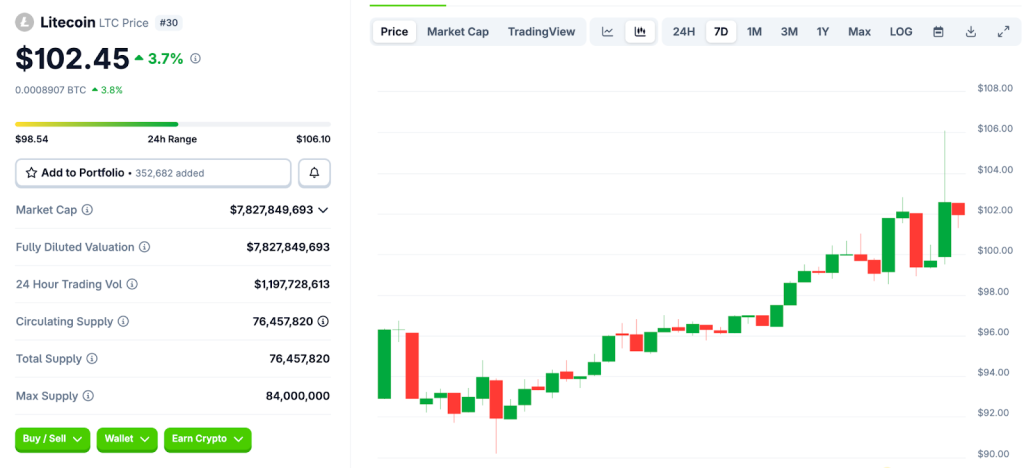

Litecoin: $LTC shows positive signs after this, but only moved a mere 3.7% over a week.

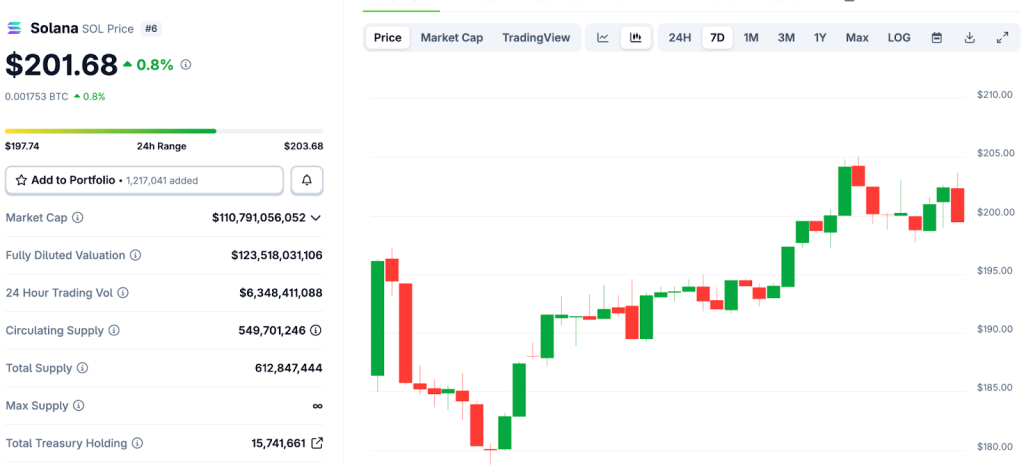

Solana: Solana shows near zero movement over the week, showing no such major impact of the news on the token price.

| Chain | TVL now | 7 Day TVL change | Net 24h Δ |

| Solana | $11.887B | +7.15% | +$21.36M |

| Hedera | $104.48M | +15.35% | +$10.76M |

But, overall all the tokens are up somehow, Why? Right after NYSE news, major DeFi investors’ sentiment went flying and they started buying heavily. Defilama data clearly shows increment in the TVL for all the three tokens during this time period, this brings to our native question.

Will ETFs suppress direct altcoin investing, in the long term?

In short, yes, they’ll divert some share,but not kill it, and it completely depends on the builders & the project itself. We can think, this will create a kind of three investor buckets:

- TradFi allocators (biggest new cohort): These Investors overwhelmingly prefer ETFs. Net new dollars from this group mostly bypass exchanges and wallets, so yes—direct buying loses market share to ETFs.

- Crypto-native users/builders: They’ll keep using on-chain tools (staking, DeFi, NFTs, governance) because ETFs can’t deliver utility—just an yield generating tool/instrument (plus maybe staking yield inside the wrapper).

- Crossover Retail / Normal User: This group will split—start with Investing in ETFs for simplicity & profits; then “graduate” on-chain when they want yield variety, airdrops, DeFi access, or governance rights.

So basically, ETFs expands the pie by accessing traditional investors to come but re-route early flows through custodial/adoption pipes. That can lift prices while underfeeding on-chain metrics in the near term.

Over time, networks that pull ETF Owners / Normal users into native experiences like, airdrops, DeFi access, or governance rights will be able to leverage these ETFs properly. For that it’s the network/project responsibilities to make the product offering appealing, create smooth UI/UX, remove blockers and make the transition friction free. In that case we can say yes Altcoin ETF’s can bring Altcoin & defi adoption.

So talking about each specific token in long term:

- Solana(SOL) : Biggest winner near-term from this. A staking ETF locks supply + compounds yield inside the wrapper (~7% in this case). There will we a net +ve 7% from yield and the rest will depend on the price fluctuations.

- Hedera (HBAR) : The chain is POS, but the Corresponding ETF will not be staking so missing out on yields. But there’s an option to opt staking in future to generate extra yield on the table.

- Litecoin (LTC): The yields generated on this will be completely price exposure (no staking). ETF helps keep LTC in the index conversation and unlocks new allocators, but it won’t boost on-chain usage by itself.

Conclusion

ETFs are the front door for mainstream capital. If you only care about price beta & yields on capital. Real risk is when too much stake and liquidity sits in few custodial ETFs, networks face governance and validator concentration pressures, which is obvious.

Real opportunity & growth is when chains and ecosystems bridge ETF holders back on-chain with token-holder perks, great Dapps ecosystem through which these yield savvy investors turn to web3 and looks out for real utility and use cases. That’s when real adoption via ETFs will happen.