Finally Indian traders can take a relief after a whole year of their funds being stuck. In late October 2025, India’s WazirX crypto exchange announced it would resume trading on October 24, ending a 16-month long outage caused by a massive hack in mid-2024 .

Let’s dive into to know what happened and ask the real question: even with most funds back, has user trust really returned?

The 2024 Cyberattack

In July 2024 WazirX was exploited by the North Korean Lazarus Group. Hackers stole roughly $230–240 Mn from WazirX – almost half of the exchange’s reported ~$500 Mn assets at the time. The breach froze user funds and forced WazirX to suspend all withdrawals and trading. Over the next year the company underwent a court-supervised recovery process. Its Singapore-based parent company Zettai proposed a “socialized loss” restructuring (spreading losses across users) and sought approval through a scheme of arrangement.

After a series of hearings, the Singapore High Court finally approved the restructuring plan on Oct. 13, 2025 . Under that plan, affected users are to receive recovery tokens and partial repayments from remaining assets (with a goal of making about ₹4,000 crore accessible).

Approximately 25% of tokens will be enabled each day from Oct. 24 to 27, getting a fully operating platform by 27th Oct.

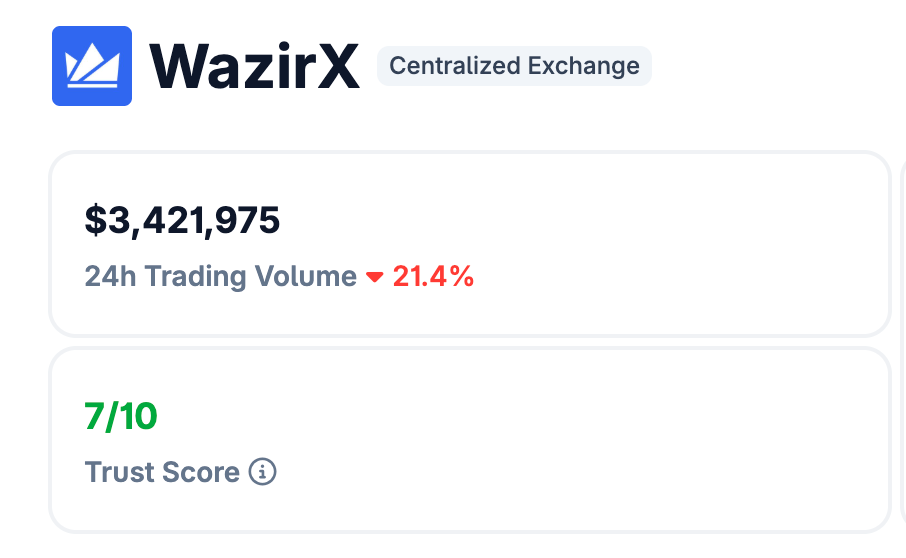

Source: Coingecko

Currently the volume on the app is around $3.4Mn, apart from that the trust score is also showing 7/10

What is the effect of the Relaunch

Let’s be real there had been a number of security breaches that triggered financial troubles, for example:

Mt Gox almost lost 850k Bitcoin in 2014 then there is QuadrigaCX, whose founder scams and left $190Mn inaccessible. FTX collapsed in 2022 & Cryptopia was hacked in 2019, none of them have come back online & take the responsibility for the losses, but wazirX is the only exchange that has been able to get back on its feet again.

I myself lost a decent amount of funds and it was inaccessible for more than a year, but I got almost 80% of my funds back after the reallocation, which I thought I never will be getting!!

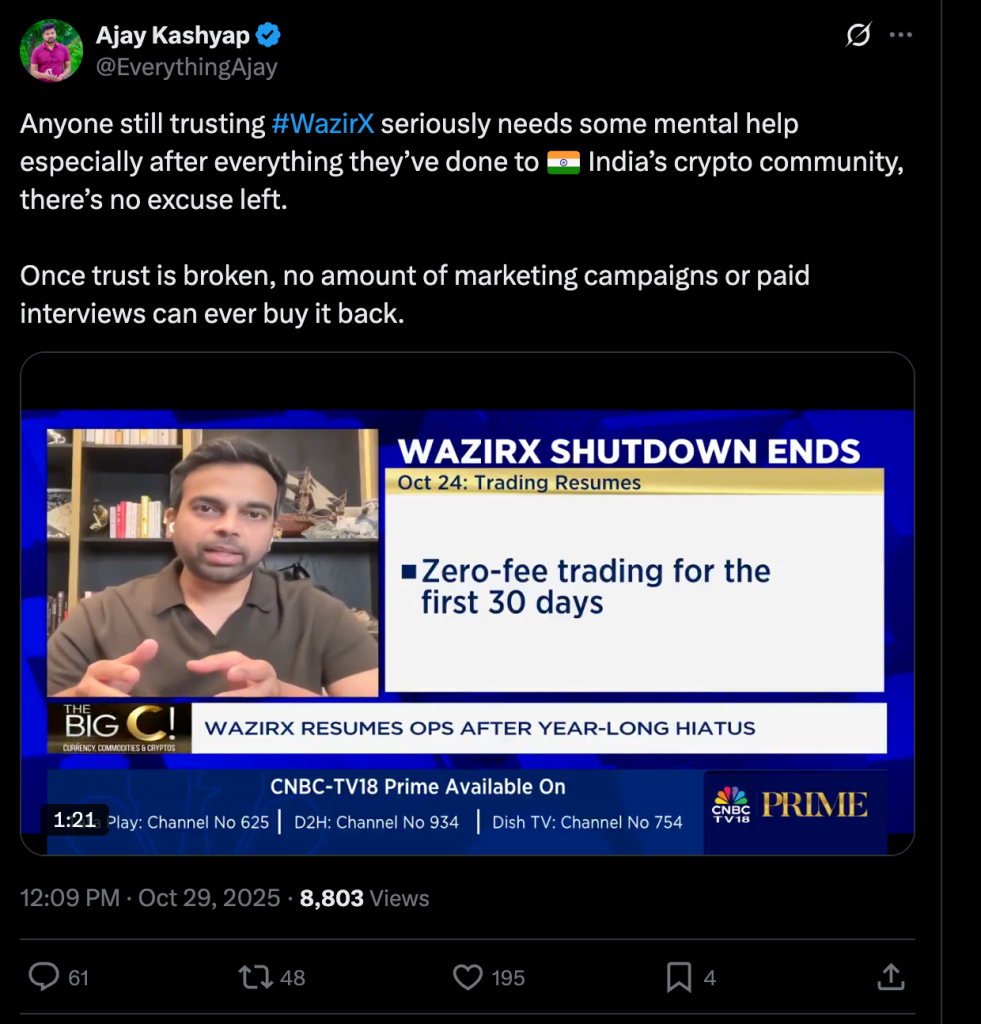

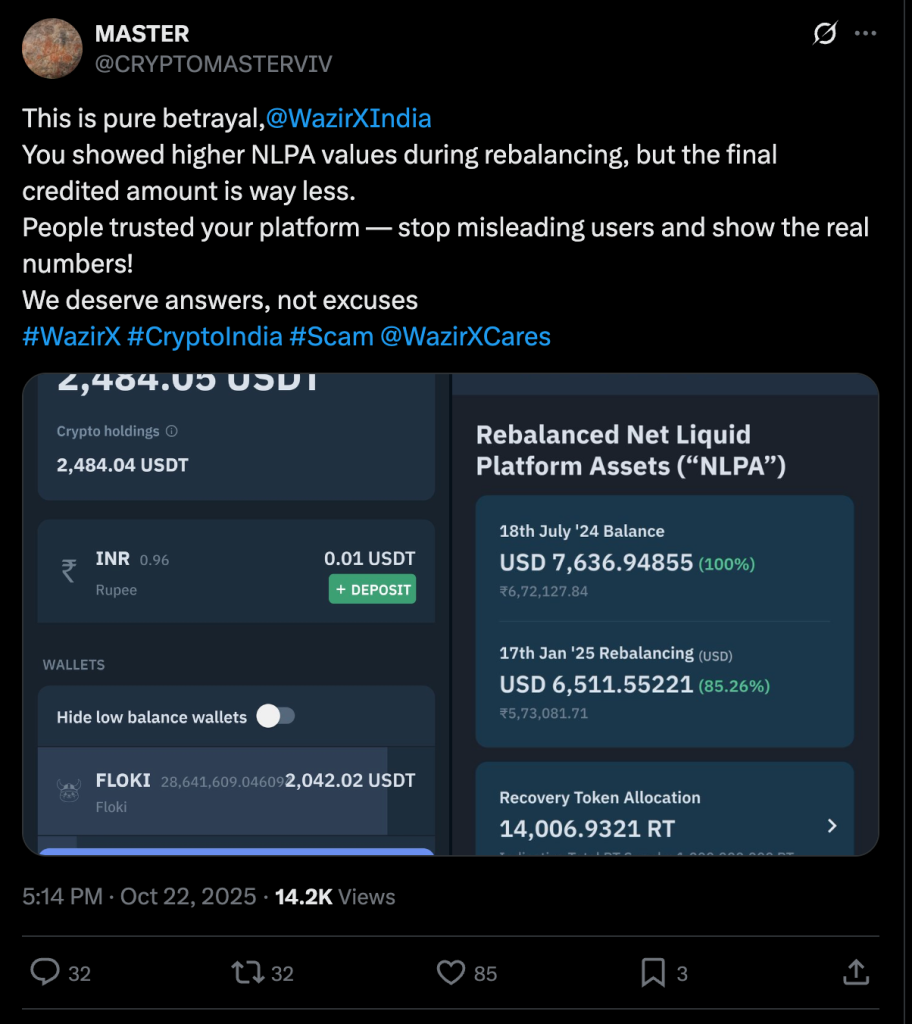

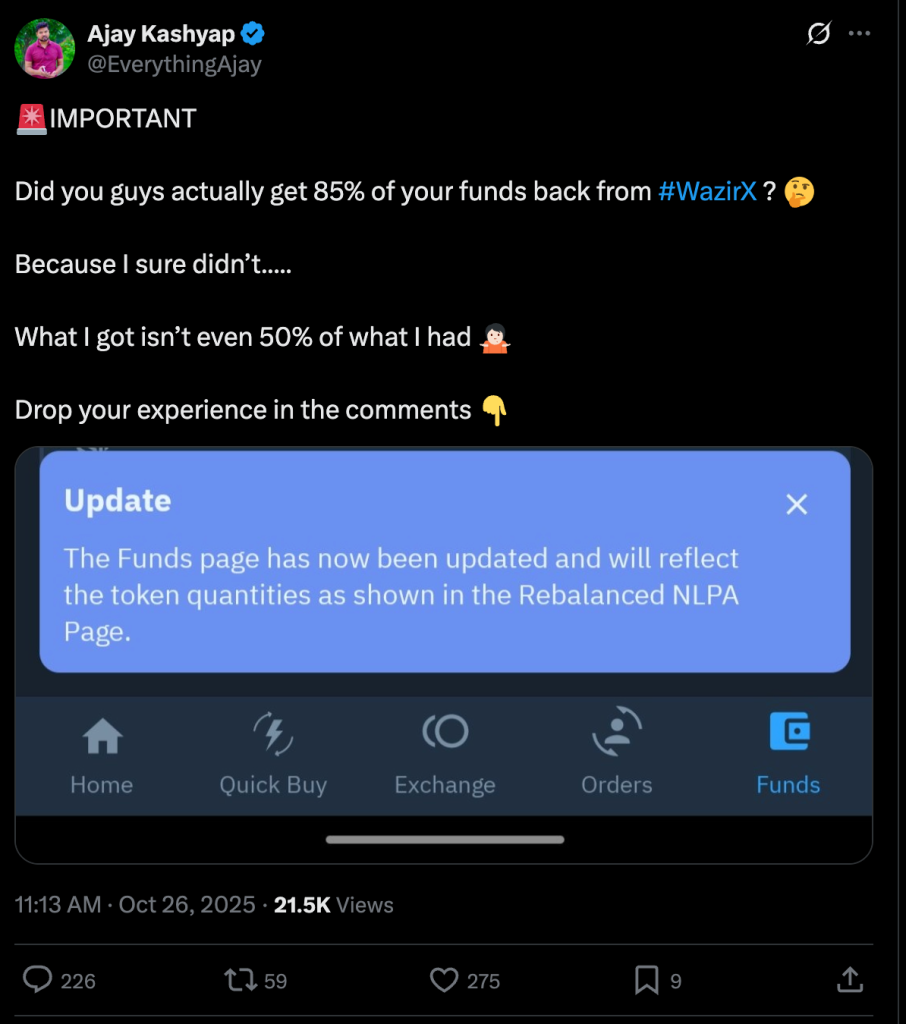

But people are having mixed feelings & Response about it and mostly its negative:

This is because there is still a significant shortfall. Reports estimate about 15% of funds remain missing after accounting for recoveries. This gap means some users will see permanent losses, which can hurt confidence. Adding to that some glitches are also present like some user’s funds are still stuck or they have received much less allocations then it was showing in the reallocation meter.

Conclusion

Since a long time India’s crypto landscape has been volatile: repeated exchange hacks and strict policies (30% Crypto Gain Tax & KYC rules) have made users wary. While the relaunch is welcome, it “will test whether India’s retail crypto community still trusts local exchanges” after past failures  . (Indeed, WazirX itself acknowledges it must “rebuild trust” in a market that was blown off .)

In short, WazirX has taken bold recovery steps – major funding, new security partnerships with BitGo, and clear communication – to restore confidence. But the legacy of the hack means some users will need to see actual fund reimbursements before full trust returns. As CoinSwitch co-founder Ashish Singhal put it, the industry’s priority should be “ensuring that user funds are fully recovered and protected” when evaluating exchanges . WazirX’s next months on the market will be a critical proof point: if it meets its withdrawal timeline and honors the restructuring promises, it could probably re-establish its reputation.

Conversely, any mishap or further delay could increase user distrust.