Perps, or perpetual futures, are recently seeing huge inflows in volume. In this article we are covering what are Perp Dex, the current major DEXs & what was the impact of the recent liquidations on these perps, let’s go!!

Perp are basically derivative contracts that allow traders to speculate on the price of crypto assets without actually owning them. Unlike traditional futures, they don’t have an expiry date—you can hold your position as long as you want,often with leverage of 50x or more, on liquidation the position is partially or fully closed depending on the margins. Unlike spot markets, perps enable long and short positions across crypto assets, real-world assets (RWAs like gold or oil), and beyond

Example, How Traders Profit or Lose, Imagine Bitcoin is trading at $100,000.

- If you go long on Bitcoin perpetual futures at $140,000, you’re betting the price will rise.

- If it does, you profit on the difference.

- If it falls instead, you take a loss.

That’s the essence of perps: flexible tools for traders who want exposure to market moves without holding the asset itself.

Perps went from side-quest to main arena

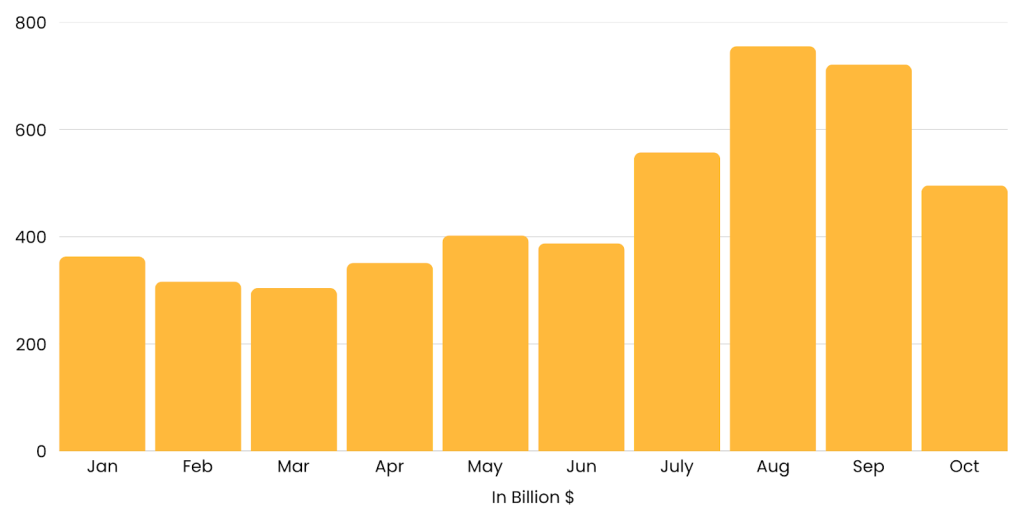

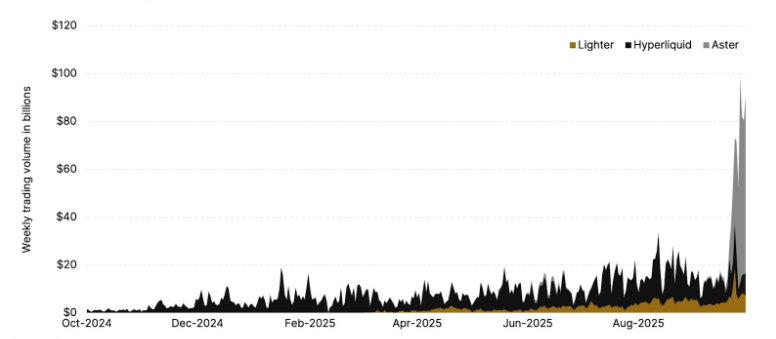

Perp DEX volumes set a record >$1T in September 2025, led by a handful of projects. That’s not noise—that’s institutional-sized flow learning to live Onchain.

As of today, DeFi Llama’s perp dashboard shows ~$929B 30-day volume, exceeds $100 billion by the first week of October 2025 and ~$17B Open Interest across DEX perps—a scale that used to be “under CEX only.”

So far in 2025, perpetuals account for 75% of total CEX trading volume, generating nearly $49 trillion — far ahead of $14.8 trillion in spot and $1.3 trillion in options, compared with 72% in 2024

(Open Interest : the total size (usually in USD ) of all live derivatives positions (perpetuals/futures) that haven’t been closed or liquidated yet) it varies for oracle type/

Perpetual Protocol Trade Volume

The Perp Wars: Hyperliquid vs. Lighter vs. Aster

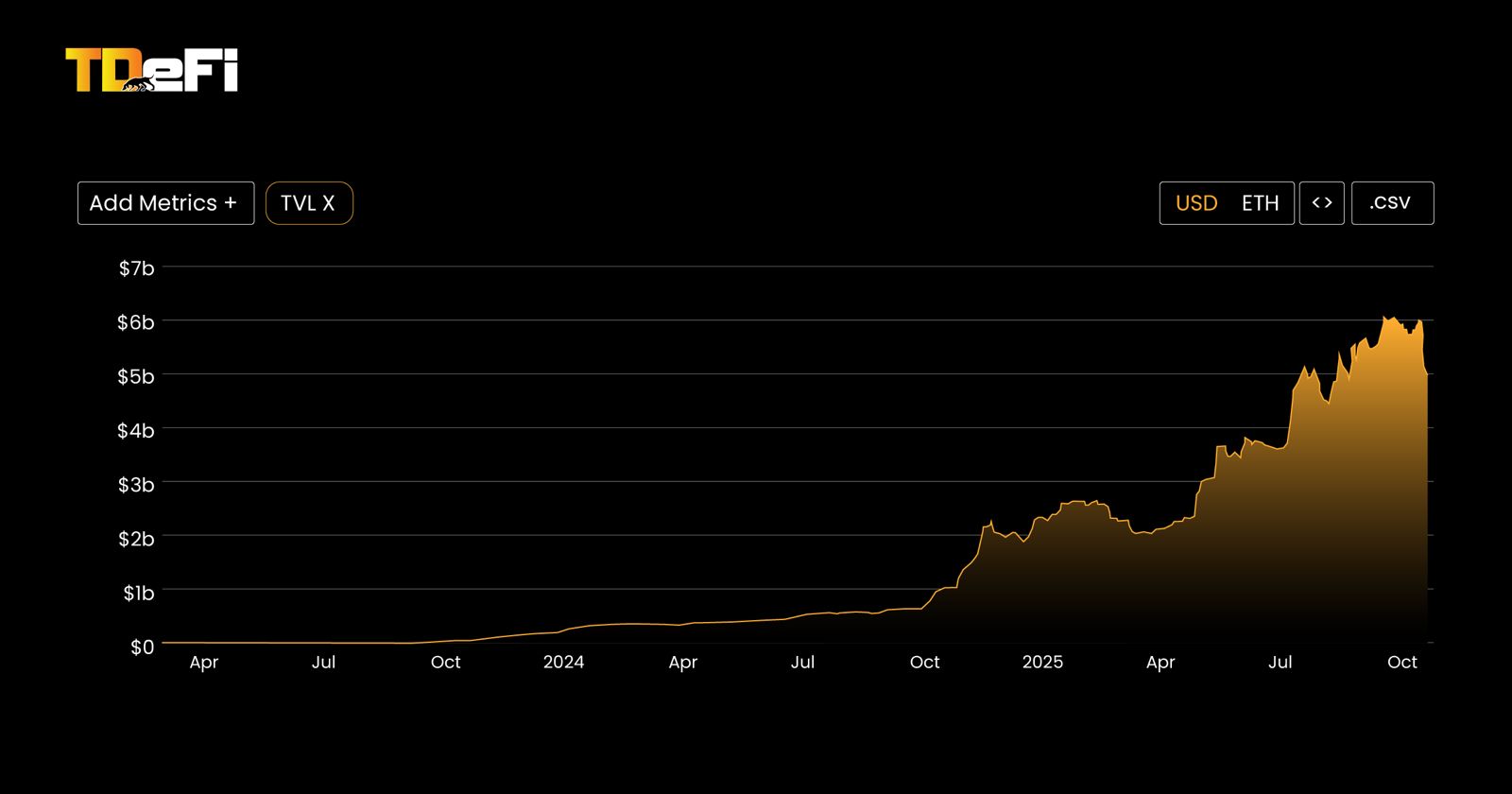

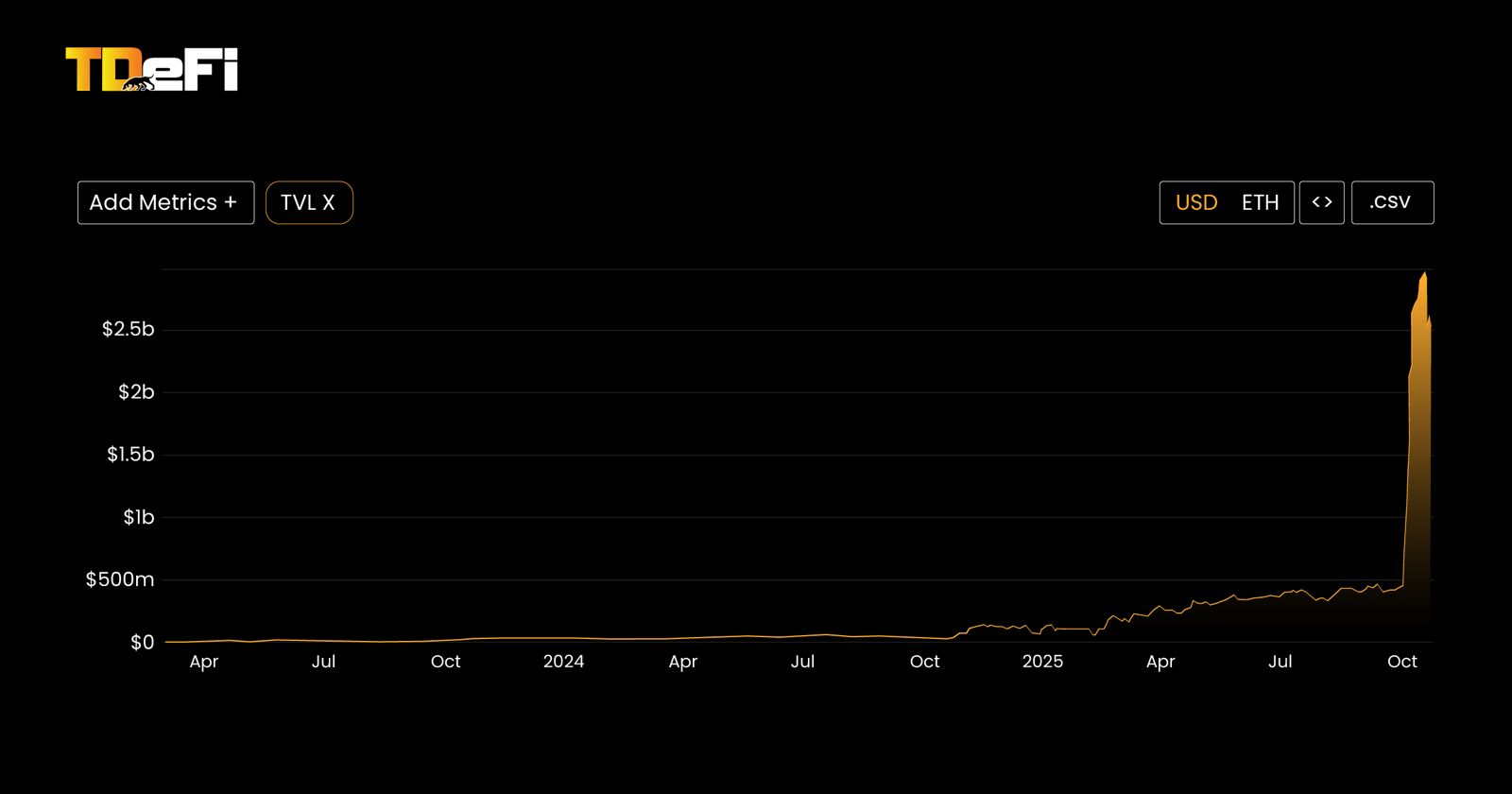

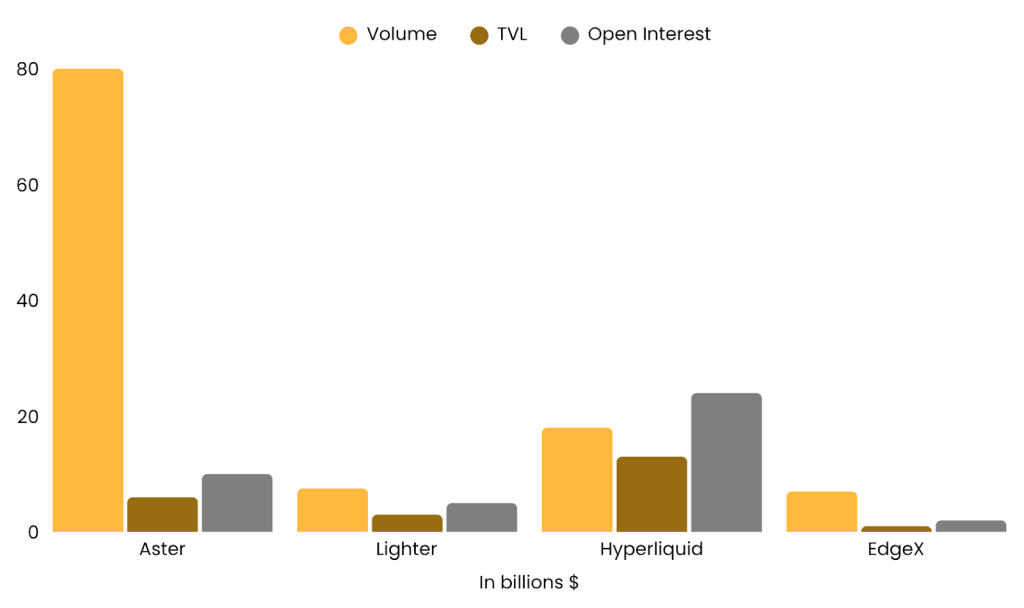

In this explosive evolution over the last 12 months for Perp Dex, Hyperliquid was the undisputed leader, commanding around 70% of market share. But by October 2025, its dominance had declined as Aster and Lighter entered the scene.

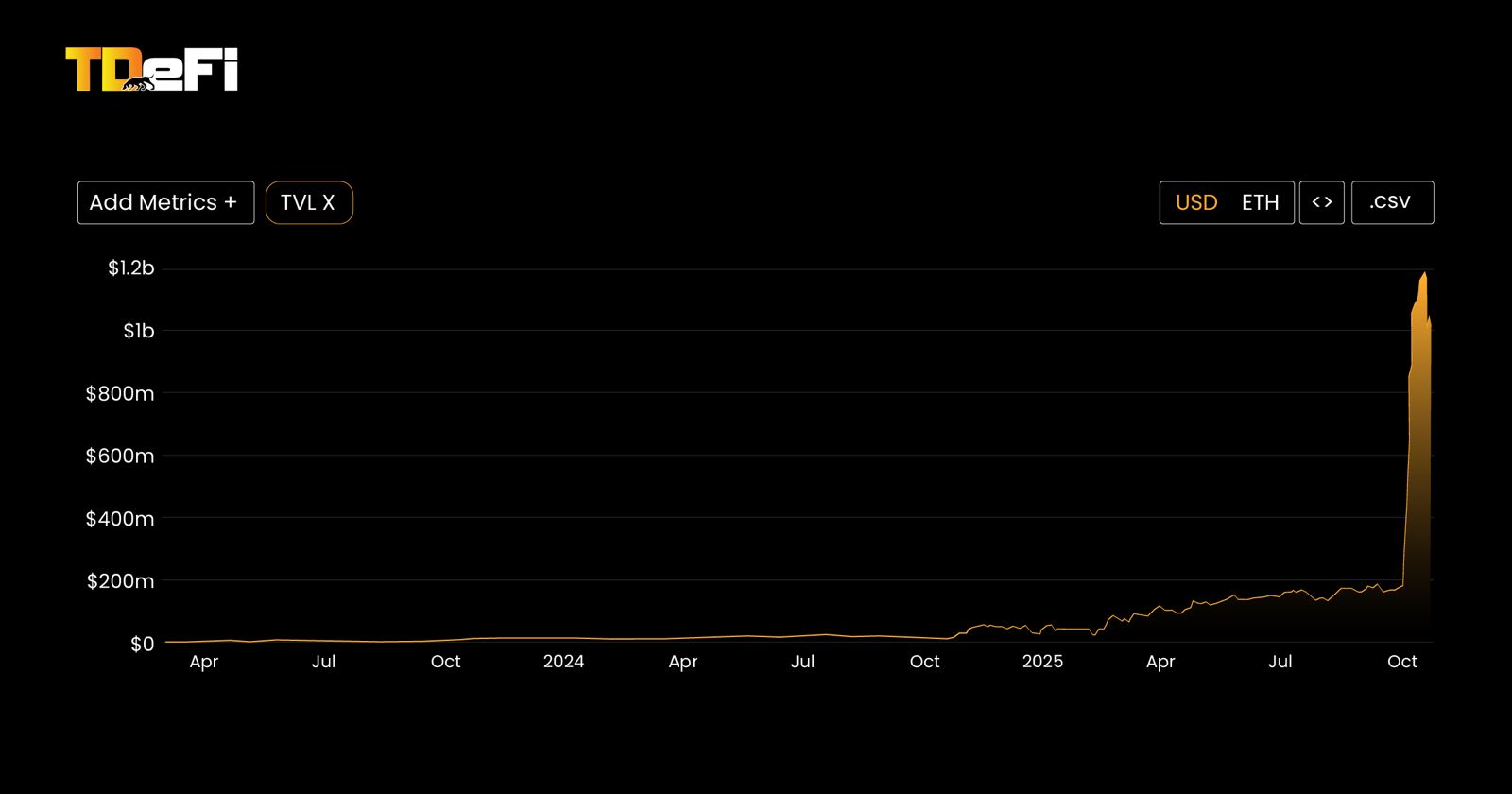

Perp DEXs have started in September 2025 with a major shift in dynamics. Hyperliquid’s share slipped to about 10%, Aster dominated with nearly 70%, and Lighter, still in private beta but newly live on mainnet as of October, captured 15%.

- Hyperliquid sustains daily volumes of $10–15 billion, signaling consistent though moderated activity. Still, its open interest remains more than four times greater than Aster’s as it offers $13.5 billion vs $3 billion for Aster.

- Aster surged dramatically, leaping from around $1 billion in late September to more than $70 billion by the end of the month, making it the clear market leader by raw trading volume.

- Lighter, which remains invite-only but launched its mainnet on October , processes roughly $8 billion each day, highlighting strong momentum before a wider rollout.

Why did this much volume change? traders are actually choosing perps Onchain !!

- Execution: As Perps bring innovation it matures the infrastructure beneath it, faster settlements, less slippage etc, because of which traders have a much more smooth trading experience, compared with other DEXs like dydx which still are not able to scale.

- Fees/funding: In CEXs hefty amount is being allocated to the exchange to list the token, but in perp dex all that amount directly goes to the community pool.

- No middle layer: No KYC is required & the funds are in self-custody

Aster Dramatic Growth

Despite Aster’s remarkable rise, Onchain data suggests its volumes may be artificially inflated. The protocol’s volume to TVL ratio of >70 to 1 is far beyond the healthy 3 to 7 range seen across other DeFi platforms, signaling possible wash trading. (this raises lots of concerns)

Source: DeFi lama

This concern is reinforced by its sudden 10 times spike in daily volume within a single week, an adoption curve difficult to reconcile with organic growth.

Risk engines & liquidations (How was there performance in the latest crash!!)

As we all know the recent liquidation was one of the largest liquidations in crypto history let’s see how major perps performance was affected!!

1) Hyperliquid — “held up” (but autodeleverage triggered)

- Operations: The team says 100% uptime and zero bad debt through the chaos; they also noted it was the first cross-margin ADL event since launch.

- Why it survived: On-chain orderbook with strict margining and a documented ADL queue that closes winners at prior mark to prevent platform loss (see formula above).

2) dYdX v4 — “stumbled” (chain halt during peak)

- Operations: dYdX mainnet halted on Oct 10–11 and later resumed after validator coordination.

- Risk model: dYdX’s default flow is liquidation → insurance fund (liquidation penalties feed that fund), with a fallback ADL if insurance can’t cover. The v4 docs/blog explicitly describe this ladder.

3) Lighter — “messed up” (hours-long outage, buttons not working)

- Operations: Lighter reported a ~4.5-hour outage during the selloff and later outlined compensation for affected users.

- Why it failed: Database / throughput bottlenecks under extreme TPS—classic infra scaling pain during liquidation cascades.

Practical routing: how to choose where to trade or list

Perps are getting VC attention now, VC interest in perp DEXs isn’t new — but it’s heating up again because of the recent volume figures.

“The infrastructure stack itself has matured — faster execution layers, more reliable oracles, cheaper settlement. “The space finally has proof a DEX can scale to billions — that unlocks venture appetite in a way we didn’t see last cycle,”

Boris Revsin, general partner and managing director of Tribe Capital said.

Perp DEX fundraising momentum is increasing.

“At least a couple of new perp DEXs a week are popping up,”. “There will definitely be more raises from the VCs that don’t already have at least one bet and feel like they’ve missed out.” said Mónica of Haun Ventures

If you need CEX-like speed with on-chain receipts: Hyperliquid’s L1 CLOB is battle-tested and still widely seen as the “fundamentals leader,” despite narrative swings. The project built a genuinely comparable experience to centralized trading — combining deep liquidity, high-frequency execution, and active community participation

If you prioritize verifiable operations and Ethereum custody: Lighter’s zk-verified matching & liquidations are a meaningful step for operational integrity. Early days, but the design targets “trust-but-verify” at the engine level.

Over the long run, the perp DEXs that endure will combine liquidity, sustainable tokenomics, and strong communities.