Hello readers, we all know a huge liquidation occurred at the end of last week. The crash was caused by a perfect storm of short-term factors, causing around $20 billion in liquidations — the worst 24-hour drain in crypto history.

COVID Crash: $1.2B

FTX Collapse: $1.6B

Recent Crash: $19.16B

That’s almost 20x bigger than the 2020 crash

In this Blog, we break down the chain reaction with numbers and points: where the leverage built up and how open interest/funding primed the move; how oracle issues and pricing errors accelerated it; the role of stablecoin dislocations and liquidity drains; and why treasury risk management (hedging runway, reducing protocol sell pressure) matters when volatility snaps. We’ll also assess user impact, separate signal from noise, and ask what the path forward looks like — including whether this was structural fragility or a solvable set of weaknesses.

The Day Liquidity Vanished: Direct Freefall

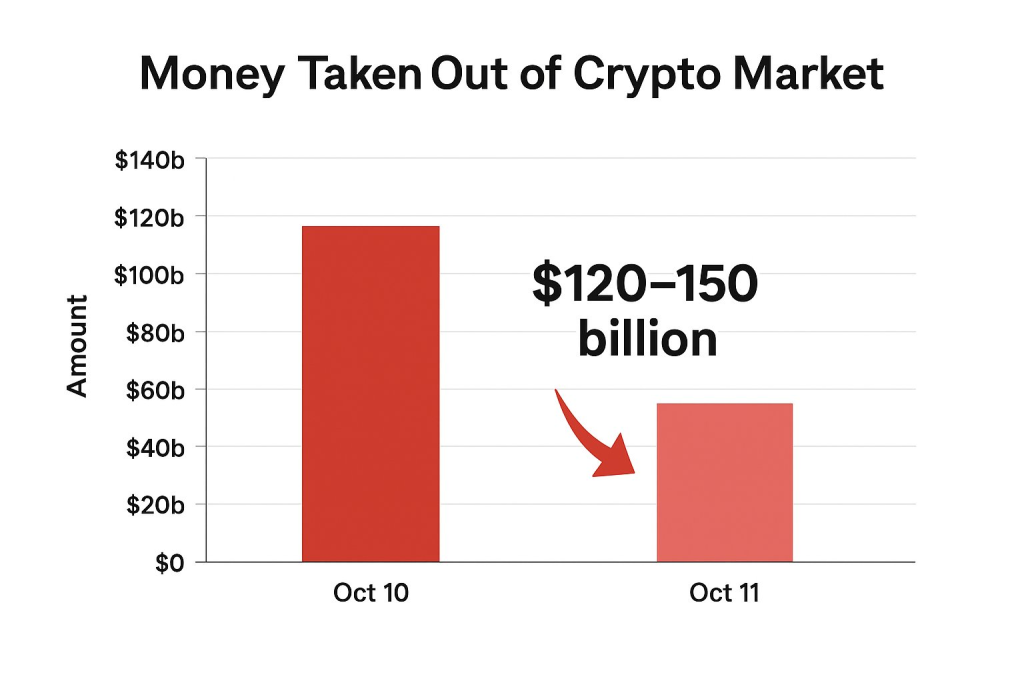

Between late Friday (Oct 10, 2025, UTC) and Saturday, the market registered the largest liquidation event on record by dollar value, with >$19B of positions force-closed in ~24 hours. Within the worst hour, at least $3–$7B flushed as perp engines tried to catch up with a suddenly risk-off macro backdrop. BTC goes below $110k—Reuters printed $104,782 intraday—while large-cap alts shed 15–30% in minutes. Coinglass-cited tallies put the headcount of liquidated accounts >1.6M.

Crash scorecard :

- Total forced liquidations: >$19B (24h); ≥$3–$7B in the peak hour.

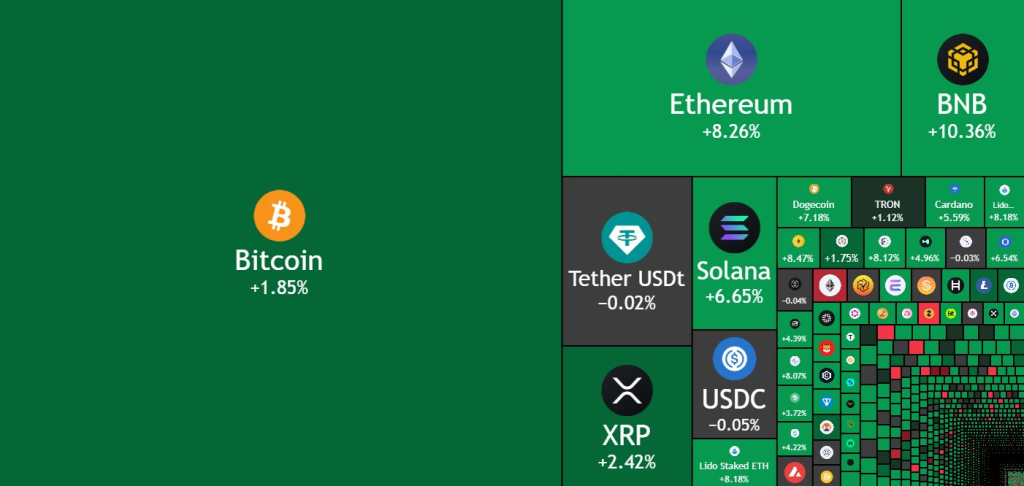

- Spot drawdowns at lows: BTC -10–12%, ETH ~-16%, large alts -20–40%.

- Global crypto market cap: estimates indicate -$125B to -$400B intraday before partial retrace (vendor differences).

Interpretation: this was a macro-spark + leverage-kindling event, magnified by venue-specific plumbing failures.

When Policy Becomes Price: Tariff Headlines, Yields, and a Dollar Spike

The spark was political. President Trump threatened a 100% tariff on Chinese imports and new export controls late Friday, escalating after Beijing’s rare-earth curbs. As those posts hit, BTC sold ~$3k in minutes. This is the cleanest timestamped causal channel we have:

headline → dollar/ rates re-price → crypto risk premium blows out.

Bitcoin chart after the tariff news

This is not just vibes. Crypto is still treated as high-beta duration: when the dollar strengthens and policy risk spikes, basis widens, funding flips, and levered longs become fuel.

Source: Cointelegraph

But currently, Trade tensions between the US and China appear to be softening, as representatives from both governments issued statements on Sunday that signaled a willingness to resume trade negotiations, giving analysts hope of a market rebound in the current week.

Invisible Hand, Visible Glitches: Oracle Manipulation & API/Display Errors

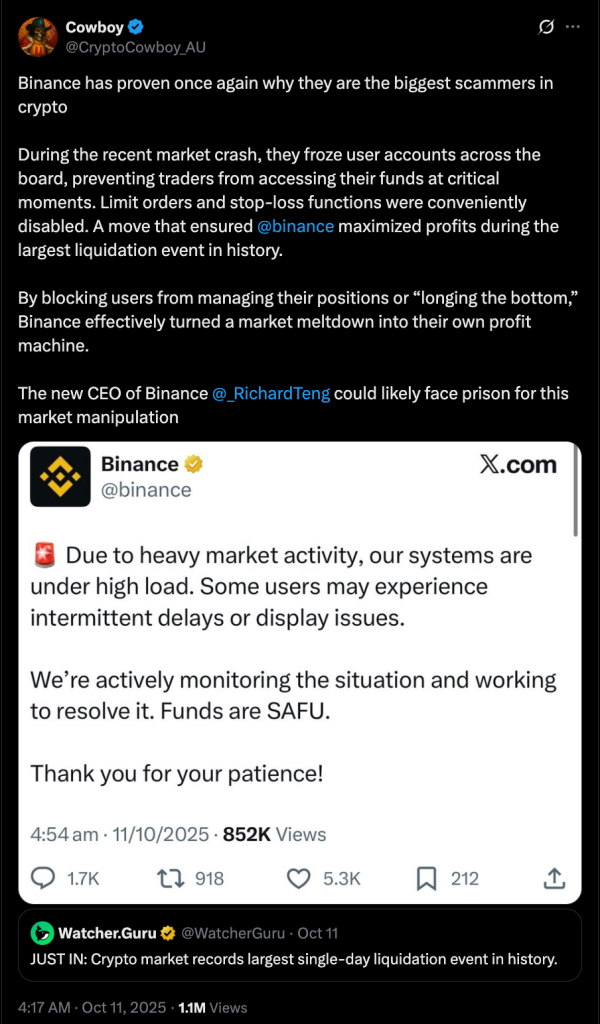

One of the reasons that caused this huge liquidation is the glitches in Binance platform. BitMEX co-founder Arthur Hayes said that major exchanges, including Binance, were “liquidating collateral tied to cross-margin positions,” which increases the sell-off. Simply put, when prices started falling, Binance automatically sold altcoins used as collateral to cover losses. This caused more selling pressure, which pushed prices down even faster.

As prices plunged, Binance’s trading systems became overloaded. Some users reported frozen accounts, missed stop-losses, and delayed trades.

Two mechanics turned a sell-off into a venue-specific rout:

- Wrapped/derivative asset pricing broke on Binance during peak stress.

- wBETH traded down ~88% to ~$430, BnSOL to ~$34.9, and USDe printed $0.65—on Binance only—before rebounding. Binance has said it will compensate affected users case-by-case and change pricing for wrapped assets to conversion-ratio methods (less reliant on stressed order books).

- Multiple analysts confirm a coordinated exploit against Binance’s “Unified Account” margin system, which referenced internal order-book data rather than deep external oracles for some collateral. These claims remain unproven, but the timing window between Binance’s announced oracle/price-index changes (Oct 6) and rollout (Oct 14) is a legitimate red flag from a controls perspective.

- Display/API issues confused risk further.

- Binance said several pairs “printed $0” due to a UI/display issue tied to tick-size changes, not actual trades at zero—yet in the moment, that screen noise triggers human and algorithmic de-risking.

Binance co-founder Yi He (Chief Customer Service Officer) issued an apology, saying that “some users have encountered issues with their transactions” amid extreme volatility and surging platform traffic.

Everybody is asking “Is Crypto a Scam?” Or Just Early Market Plumbing?

It’s fair to ask hard questions when USDe prints 65 cents on one venue and wrapped assets goes to pennies. But the evidence points to a macro shock interacting with leverage and venue-specific design choices, not some universal fraud:

- Cause hierarchy: tariff headlines with a clear timestamp → largest dollar liquidation day ever → venue-specific pricing/index failures that worsened forced selling.

- Controls evolved in real time: Binance committed to compensation and pricing method changes for wrapped assets within 24h.

- Risk class is known: oracle manipulation is a documented, mitigable risk; detection research is mature and getting better.

Scams exist in every asset class; systemic fragility is not the same thing. This episode reads as plumbing failure under stress, not proof the asset class is fake.

The Next 90 Days: What the Future Holds

Normal case: Macro cools as rhetoric softens (we already saw a Monday relief bid), but policy headline risk will keep volume sticky. We can expect dominance-heavy rotations, with alts lagging until market-making spreads normalize and OI rebuilds.

Watchlist (with actions):

- Tariff path / DXY & 10Y: If DXY = “the US dollar index” sustains >99–100 and real yields firm, keep treasuries hedged and emissions throttled. Above 100 = stronger dollar, below 100 = weaker.

- Venue engineering updates: Always confirm the new feeds are live and your risk tools use them.

- Liquidity quality vs. quantity: Track depth @1% and MM quote persistence, not just daily volume.

- Stablecoin health: Compare prices across multiple exchanges and design rules so your liquidation logic treats local glitches differently from broad

Answering the only question that matters: Will it happen again?

Maybe—macro shocks are inevitable. But the damage can be smaller if treasuries hedge, venues adopt durable index/oracle design, and protocols add dislocation-aware guardrails. That’s plumbing, not PR.

But there are some positive news, some tokens like $SNX, $BNB, $ZEC, and $TAO are already trading above their levels from before Friday’s crash, and JUST IN: $220,000,000,000 has flowed back into the crypto market following the crash.