Hello our favourite readers, it’s finally the end of Octobear markets & this week is full of positive news like –

MONDAY → US-CHINA DEAL

WEDNESDAY → FOMC RATE CUT (by 25 bias points)

THURSDAY → FED PRINTS $1.5 TRILLION

FRIDAY → S&P 500 EARNINGS RELEASED (Some already released!!)

SATURDAY → TARIFF DEADLINE (Expected Announcement)

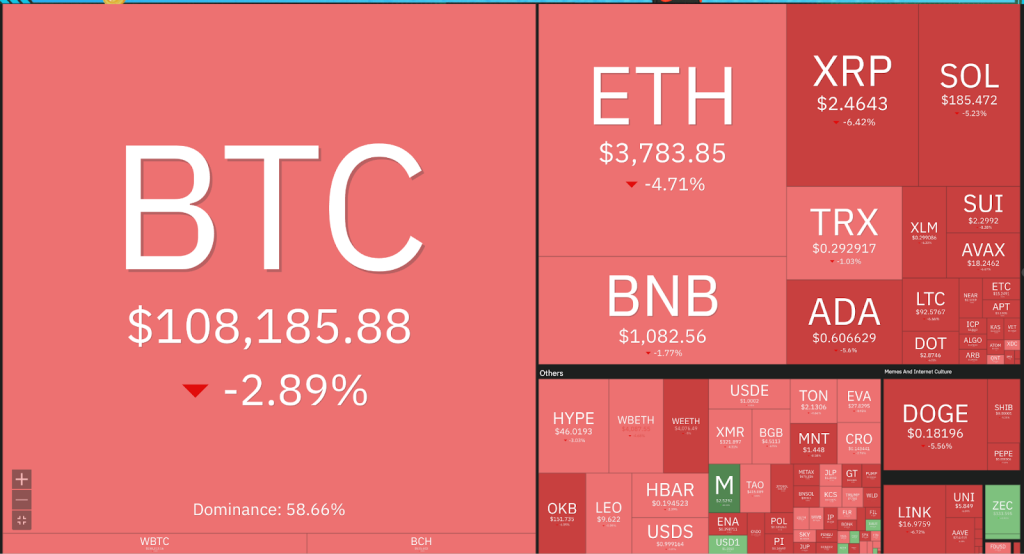

But even so, most of the tokens are down, let’s dig deeper and try to understand/make sense Why this is happening & what is the reason behind all these nuance –

As of 30 OCT

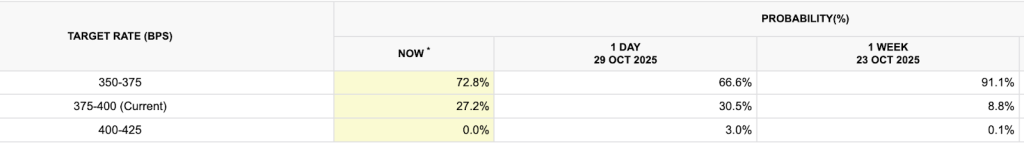

The Fed cut, but Powell cooled December hopes

The FOMC delivered a 25 bps cut to 3.75%–4.00%. But more important was the speech of Fed Chairman, the main reason the market sold off is that Powell was less supportive of rate cuts than expected.

Based on data, traders had priced in a nearly 90% chance of a December cut before he spoke. After he spoke, those odds plunged to around 65-70% that shows a real sentiment loss.

Source: FedWatch

The Trump-Xi News Was Just Noise

The market initially liked the “positive framework” from the Trump-Xi meeting, but it was just “hope.” There was no final, signed text. The Fed’s hard math (higher yields, stronger dollar) was a “right now” problem that easily overpowered the vague “maybe”.

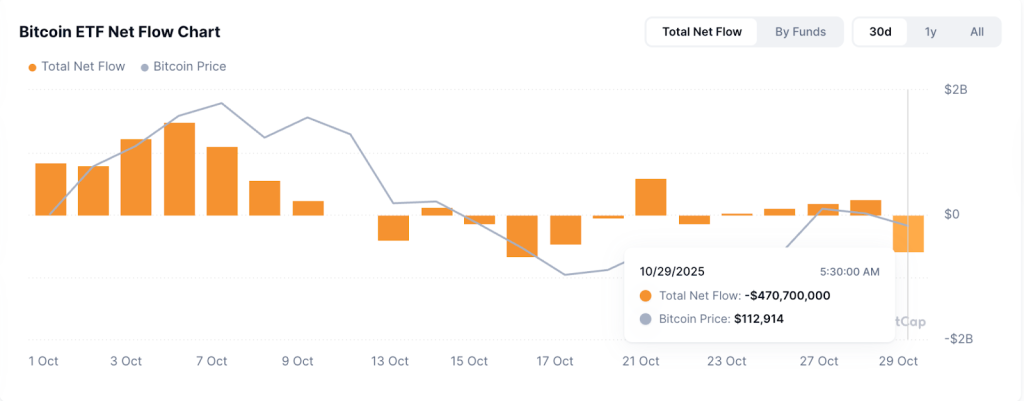

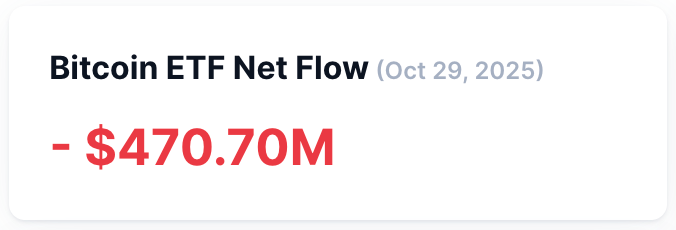

BTC ETFs flipped to net outflows

On Oct 29, U.S. spot BTC ETFs saw ~$470.7m net outflows. That’s a direct, measurable drain on spot demand. That brings the price of bitcoin down along with some of the major blue chips.

Source : CMC

Conclusion

The broader “Web2” market, represented by the S&P 500 and the Dow Jones, did exactly what we’d expect: they fell, and as soon as Powell started speaking, they “fall lower n lower” and finished the day negative.

“But wait,” we might say, “the Nasdaq hit a record!”

And this is the most important thing. The only reason the tech-heavy Nasdaq survived was because of pure, brute-force earnings hype that was unrelated to the Fed. On the same day:

Like:

- Nvidia became the first company to hit a $5 Tn market cap.

- Alphabet (Google) soared 6% after hours, reporting it had crossed $100 Bn in quarterly revenue for the first time.

And there’s more yet to come!!

Practical Tips for Navigating the Current Market

Diversification: Spread your investments across different assets to mitigate risk. This can include a mix of large-cap and small-cap cryptocurrencies, as well as other financial instruments.

Risk Management: Be cautious with leverage and set realistic stop-loss orders to protect your capital.

Stay Informed: Keep up with global economic news and geopolitical developments, as they can significantly impact the crypto market.

Patience: Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on long-term market trends and your investment goals.

So, summarising the experts’ tips, keep patience until the USD/Dollar eases and ETF flows re-turn positive, currently bounces likely to face supply-issues from the traders. Space need a push in order to retain the momentum again!!