The Number That Could Shake the Cycle

You’re not waiting for the Fed to cut rates. You’re waiting for the market to believe it might.

That belief begins with one number: today’s CPI.

At 12:30 PM UTC, the U.S. Consumer Price Index will be released, and the ripple effects will stretch far beyond Wall Street terminals. Whether you’re building a DeFi protocol, raising a token round, or timing a product launch, the data print today sets the tempo for everything that follows: FOMC tone, crypto liquidity, VC behavior, and user sentiment.

Let’s be clear: this is not “just” inflation data. This is a macro signal that could move billions, and founders who position correctly stand to ride that wave. Those who don’t will end up scrambling behind it.

Three Paths After the Print: What Markets Are Expecting, and What They Fear

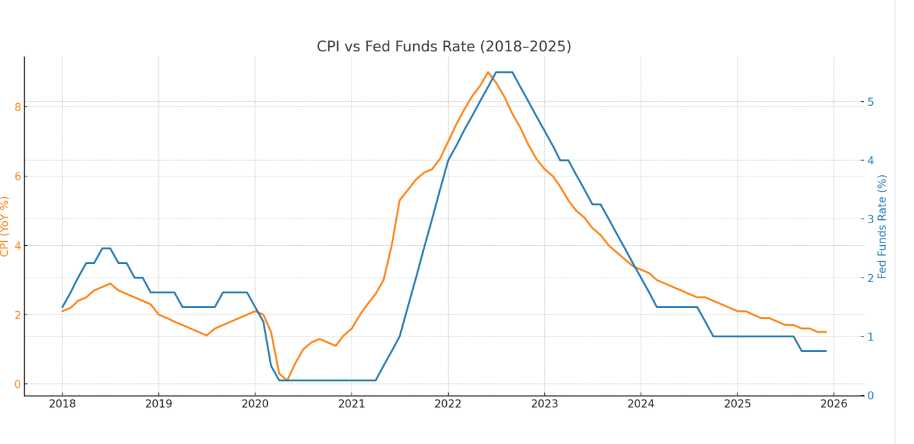

Right now, Fed Fund futures are pricing a 63% chance of a 25 bps cut at the upcoming FOMC. The market is leaning dovish, but not decisively. That makes today’s CPI the tiebreaker.

Scenario 1: CPI surprises low (2.7–2.8%)

Markets will interpret this as validation for a soft pivot. Rate cut odds rise. BTC likely tests $125K+. Altcoins breathe.

Scenario 2: CPI in line (2.9–3.0%)

The narrative stays in limbo. Market trades range-bound. Volatility rises as positioning flips daily. The Fed may still cut, but language will be cautious.

Scenario 3: CPI surprises high (>3.1%)

Hawkish overtones dominate. Rate cut hopes recede. Risk assets retrace. Capital tightens. Founders face slower deal cycles, defensive markets.

No matter what the print is, the Fed’s policy path will remain “data-dependent.” But for investors and builders, it’s not about what Powell does. It’s about what he might do, and when. CPI shifts that window of belief.

CPI, Then FOMC, Then Fallout: Why Crypto Doesn’t Wait for Press Conferences

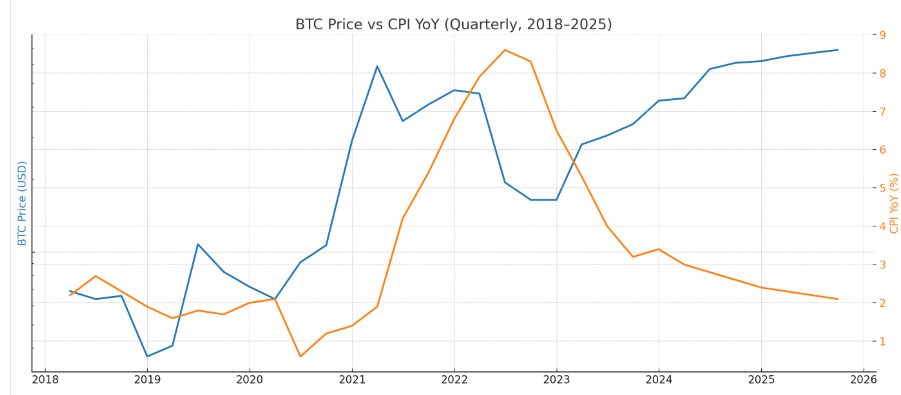

Historically, crypto front-runs the Fed. Every. Single. Time.

- In March 2020, BTC bottomed weeks before the Fed’s emergency cuts.

- In Q1 2023, BTC surged 30% while the Fed was still hawkish.

- In late 2024, crypto moved before the Fed formally began its cutting cycle.

This pattern isn’t random, it’s reflexive. Markets don’t wait for confirmation; they trade on expectation.

Why does this matter to you? Because your token event, fundraise, or GTM campaign doesn’t happen in a vacuum. It rides on risk sentiment. And that sentiment will move on CPI.

If BTC breaks $125K after a soft print, expect VCs to re-enter, retail to rotate, and infrastructure deals to regain traction. If CPI disappoints, expect capital to stay cautious, and LPs to delay allocations.

For Founders, This Is Not a Wait-and-Watch Moment

You cannot afford to treat macro as background noise.

CPI today, FOMC next week, and the resulting tone will reshape how investors perceive your timing. Here’s what founders should be doing right now:

1. Prep the Data Room

If CPI comes soft and risk-on returns, deals will move fast. Having your materials ready means you can ride the liquidity window, not chase it.

2. Line Up Soft Commitments

Have VCs already watched? Get soft “yeses” ahead of the macro pivot. Post-CPI FOMO is real, and you want to be in pole position.

3. Align Your Token Strategy

Launching a token in October? CPI could make or break sentiment. A soft print = go. A hot print = delay emissions, tighten narratives, extend runways.

4. Secure Non-Dilutive Capital

If CPI disappoints, capital stays tight. Start applying now for L1 grants, retro funding, or ecosystem programs that don’t eat equity or tokens.

5. Reprice Risk Internally

Run macro stress tests on your GTM and treasury. What happens if capital costs stay high till Q1 2026? Adjust now, not later.

You’re Not Just Building Tech, You’re Timing Belief

CPI prints at 12:30 PM UTC. The number won’t change your codebase, but it will change how people value what you’re building.

If it confirms a soft pivot, you want to already be ready to raise. If it holds steady, you want to preserve optionality. If it shocks, you want to be already in defense mode.

In Web3, macro is the narrative. Get ahead of it, or get drowned by it.