Waiting for the Cut, But the Market Might Move First

You don’t need Jerome Powell to actually cut rates to know what comes next.

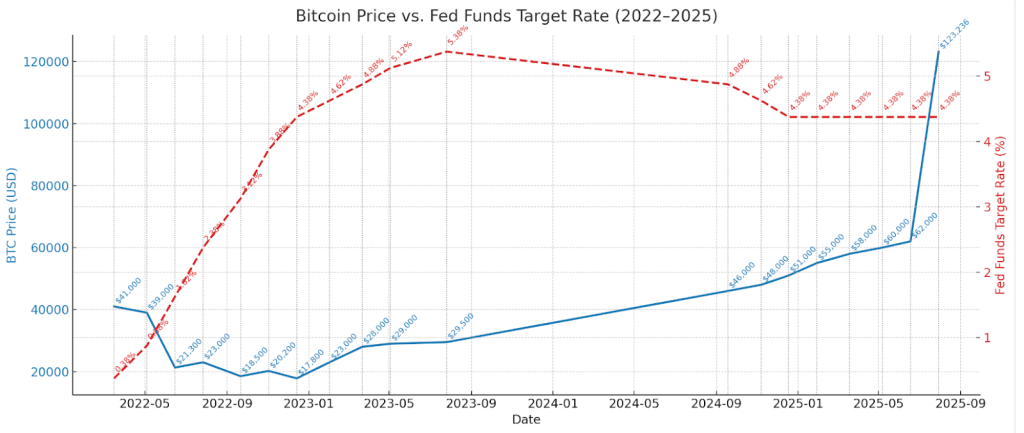

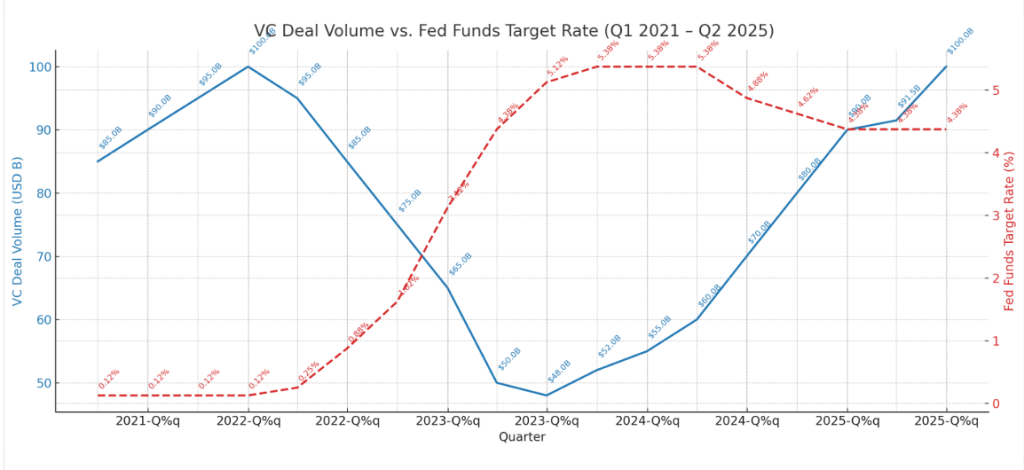

If you’re building in Web3, you already feel it: capital is cautious, valuations are fragile, and LPs are skittish. But under the surface, markets are twitching. Bitcoin has hovered near $118K, and venture interest is quietly reawakening. What changed? Not the rate. The expectation of change.

In Q1 2023, BTC surged 30% before the Fed paused. The same happened in March 2020: investors front-ran the pivot. The lesson? If you’re waiting for the Fed to announce a cut to raise your round or launch your token, you’re already late.

The September Setup: What the Market Is Really Pricing In

September 2025 is shaping up as a macro inflection point. Fed Fund futures currently price a 63% probability of a 25 bps rate cut. Inflation is cooling, Core PCE just printed 2.9%, its lowest in two years. But the Fed’s dot plot remains hawkish, suggesting only one cut this year.

This divergence is the eye of the storm. On one side: a dovish setup of slowing GDP and tame inflation. On the other: a Fed still scarred by 2021’s mistake of easing too soon. The result? A policy path held hostage by risk management, not data.

For Web3 founders, this means uncertainty isn’t going away in September. It’s getting louder. Powell’s tone, especially on “financial stability” and “lag effects”, could tip sentiment more than the rate itself. And sentiment is the real signal.

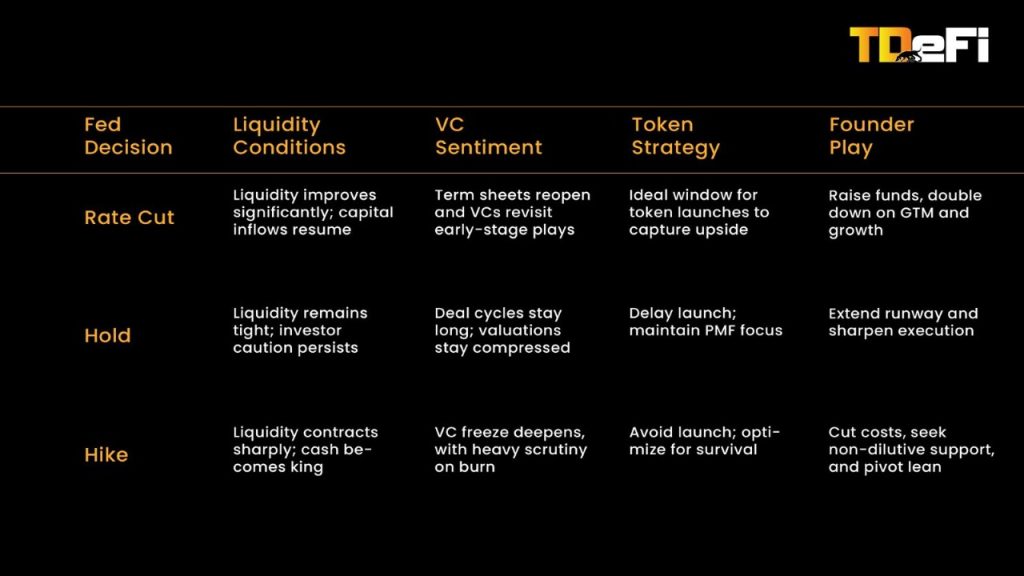

Three Scenarios, Three Founder Playbooks

Scenario 1: The Fed Cuts (25bps or more)

- What happens: Liquidity expectations surge. BTC likely pushes past $125K. DeFi volumes spike.

- Founder move: Accelerate your raise. Secure capital before froth returns. Re-engage cold leads.

- Token strategy: Launch within 30-60 days. Catch the wave before it peaks.

Scenario 2: The Fed Holds

- What happens: Flat-to-cautious markets. BTC range-bound. Risk assets tread water.

- Founder move: Delay raise to Q1 2026 if possible. Stretch runway via grants or convertible notes.

- Token strategy: Delay emissions-heavy mechanics. Prioritize PMF and stickiness.

Scenario 3: The Fed Surprises Hawkishly

- What happens: BTC drops. Altcoins bleed. VC slows further.

- Founder move: Go full defense. Cut burn. Seek non-dilutive capital. Reprice if needed.

- Token strategy: Freeze token events. Focus on capital-light GTM channels.

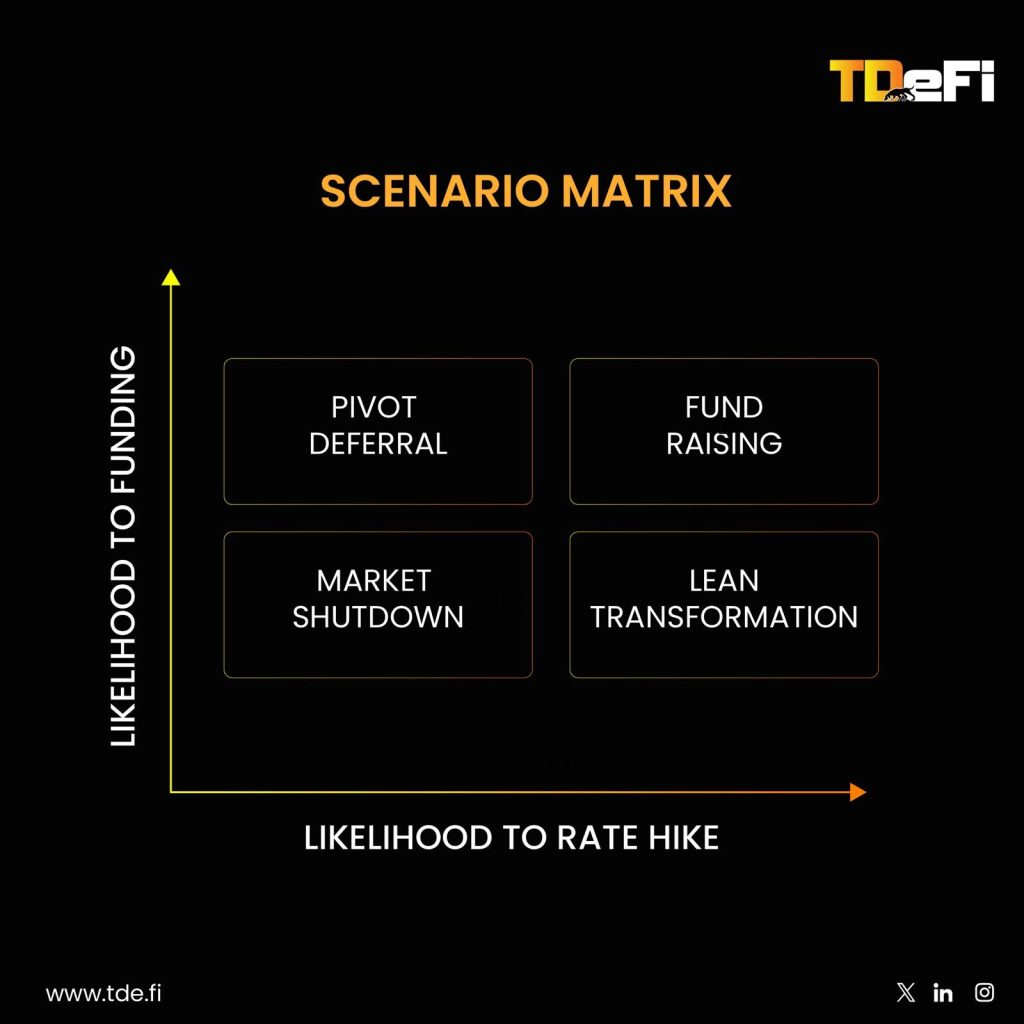

Each scenario doesn’t just demand reaction. It requires positioning. Founders must game out their strategic liquidity timeline now, not after Powell speaks.

BTC Above $125K? Why a Soft Pivot Could Uncork Risk Appetite

The psychology of liquidity is powerful.

If Powell cuts, or even hints he might by year-end, BTC could blow past $125K. Not because of fundamentals, but because belief returns. And with BTC strength comes tailwinds: altcoins recover, DeFi volumes lift, and yield-chasing returns.

Why this matters for founders: risk capital flows downstream.

- Infra deals resurface

- ZK projects get re-evaluated

- RWA models gain traction as yields compress

If your raise or token launch is even adjacent to these narratives, you want to be ahead of the turn, not chasing it. By the time decks flood inboxes again, investor attention will have moved on.

Don’t Just React, Position for the Pivot Before It’s Telegraphed

Optionality is the founder’s greatest asset in a macro-driven cycle.

You should not be betting on a September cut. You should be engineering your strategy so that if a cut happens, you look like you saw it coming. That means:

- Preparing a clean data room today, not post-FOMC

- Lining up soft commitments with warm VCs before Powell speaks

- Launching GTM pilots that can be scaled if sentiment shifts

Because the best rounds get done before consensus. And the best founders raise into conviction, not comfort.

The Macro Doesn’t Care About Your Burn, But Your Investors Do

This cycle has one lesson for builders: macro isn’t background noise. It’s your actual backdrop.

Rates define your cost of capital. They reshape how VCs assess runway, traction, and TAM. And they determine what success looks like: 20x in a risk-on world vs 3x with defensive tokenomics.

Your burn rate, token unlock schedule, and revenue model all sit on a macro fulcrum. So stop treating the Fed as a footnote. Start treating Powell’s tone like your co-founder. Because when rates move, your entire operating reality shifts.

In 2025, timing the macro isn’t luck. It’s a strategy.

Closing Thought: The Best Founders Are Macro Traders in Disguise

You’re not just building dApps or launching tokens. You’re managing liquidity, timing narrative arcs, and shaping investor psychology.

September isn’t just another Fed meeting. It’s your strategic checkpoint. Treat it like the earnings season for your startup.

Because in Web3, the macro is the message. And if you get ahead of it, the next bull run won’t just carry your project, it’ll be your inflection point.