You’re Not Pitching What They’re Buying

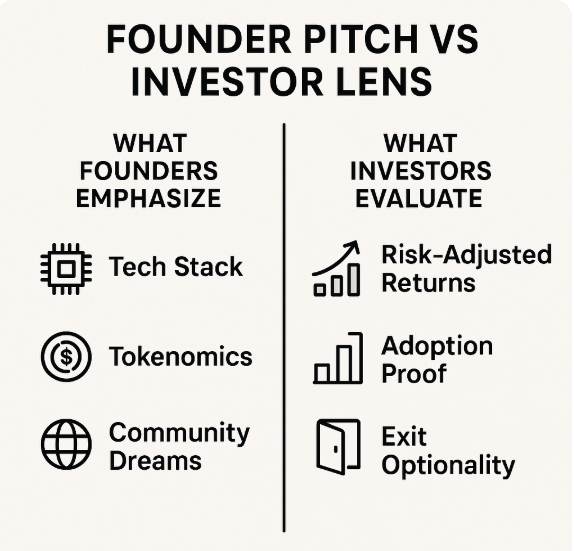

You walk into the room, deck polished, tokenomics chart glowing, community numbers inflated just enough to sound impressive. You start with the tech, the architecture, the vision. Ten minutes in, the investor leans back, arms folded. You already lost them. Why? Because you’re not pitching what they’re buying.

Investors don’t fund ideas. They fund risk-adjusted returns. They need a story they can defend in their Monday IC meeting, a story about market timing, adoption signals, and why this token or protocol won’t collapse when liquidity dries up. Most Web3 founders talk about what excites them. Few talk about what calms investors’ risk radar. That’s the first failure.

The Tokenomics Trap: Numbers Without a Story

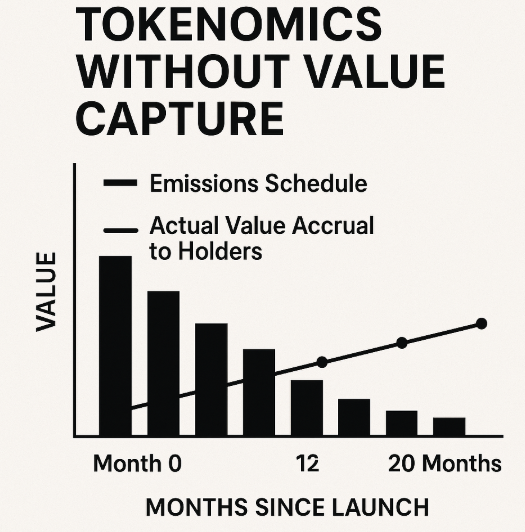

Founders obsess over tokenomics. They fill slides with emissions schedules, staking incentives, and supply charts. But here’s the problem: numbers without a story are just noise.

A token isn’t an economic model. It’s a contract of belief. Investors want to know who accrues value, why, and how it compounds over time. When founders throw token emissions without showing how it translates into user demand and liquidity depth, the tokenomics slide becomes a red flag, not a green light.

Traction Isn’t Hype, It’s Proof

“I’ve got 50,000 Discord members.” “Our waitlist is growing every week.” “We’re launching next quarter.” Investors have heard it all before. What they’re really asking: What proof do you have that people want this now?

Traction is not noise. It’s retention, revenue, daily active wallets, liquidity depth, or anything that signals pull, not push. Too many Web3 founders pitch on potential demand. The winners show proof of demand in motion.

Case in point: Uniswap didn’t raise because they had a vision for AMMs. They raised because they had users, volume, and market share that couldn’t be ignored. Proof is what converts a pitch from speculative to inevitable.

The Macro is in the Room with You

Most founders pitch as if the only variables are product and execution. But in 2025, macro is the third co-founder in the room. Interest rates, liquidity cycles, and investor psychology shape every yes or no. If you pitch a high-emissions, high-burn model in a high-rate environment, you’re not just fighting competition, you’re fighting gravity.

Investors don’t want founders who ignore the macro. They want founders who can read the room. Knowing when to raise, when to wait, and how to align token events with liquidity cycles is part of the pitch. Pretend macro doesn’t exist, and you’ll get treated like you don’t exist either.

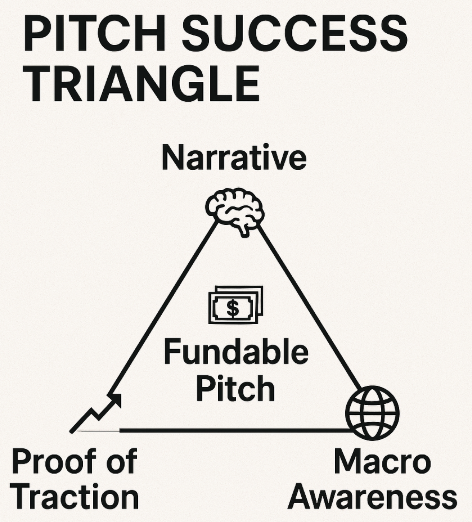

Fixing the Pitch: From Whitepaper to War Room

So how do you fix it? Stop treating your pitch like a whitepaper. Start treating it like a war room briefing. Investors don’t need to know everything. They need to know why this bet, right now, is asymmetric in their favor.

Here’s how you shift:

- Lead with narrative. What is the big story arc you’re riding — regulation, infrastructure shift, or consumer adoption curve?

- Anchor in proof. Show traction, user behavior, or ecosystem alignment that makes this more than theory.

- Frame tokenomics as strategy, not math. Show how incentives drive liquidity, retention, and value accrual.

- Address macro upfront. Investors should feel you understand the funding climate better than most founders.

In short: your pitch should make investors feel like you’re not just a founder, you’re a strategist who understands the battlefield.

Final Thought

Most Web3 founders fail at pitching because they pitch what excites them, not what convinces investors. The fix isn’t adding more slides. It’s flipping the frame. Narrative over noise. Proof over hype. Macro over ignorance. Do that, and you don’t just pitch better, you fundraise like the markets were built for you.