In the over-flooded pool of Web3 businesses, there’s no scarcity of buzzwords and trends. But amidst the hype, one crucial element often gets overlooked: token distribution models.

Beyond the marketing jargon, understanding the nuances of token distribution is essential for building a sustainable and thriving Web3 project. This exhaustive guide explores the various aspects and strategies employed by successful projects, providing you with the insights needed to make informed decisions.

What Is a Token?

Representing a unit of value issued by a project, a token acts as a gateway to various services, including facilitating transactions, symbolizing an underlying asset, and granting governance rights within a decentralized network. Built on blockchain platforms like Ethereum or Binance Smart Chain, which provide the required infrastructure for creating, distributing, and managing them, tokens power decentralized networks and offer unique functionalities. Tokens can be categorized under utility tokens, which provide access to a service; security tokens, which represent ownership of an asset; and governance tokens, which grant voting rights within a decentralized organization.

What is Token Distribution?

Token distribution means to allocate tokens to various stakeholders, including investors, team members, advisors, and the community. It is an important aspect of all Web3 businesses. A well-designed token distribution plan ensures fairness, transparency, and long-term sustainability.

Smart investors closely pay attention to token allocation structures, preferring projects that prioritize community involvement and avoid excessive allocations to insiders. An exemplary token distribution plan strikes a neat balance, ensuring a fair and equitable distribution of tokens among all stakeholders.

Token Distribution Models

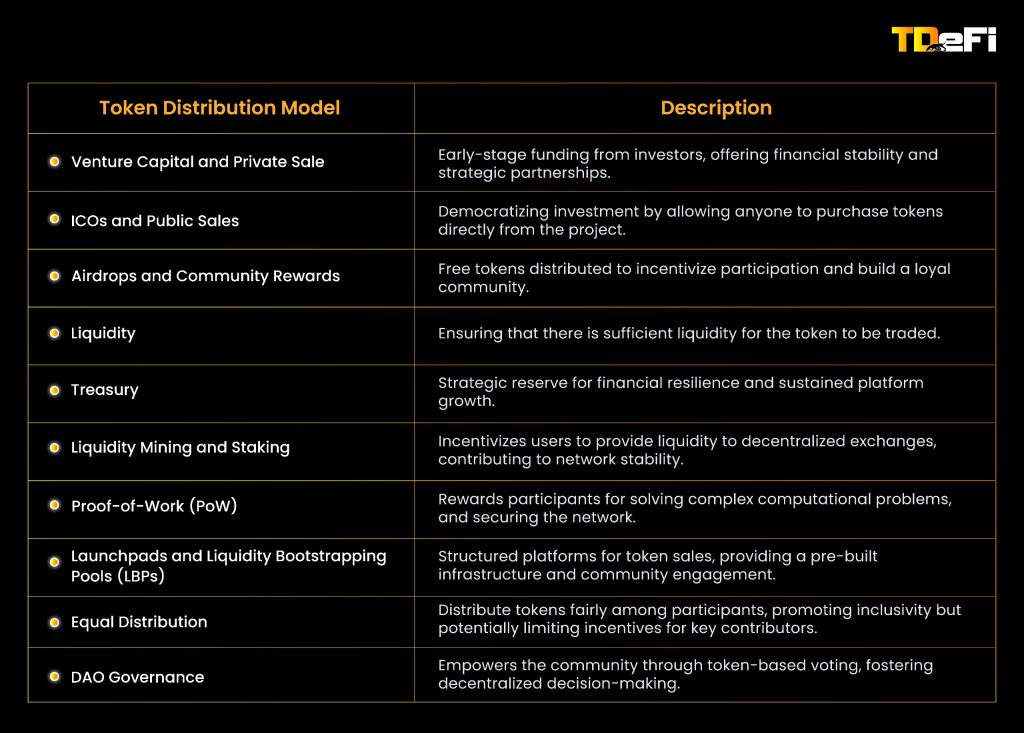

Token distribution models are strategies for allocating and dispersing a cryptocurrency’s tokens among its stakeholders. This process is essential for decentralization, incentivizing participation, and securing funding.

Choosing the right token can greatly affect a project’s long-term viability and success. Below are some commonly used token distribution models in the Web3 space:

- Venture Capital and Private Sale: These include all the early-stage funding where a significant portion of tokens are sold to investors and venture capital firms, at a discount. VC involvement offers financial stability and valuable connections but may lead to centralization if not managed carefully. Hence, it is important to balance the benefits of early funding with the risks of concentrated ownership.

- ICOs and Public Sales: Here, businesses offer tokens directly to the public, often through highly publicized launch events. This democratization of investment allows anyone to participate, regardless of their background or financial standing. While they can raise huge amounts of funds, careful regulatory compliance to avoid legal pitfalls is a prerequisite. Over the years, ICOs have evolved with better-structured approaches like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), which aim to address regulatory concerns.

- Airdrops and Community Rewards: Tokens are distributed for free to the holders of a particular token. This distribution model is used to engage users and encourage participation, but can attract short-term speculators. Airdrops are strategically used to reward early adopters and active participants, encouraging a sense of ownership and loyalty.

- Liquidity: Allocating tokens to a liquidity pool is essential for maintaining a healthy trading ecosystem. It ensures liquidity, and price stability, which contribute to the overall success of the token in the market.

- Treasury: A treasury is a designated pool of funds or tokens that a project holds in reserve to build financial resilience and ensure sustained growth. Serving as a financial safety net, this token allocation provides flexibility for future development, unexpected expenses, or market fluctuations.

- Liquidity Mining and Staking: Here, participants provide liquidity to a decentralized exchange by locking their tokens and earn tokens as rewards. Though this model improves network stability, security and liquidity, it requires sincere management to prevent inflation.

- Mining or Proof-of-Work (PoW): This is a classic token distribution model inspired by Bitcoin, where tokens are distributed as rewards for solving complex computational problems, thereby contributing to the network’s security. However, this raises the concerns about the ongoing climate changes and is not suitable for the long run.

- Launchpads and Liquidity Bootstrapping Pools (LBPs): These platforms encourage token sales and distribution by providing a structured approach to fundraising and community engagement. Additionally, launchpads offer projects with a pre-built platform and audience, simplifying the complexity of launching a token sale.

- Equal Distribution: In this egalitarian approach, tokens are distributed equally among participants in the ecosystem. While it promotes fairness, it may however, not align with strategic business goals. Equal distribution can be effective in creating a broad base of token holders, but may be inefficient in incentivizing key contributors adequately.

- DAO Governance: Many Web3 projects establish Decentralized Autonomous Organizations (DAOs), allocating tokens to community members who can vote on project development and resource allocation.

PS: It’s critical to balance the interests of various stakeholders like developers, investors, and users, for a fair and sustainable ecosystem. This will affect the overall success of a project.

How To Do Token Distribution?

Token distribution goes beyond just raising funds. It also focuses on building a sustainable ecosystem. A well-structured distribution strategy enhances network security, and nurtures a loyal community, driving engagement, innovation, growth, and long-term success. Effective token distribution involves several key steps:

- Define Objectives: Plan distribution based on project goals and market needs. Clearly define what you want to achieve with your token distribution- fundraising, user acquisition, or network security.

- Consult Legal Experts: Before launching your token, you should consult with legal experts. This ensures compliance with relevant regulations. Understanding the legal framework is a critical aspect of preventing legal pitfalls and building sustainable Web3 businesses.

- Finalize Tokenomics: This is one of the crucial steps. Founders must determine token utility, total supply, pricing, and more. A solid tokenomics model helps to support the project’s growth and achieve sustainability.

- Determine Allocation: Begin with strategically allocating tokens to stakeholders. One way you can do this is by considering the roles and contributions of different stakeholders, followed by allocating tokens to them.

- Create a Vesting Schedule: Implement a vesting schedule to encourage long-term commitment. It can prevent early sell-offs and maintain price stability.

- Choose a Distribution Mechanism: Select the most suitable model for your project by understanding the project’s goals, target audience, and market conditions. Then decide whether you’ll use an ICO, STO, IDO, or other method.

- Build Smart Contracts: Develop the smart contract code that will govern your token distribution, ensuring transparency, security, and efficiency. Pick a suitable blockchain platform, such as Ethereum, Solana, etc., that aligns with your project’s goals and technical requirements.

- Audit Smart Contracts: Conduct regular and thorough audits by independent third-party experts. Smart contract audits identify and address potential vulnerabilities in your smart contract code. It helps prevent costly errors and security breaches, protecting a business’s reputation.

- Engage the Community: Use social media platforms, online forums, and impactful PR to inform your community about the upcoming token distribution process, tokenomics, and project roadmap to generate interest.

- Launch: Launch the token distribution according to the predetermined mechanisms and timelines outlined in your whitepaper or tokenomics document. Continuously monitor the distribution process and be prepared to make adjustments as needed to ensure a smooth and successful launch.

Real-world Examples of Token Distribution

- Ethereum’s ICO: Ethereum’s Initial Coin Offering (ICO) in 2014 was a landmark event that raised over 31,000 BTC, valued at approximately $18.3 million at the time.

- Uniswap Airdrop: Uniswap, a leading decentralized exchange, distributed its UNI tokens through an airdrop to anyone who interacted on the platform, rewarding early adopters and users. This helped in galvanizing a more engaged community.

Closing Thoughts

Token distribution is the most vital component of any blockchain or Web3 project’s success. It is all about strategically empowering stakeholders, building loyal communities, and ensuring long-term sustainability. As the blockchain landscape continues to evolve by leaps and bounds, the importance of thoughtful token distribution cannot be overstated.

For entrepreneurs and founders in the Web3 space, understanding and implementing effective token distribution models is necessary to outsmart their competitors. By aligning distribution strategies with business objectives and market trends, founders can create robust ecosystems that drive innovation and growth. Moreover, leveraging the expertise and resources of startup advisors and incubators like TDeFi can significantly improve a startup’s ability to overcome the complexities of token distribution and achieve lasting success.