Hello Readers, Bitcoin is not taking a break and making traders awe, after Bitcoin’s worst October in a decade, most traders were betting on November’s legendary track record to save the day. Instead, we got a bloodbath. Over $1.7 billion in leveraged positions liquidated in 24 hours.

November is supposed to be Bitcoin’s best month. Historically, it averages 42% gains. But right now? The market’s acting like it forgot to read the script.

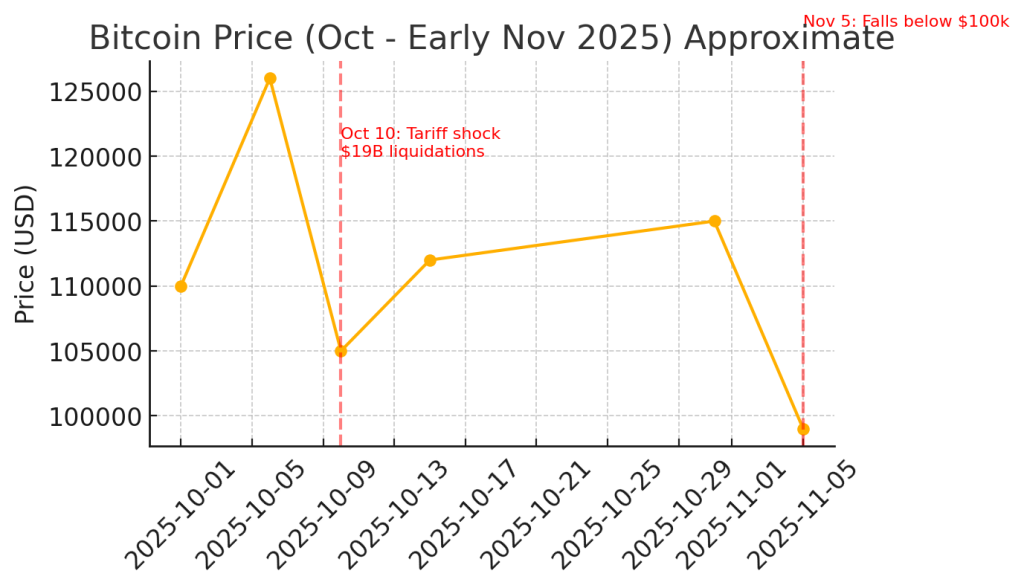

Bitcoin’s price suffered a sharp decline in late October and early November 2025, falling over 20% from its all-time high of ~$126,000 reached in early October . In the first week of November, Bitcoin broke below the $100,000 level for the first time since June .

This pullback literally erased a significant portion of the year’s gains and spooked many investors. Let’s dig deeper and try to find out what the reason behind this fall & is there is a hope for major recovery?

Several key factors contributed to this recent Bitcoin dump:

Year-to-date, both Gold and the S&P 500 are now outperforming $BTC.

Rate cuts. Regulation. Stablecoins. Tokenization. Liquidity. Trade Agreements. GDP. Mag 7 Earnings. Big Beautiful Bill. Trump

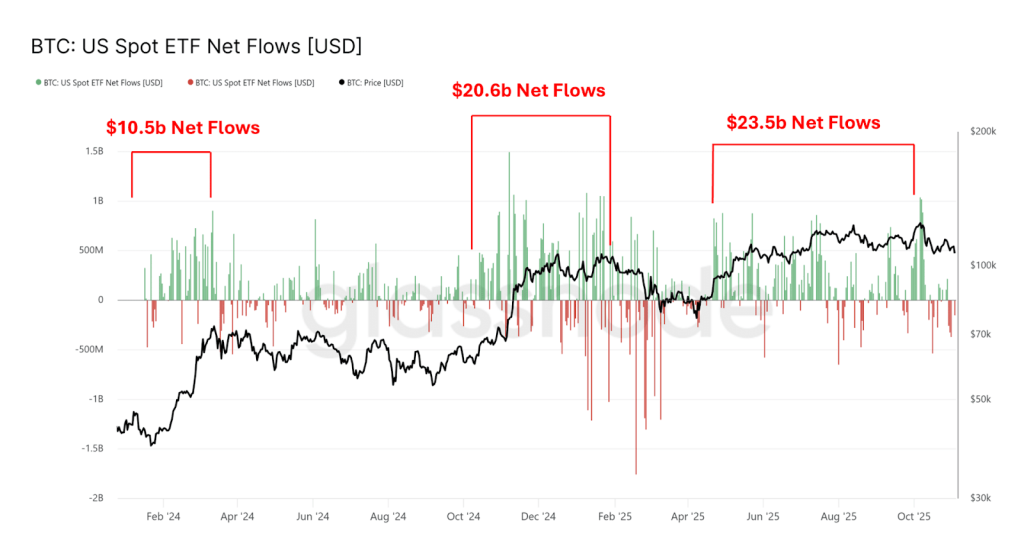

1. ETF Outflows

Source : Glassnode

These are great numbers however, since October 10th, the ETFs have seen $1.4b of net outflows. But it’s not the size of the outflows that is concerning. It’s the lack of inflows.

The Flat Line

MicroStrategy, one of the biggest accumulators currently holds over 641k $BTC.

They purchased 476k BTC from Oct’ 23 through July ‘25 and just 12.2k $BTC in the last 3 months!!!

2. Recent Massive Liquidation

On October 10, a geopolitical surprise (a U.S. announcement of 100% tariffs on Chinese imports) triggered panic selling . As prices fell, over $19 billion in leveraged positions were forcibly liquidated within 24 hours  – the largest single-day wipeout in crypto history, even bigger than events like the FTX collapse.

Over 1.6 million trading accounts were affected , sending Bitcoin plunging about 18% from ~$126K to around $105K in a flash crash.

3. Whales Releases position

In the aftermath of the initial crash, large Bitcoin holders (“whales”) and long-term investors began selling to take profits, adding further downward pressure. On-chain analysis indicates roughly 400,000 BTC (worth about $45 billion) were offloaded by long-term holders over the past month.

The shift in institutional sentiment was a key blow – these same institutions had driven Bitcoin to $126K in early October, but by early November they were in profit-taking mode amid macro uncertainty. The impact wasn’t limited to Bitcoin itself: crypto-related stocks fell in tandem, with companies like MicroStrategy, Coinbase, and others dropping over 6% on the day of the big dip, reflecting how institutional risk-off behavior spread across the sector.

Good News??

But Even with of these if we look into the Holders data :

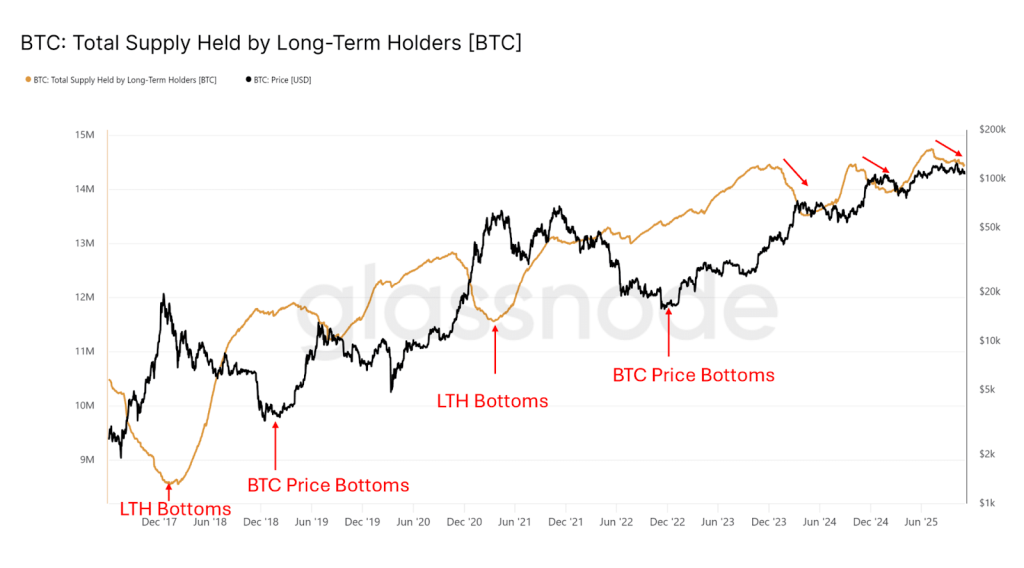

Long Term Holders

Source : Glassnode

As seen on the graph currently LTH are not buying but accumulating giving a chance for the STH to buy the bags!

- Long-Term Holders (LTHs) are considered the “smart money” or convicted investors. Their behavior signals major market tops and bottoms.

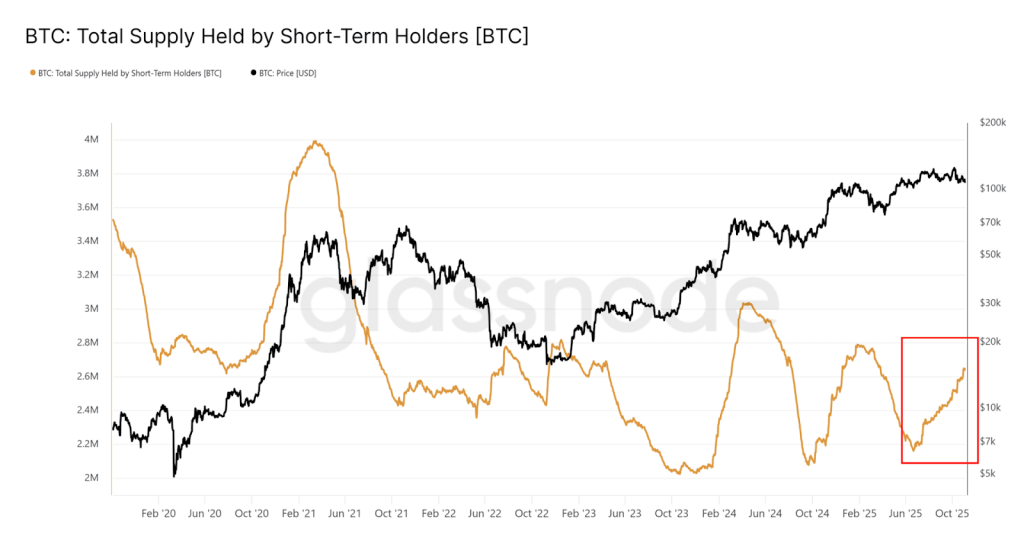

- Short-Term Holders (STHs) are considered new entrants or speculators. Their behavior signals market excitement, euphoria, or panic.

| Holder Behavior | What it Means | Implication for Price |

| LTH Supply is GOING UP | LTHs are accumulating (buying) from weak hands. | Bullish. Often signals a market bottom is in or near. |

| LTH Supply is GOING DOWN | LTHs are distributing (selling) to take profits. | Bearish. Often warns of an approaching market top. |

| STH Supply is GOING UP | New, speculative buyers are flooding the market. | Bearish Warning. Signals euphoria and a potentially overheated market. |

| STH Supply is GOING DOWN | New buyers have panicked and sold their coins. | Bullish. Signals capitulation and a potential market bottom. |

Short Term Holders

Source: Glassnode

Pattern seen 2x already this cycle

The Signal:

LTH shift from distribution → sustained accumulation

STH Buys up the bags

Market expansion begins shortly after this transition. We need to watch for LTH supply to start increasing again. But currently the Long Term Holders become accumulators, in previous season 17’ it took 8 Months after this translation to get into bear market, so the hard bottom is still far!!

We think long-term holders will step back into the market when STH buys more & more and sends their coins back to where they came from (with some becoming long-term holders).

Conclusion

Again!!

Rate cuts. Regulation. Stablecoins. Tokenization. Liquidity. Trade Agreements. GDP. Mag 7 Earnings. Big Beautiful Bill. Trump.

These factors have led many to conclude that the 4-year cycle is a “thing of the past.”

Till Now. $BTC has been in an up-only trend since January ‘23. Buying every dip has been the correct move for traders. Therefore, it’s not surprising that many market participants may have a hard time shifting out of a more bullish stance. After all, the narratives are all in place.