Hello readers, Coinbase casually drops the Q3 Revenue details and its insane, $432.6 Mn in net income, even the “What will Coinbase say during their next earnings call” markets from Kalshi and Polymarket saw $80,242 and $3,912 worth of bets placed.

We’re staring at the same equation every other crypto operator is: CEX profitability is cyclical; on-chain growth is secular. If Coinbase can fuse both into a single distribution engine—CEX + USDC + Base—does this value accrue to COIN equity or into a potential $BASE token?

Coinbase Wants to Be Our Go-To Option

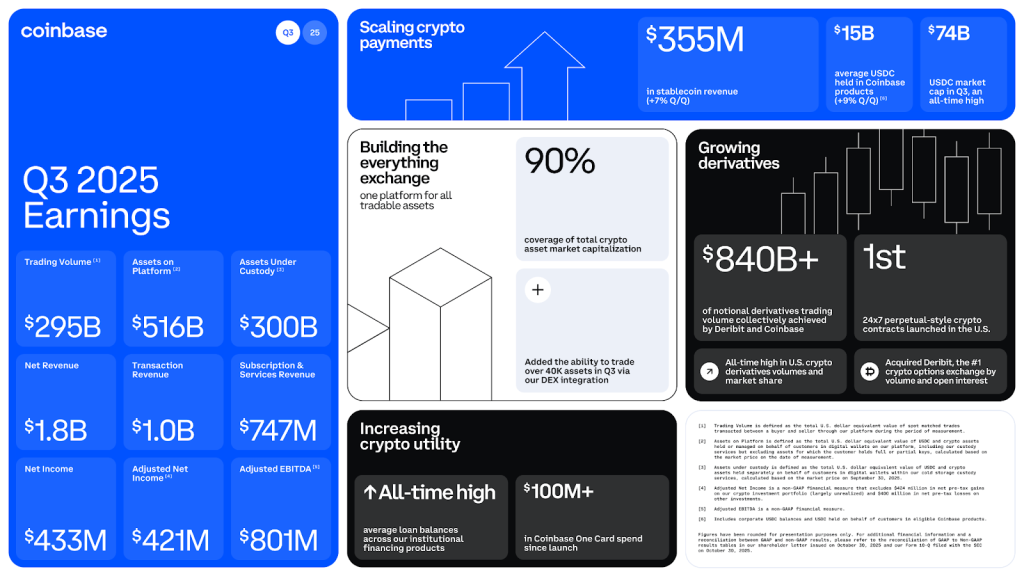

Coinbase has stopped talking like a pure exchange and started operating like a full-stack on-chain distribution platform. In Q3’25, the company again framed progress toward an “Everything Exchange”: broader spot listings (covering ~90% of crypto’s market cap), U.S. perps and 24/7 futures, global options via Deribit, and a payments push anchored in USDC—with average USDC held in Coinbase products hitting an all-time high of $15B and stablecoin revenue at $355M for the quarter.

Source: Coinbase

It’s also been leaning further into bitcoin as a balance-sheet bet, adding roughly 2,772 BTC (~$299M) in Q3 while reiterating the Everything Exchange arc on the earnings call.

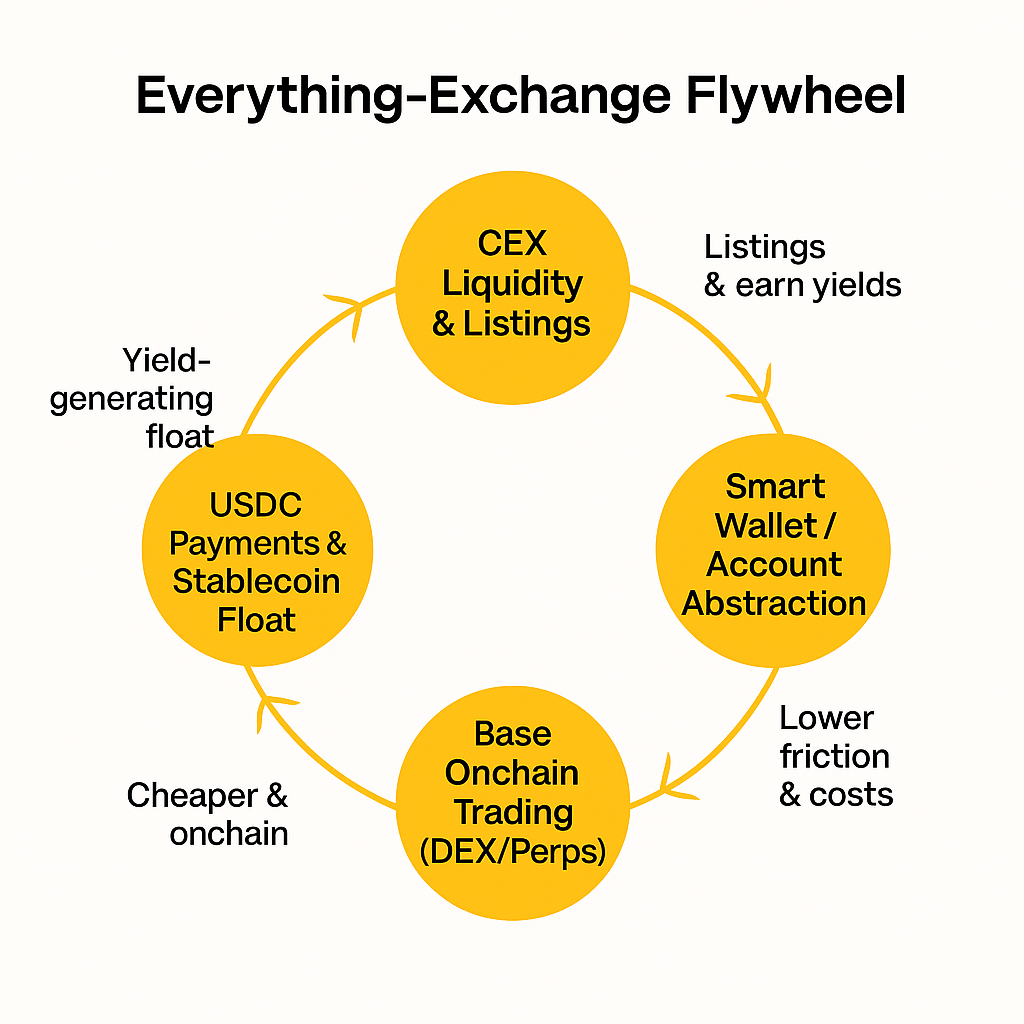

What it means for you: distribution > features. Coinbase’s native funnel—consumer app ↔ prime ↔ derivatives ↔ custody ↔ USDC ↔ Base—compounds acquisition and LTV. If a $BASE token ever exists, it plugs into a pre-built demand surface rather than trying to manufacture one.

Each node is both a product and a distribution surface. USDC lowers payment friction, Base lowers transaction costs and time-to-ship, while derivatives/custody monetize depth. The flywheel keeps users inside Coinbase’s rails—on and off chain. The Q3 letter explicitly ties these pillars together under the “Everything Exchange” vision.

Base Is the On-Chain Growth Engine—And India Is Lighting the Fuse

On any given day, Base is processing millions of transactions; recent peaks hit ~14.5M daily tx and current snapshots regularly show 10–12M+. DeFiLlama puts Base’s DeFi TVL at ~$5.2B alongside ~$1.8B

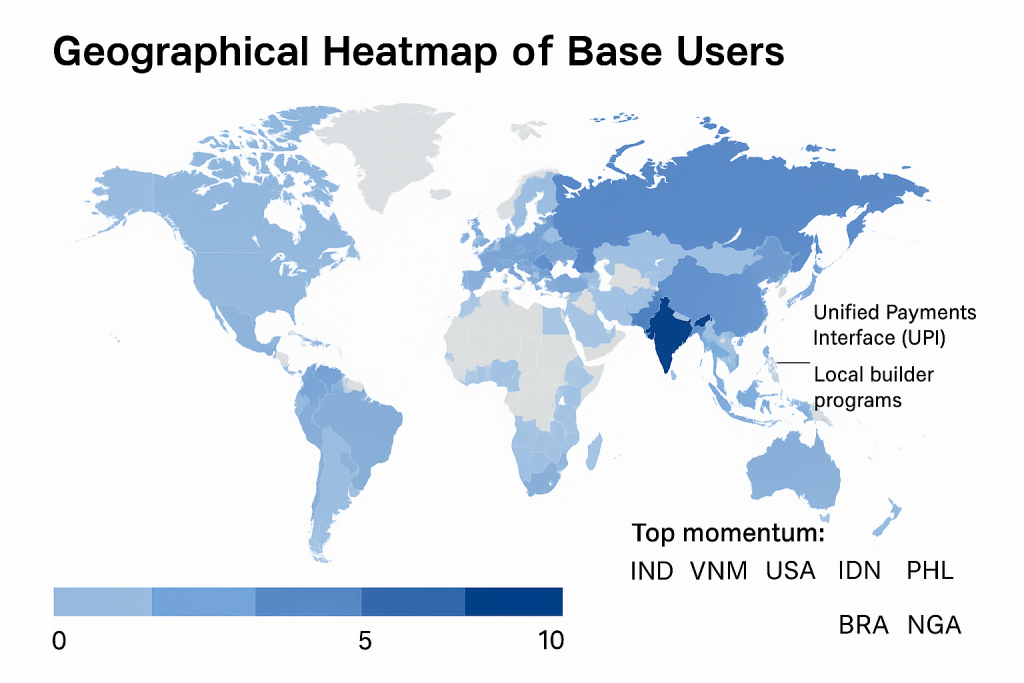

Why India matters: Coinbase/Base isn’t just “present” in India; it’s programming the market.

- Based India / Devfolio and Base Batch India have run region-specific build tracks with prizes, mentorship, and funnels to funding—converting developer supply into shipping orbit.

- Coinbase has historically funded scholarships for India-based Ethereum bootcamps, signaling a longer-cycle talent pipeline.

- “Onchain India” programs (with Base support) have amplified grants, partnerships, and community events.

- The macro tailwinds are real: India ranked #1 in Chainalysis’s 2025 Global Crypto Adoption Index, and UPI—India’s real-time payments rail—crossed 20B monthly transactions in Aug’25, a proxy for digital finance readiness.

Hard wallet-level geodata is scarce, but programs, events, and third-party indices point to India as Base’s highest-leverage growth surface: most builders per dollar of incentives and the fastest conversion from hackathon → live app. Chainalysis rankings and UPI scale reinforce the macro.

If $BASE Drops, Who Gets Paid? (A VC-First Read)

A token fundamentally changes the split between equity and network stakeholders. Think in cash-flow primitives:

• Sequencer fees & MEV: Today, OP-stack L2s accrue sequencer revenues that (by design/governance) can be shared to ecosystems or treasuries. Optimism routes value to RetroPGF; Arbitrum’s DAO actively manages sequencer/timeboost revenue in treasury proposals.

Comparable playbooks:

• BNB hard-codes value via quarterly burns tied to activity—equity (Binance) gains from the platform, while token captures reflexive upside through burn mechanics.

• OP directs sequencer surpluses toward public goods and aligned chains—value shows up as ecosystem strength vs. direct holder yield.

• ARB keeps sequencer cash flows at the DAO, influencing grant budgets and runway.

| Chain (snapshot) | 24h Chain Fees | 24h Chain Revenue | 24h DEX Volume | 24h Perps Volume | 24h Txns |

| Base | ~$314k | ~$309k | ~$1.79B | ~$817M | ~11.98M |

| Arbitrum | ~$59.9k | ~$58.9k | ~$825M | ~$940M | ~3.81M |

| OP Mainnet | ~$4–10k | ~$4–10k | ~$34–58M | ~$0.1–0.5M | n/a |

If Base already out-monetizes peers on raw fee pools and flow, the token vs. equity split becomes the core underwriting question. A token that diverts a material share of sequencer/MEV to holders will re-rate COIN’s sum-of-parts unless offset elsewhere in the stack.

What Does JPMorgan’s $34B Check Out?

JPMorgan argues a Base network token could unlock up to $34B in value, with nearer-term estimates of $12–$34B depending on structure and market context. That’s on top of separate estimates that $4–$12B in equity value could accrue to COIN if Base monetizes with or without a token.

Reality check via activity-to-revenue bridge:

Activity → Fees/MEV: Base is printing multi-million daily tx and billion-scale DEX/perps volumes, which translate into chain fees (snapshot ~$309k/24h) and MEV surfaces. Annualized naïvely, that’s $110–$150M+ in chain-level fees alone at today’s cadence (before MEV), with high variance.

Who captures what:

No token scenario:

sequencer/MEV share flows to Coinbase (directly or via rev-share with OP Collective), plus USDC float (Q3 stablecoin revenue $355M) and off-chain P&L from derivatives, custody, and app distribution. Equity accrues most of the value.

Token launched scenario:

a portion of those flows is socialized to token holders/DAO (OP/ARB style). Equity still benefits from the Everything Exchange funnel (conversion, cross-sell, custody), but token captures a new, explicit claim on cash flows and governance.

What should normal users do If You’re Allocating Capital (or Shipping on Base)

- Underwrite the split. Before you price $BASE, map where fees, MEV, and optionality (builder retro-grants, app-store rev share) actually flow—token, DAO, OP Collective, or COIN. Use OP/ARB as baselines, but expect Coinbase-specific twists.

- Favor India-rooted distribution. If your app needs users, build with Indian payment and social primitives in mind. The Devfolio/Base programs plus UPI ubiquity compress CAC.

- If you’re a founder, optimize for retained, multi-surface engagement (payments + social + DeFi), not transactional bursts. If you’re an investor, haircut any airdrop thesis that doesn’t include anti-sybil, multi-epoch constraints proven by OP/ARB.

Conclusion

Coinbase is building a distribution monopoly that closes the loop between CEX profits and on-chain growth. Base is already a top-throughput L2 with ~$5B TVL and 8–12M+ daily transactions, with India acting as the most explosive builder/user wedge. A $BASE token could crystallize value capture at the network, while equity soaks up USDC yields, custody, and app-store economics. JPMorgan’s $12–$34B token value-unlock case can granted at scale—but only if the token actually participates in fees and governance rights. It would be really interesting to see how the platform is going to perform in coming weeks!!