Every time tech stocks skyrocket, someone screams “bubble!” But after Nvidia’s latest earnings report, we need to talk about what’s actually happening with AI because the numbers tell a very different story than the panic & pressure.

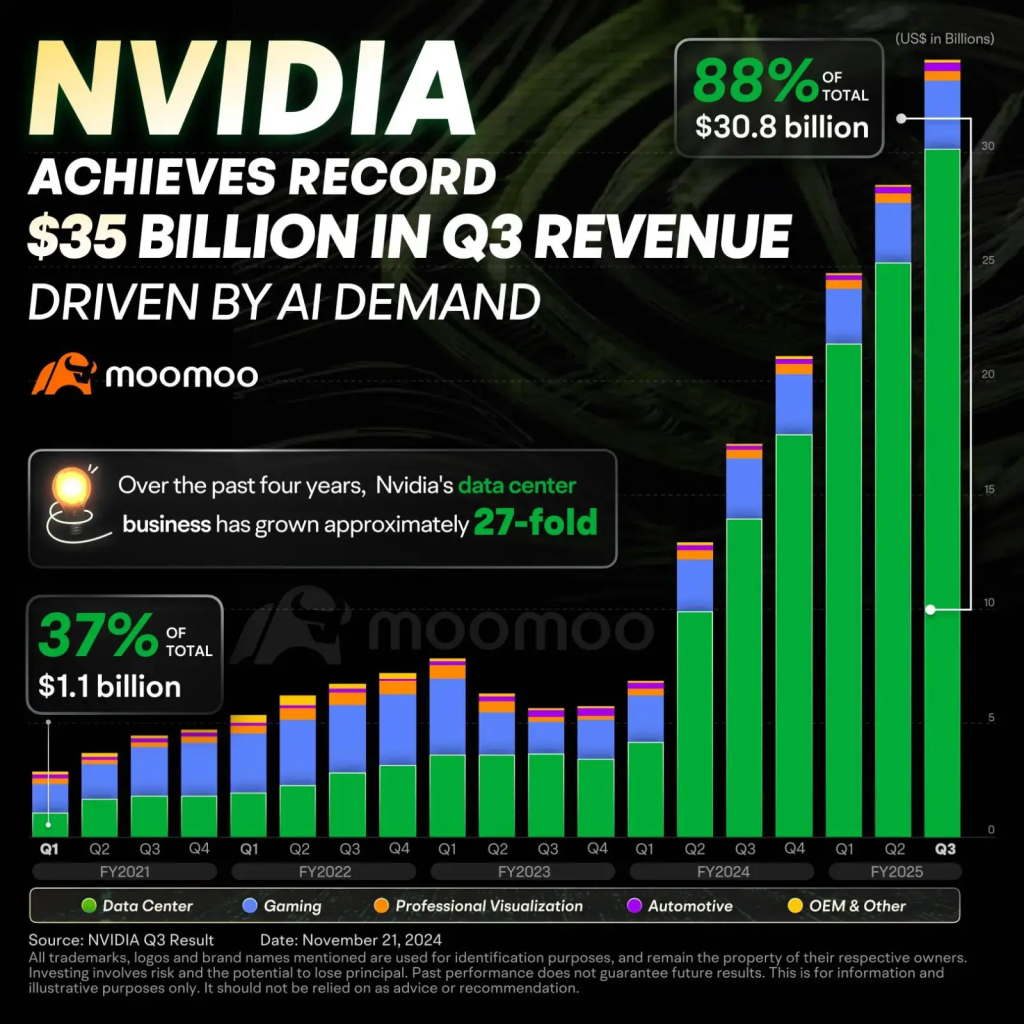

Last week, Nvidia posted numbers that made even seasoned Wall Street analysts do a double-take. Talking $57 billion in quarterly revenue (a 62% jump from last year) and $30.8 billion in pure profit (up 65%). To put that in perspective, that’s more revenue in three months than most Fortune 500 companies make in an entire year.

Source: Link

But here’s the kick analysts were already expecting a monster quarter, around $54.7 billion. Nvidia still beat that by $2.3 billion. Then CEO Jensen Huang stood up and projected $65 billion for next quarter, essentially saying “you haven’t seen anything yet.”

Source: Link

The market’s response? Nvidia’s stock jumped 5% in after-hours trading, adding over $200 billion to its market value overnight. That’s more than the entire value of companies like Netflix or Adobe. Bitcoin, which had been slumping around $85,000, popped back above $90,000. Ethereum climbed from below $2,900 to over $3,000. The S&P 500 futures rose 1% before the market even opened.

All because of this crushed earnings.

What Exactly Is an “AI Bubble” Anyway?

A bubble happens when prices shoot up based on hype rather than actual value and then crash when reality sets in. Think the dot-com era of 1999-2000, when companies with zero revenue and business plans written on napkins were worth billions. Or the 2008 housing crisis when everyone convinced themselves home prices could only go up.

Source: Gemini

The concern now? Tech companies are pouring hundreds of billions of dollars into AI infrastructure. Critics see the same warning signs: massive capital spending, sky-high valuations, and executives promising a revolution that might not materialize.

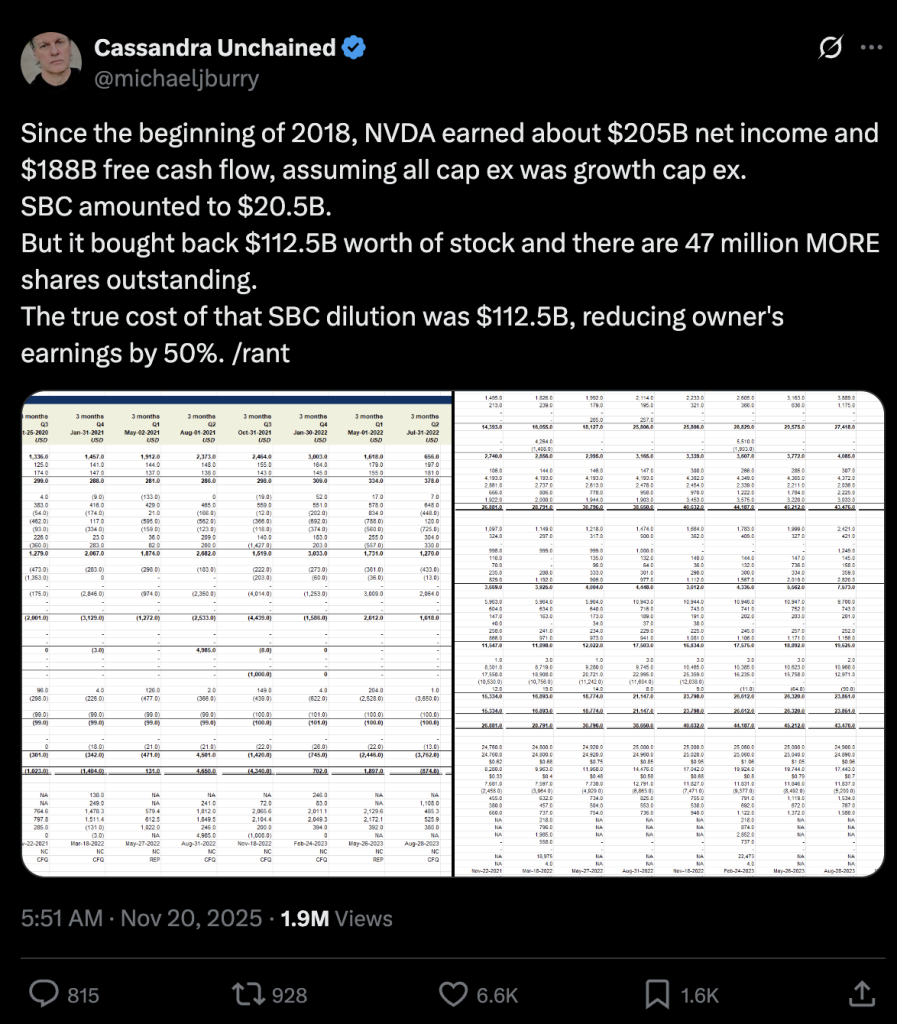

Michael Burry yes, that Michael Burry who predicted the 2008 crash—is literally shorting Nvidia and Palantir right now. He’s posted charts comparing current tech capital expenditure to bubble-era levels and basically saying “here we go again.”

Source : X

Even Sam Altman, the CEO of OpenAI (the company behind ChatGPT), said flat-out: “We are overexcited about AI” and “the market is in a bubble.”

When the guy building the AI technology says investors are too excited, you’d think that would give people pause.

But Here’s Where It Gets Interesting, Jensen Huang isn’t buying the bubble talk for a second.

On Nvidia’s earnings call, he addressed the skeptics directly: “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.”

His argument? Real companies are spending real money on AI because they’re seeing real results. Nvidia isn’t selling dream chips to startups with no business model—they’re selling to Microsoft, Google, Amazon, Meta, and thousands of enterprises building actual AI-powered products.

The data backs him up:

– Data center sales: $51.2 billion this quarter alone (up 66% year-over-year)

– AI chip orders booked: $500 billion worth through 2026

– Demand for Blackwell chips: CFO Collette Kress described it as “off the charts”

These aren’t speculative investments. These are purchase orders from the biggest companies on Earth.

The Expert Divide: Who’s Right?

The fascinating thing about this debate is that smart people are on both sides—and they’re looking at the same data.

The Bulls (AI is real and sustainable):

The Analyst who’s been bullish on tech for years, called this a “pop-the-champagne moment.” He wrote that fears of an AI bubble are “way overstated” and we’re only in the “top of the third inning” of this transformation. ( that means we’re maybe 30% through this trend.)

Mark Cuban, the legendary Investor points out a crucial difference from the dot-com era: “We’re not seeing funky companies just go public.” Back in 2000, companies with no revenue were IPO-ing at billion-dollar valuations. Today’s AI companies (for the most part) have actual products, paying customers, and revenue growth.

Jeff Bezos calls this an “industrial bubble”—similar to the railroad boom of the 1800s or the internet buildout of the 1990s. Yes, there’s overinvestment. Yes, some companies will fail. But the infrastructure being built is real and will power innovation for decades. His take? “AI is real” and these frenzies ultimately benefit society.

Mark Zuckerberg offered a nuanced view: there could be a bubble if AI progress stalls. But if companies keep delivering breakthroughs year after year, “maybe there is no collapse.” It all depends on whether the technology keeps advancing.

The Bears (We’re heading for a crash):

Sam Altman’s warning is hard to ignore. When the CEO of the hottest AI company says investors are overexcited, that’s a red flag.

Michael Burry’s short positions speak for themselves. He’s literally betting billions that Nvidia and similar stocks will crash.

The argument: We’ve seen this movie before. Massive capital spending, revolutionary promises, valuations that assume perfection—then reality disappoints and everything crashes.

Some numbers

The Emerging A.I. Bubble The AI market is projected to grow to over 1.75 trillion dollars in market share over the next 7 years. With this unprecedented rise, 35% of software companies are now incorporating AI into their businesses. Artificial intelligence has been discussed on 38% of S&P 500 quarterly conference calls. But, it’s not just talk. We found that 97% of native AI companies are growing at the same rate or faster than other companies.

Source: Google

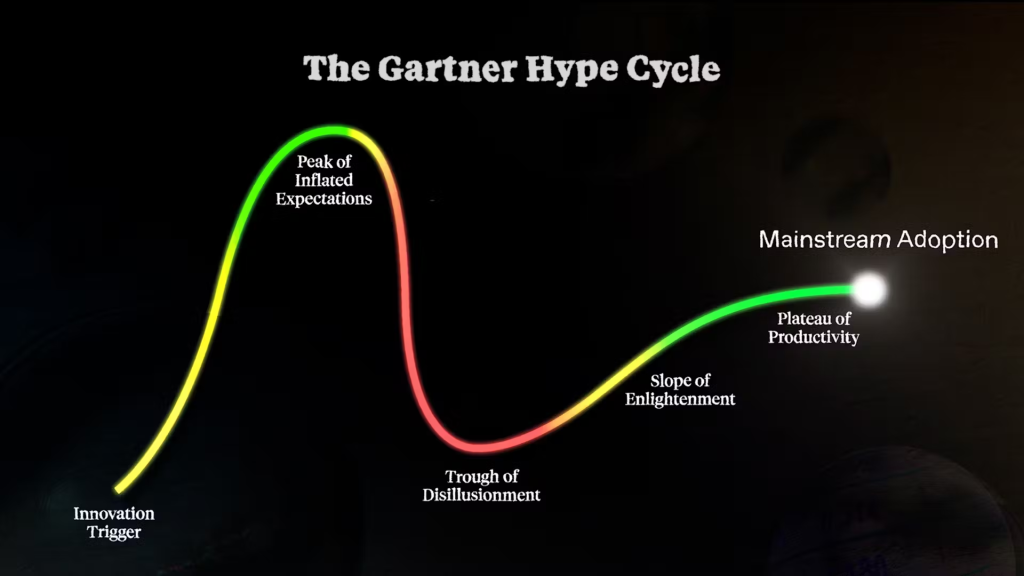

We are certainly past the early stages of the Gartner hype cycle but are we at the point of panic where you should consider changing your strategy to prepare for a crash?

The Real Question: What Does This Mean for Us?

Whether we’re invested in tech stocks, crypto, or just trying to understand where the economy is heading, here’s our take:

This isn’t the dot-com bubble. Not yet, anyway.

The dot-com era was fueled by companies with no revenue, no profits, and business plans that literally said

Step 1: Build website -> Step 2: ??? -> Step 3: Profit.”

Today’s AI leaders are generating massive cash flows. Nvidia’s $32 billion in quarterly profit isn’t theoretical—it’s in the bank. Microsoft, Google, and Amazon are seeing measurable returns on their AI investments through productivity gains and new revenue streams.

But that doesn’t mean there’s zero risk.

Historical patterns matter. Every transformative technology—railroads, radio, automobiles, the internet—sparked investment frenzies that ended badly for many investors. The technology itself was real and changed the world, but not every company survived, and plenty of investors got burned buying at the peak.

Here’s my read on the data:

1. The AI boom is real right now. Companies are ordering $500 billion in chips because they need them, not because they’re speculating.

2. We’re early, not late. When Dan Ives says “third inning,” he’s probably right. AI adoption in most industries is still in single-digit percentages.

3. But valuations matter. Even great companies can be bad investments if you pay too much. Nvidia’s price-to-earnings ratio is elevated—not absurd, but elevated.

4. Winners will emerge, losers will fail. Just like Amazon survived the dot-com crash while Pets.com didn’t, some AI companies will dominate while others will vanish.

5. The infrastructure is being built whether or not individual stocks go up or down. The data centers, chips, and AI models being created now will power technology for the next 20 years.

Conclusion

After looking at Nvidia’s earnings, the market reaction, and both sides of the bubble debate,

We’re in the middle of a massive, real transformation, but that doesn’t mean every stock at every price is a good investment.

Jensen Huang is right that this isn’t a bubble in the traditional sense. Real demand is driving real revenue and real profits. But Sam Altman is also right that investors might be getting ahead of themselves on timing and expectations.

The smart play? Stay informed, don’t need to panic over headlines, and remember that even during bubbles, great companies emerge. Amazon lost 95% of its value in the dot-com crash—then went on to become one of the most valuable companies on Earth.

As Bezos noted, when the dust settles, “it’s often the good ideas that benefit society.”

So yes, there will be volatility. Yes, some investors will lose money. But if we’re betting against AI fundamentally transforming computing, business, and society—well, Nvidia’s $57 billion quarter suggests you might want to reconsider.

The data is clear: Nvidia crushed expectations, companies are still massively investing in AI, and the market believes this trend has legs. Whether that makes you bullish or cautious is up to you—but at least now you have the numbers to decide.

What do you think—are we in an AI bubble, or is this just the beginning? Drop a comment below.