You’re Not Short on Capital, You’re Short on Control

The average Web3 founder doesn’t fail because they run out of money. They fail because they run out of control.

Control over priorities. Control over burn. Control over time.

You started this because you believed in decentralization, in aligning incentives, in building in public. But somewhere between raising a pre-seed, managing a Discord, and shipping version 1.4.7-beta, the chaos crept in.

And that chaos is expensive.

You don’t need to raise again. Not yet. First, you need to manage better. Because fundraising under duress is not strategy, it’s surrender.

The Burn Isn’t the Problem. The Budget Is.

Crypto startups wear burn rate like a badge. “We only burn $100K a month!”, as if low spend equals smart spend.

But low burn with misaligned allocation is just slow death.

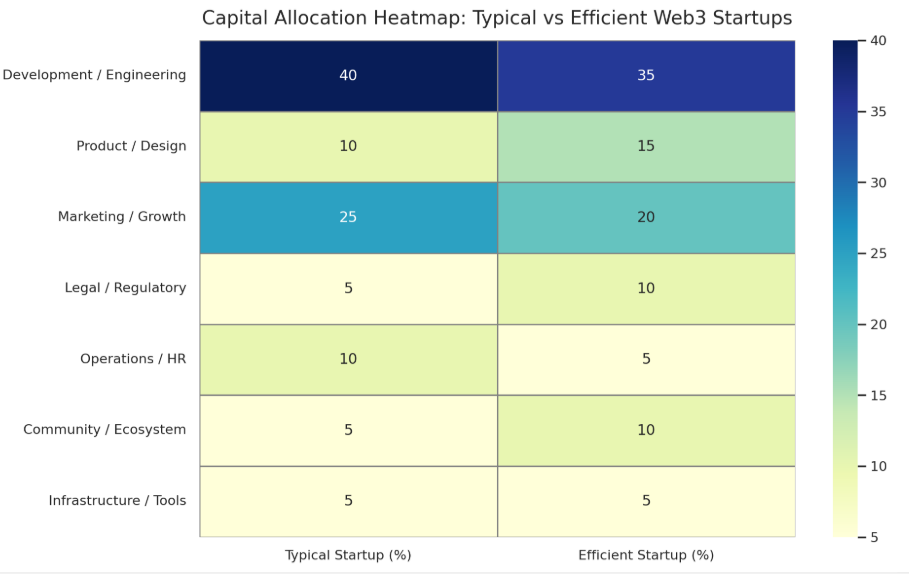

Capital efficiency isn’t about spending less. It’s about spending with precision. Founders must stop asking “What can we afford?” and start asking “What drives the next inflection point?”

Do you know your CAC-to-LTV ratio? Do you know which hires actually contribute to product velocity? Do you know which budget lines you added in a bull market but never cut in a bear?

A dollar not driving user growth, retention, or monetization is dead weight. And dead weight kills startups.

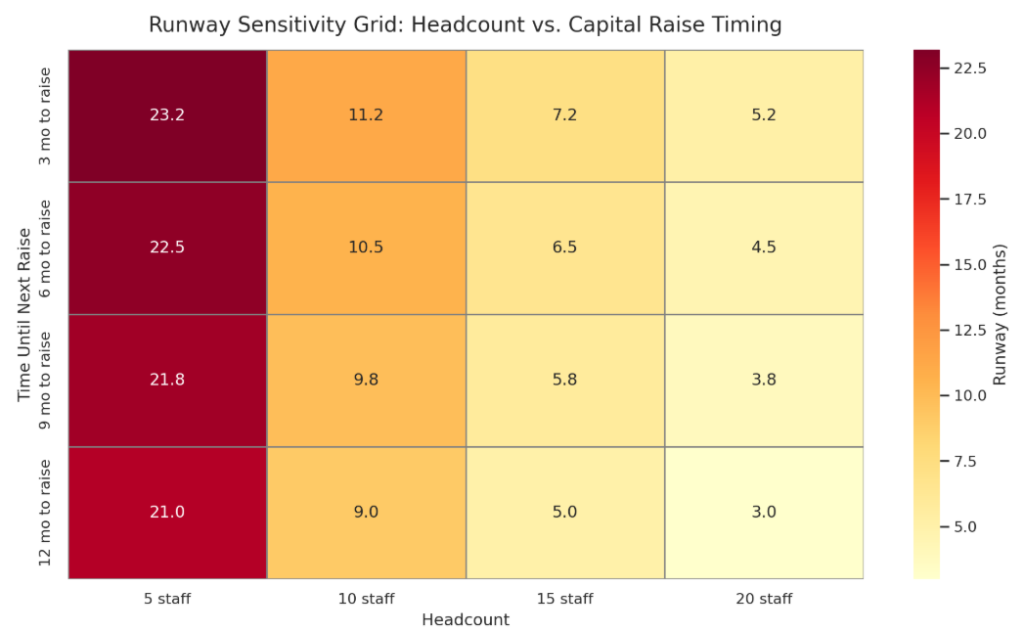

Time Is the One Asset You Can’t Raise

Money can be refilled. Your time cannot.

Founders love to talk about capital allocation. But the best ones obsess over time allocation.

Where are your hours actually going? Fundraising decks, daily standups, dApp UI tweaks, investor calls, governance proposals… and somehow you’re also head of BD?

Track your calendar like a cap table. Because your time is the business. Every hour spent firefighting a support issue is an hour not spent solving the next strategic bottleneck.

Want to know why your roadmap is slipping? Look at how much of your week goes to reactive tasks vs. proactive strategy. That’s your answer.

How to Build a Team Without a Payroll

The best Web3 teams aren’t big. They’re modular.

You don’t need a 30-person in-house team. You need a flexible squad of aligned contributors who show up at the right moment, with the right skills, and the right incentives.

Freelancer collectives. Token-based bounties. DAO workstreams. Ecosystem grant recipients. These aren’t edge cases. They’re your new HR stack.

Want to move fast without bloating? Create a contributor funnel:

- Bounties for microtasks (content, QA, translation)

- Token grants for mid-scope contributions

- Part-time retainers for core devs or BD

- Retroactive rewards for community MVPs

Use smart contracts to automate payments. Use SBTs or on-chain reputation to gate access. Build culture through contribution, not contracts.

Capital Efficiency Is a Founder’s Weapon, Not a Vibe

Raising $3M is not a moat. Managing $300K well is.

In bull markets, founders chase valuations. In bear markets, the smart ones chase efficiency.

Capital efficiency isn’t just runway math. It’s an operating philosophy:

- Model three funding scenarios: full raise, half raise, zero raise

- Reforecast every quarter like a public company

- Tie roadmap deliverables to capital milestones

- Incentivize team with long-term upside, not short-term salaries

VCs notice. So do users. So does your community. Scarcity breeds discipline. And disciplined teams don’t just survive cycles, they win them.

You’re Not Running a Project. You’re Allocating a Portfolio

Web3 is noisy. But your job is to be clear.

Think like an allocator: of capital, of people, of time. Every dollar, hour, and hire should move you closer to product-market fit, community trust, and protocol traction.

Because in this market, the winners won’t be those who raised the most.

They’ll be the ones who needed the least.