Privacy coins are on fire right now. This all started after the amazing surge of Zcash, a Bitcoin fork, and now it seems all the other major privacy coins are following its path — like $FIRO, which surged 42%+ in less than 24 hours. So what’s happening with them, what’s the actual reason for the pump, and what should we be looking at for profits?

Let’s dig deeper and try to understand this all:

Source: Google

Macro picture

If we look into the whole privacy coins space, they are on a surge after a recent narrative shift where users are more focused and cautious about their privacy.

It is safe to say that it all started when Zcash surge almost 19.6%+ in 24hr, with currently

$6.67 Bn 24 hours Market Cap shows a renewed interest in privacy as political noise spikes.

Deep Dive

Political Uncertainty & Privacy Narrative (Bullish Impact)

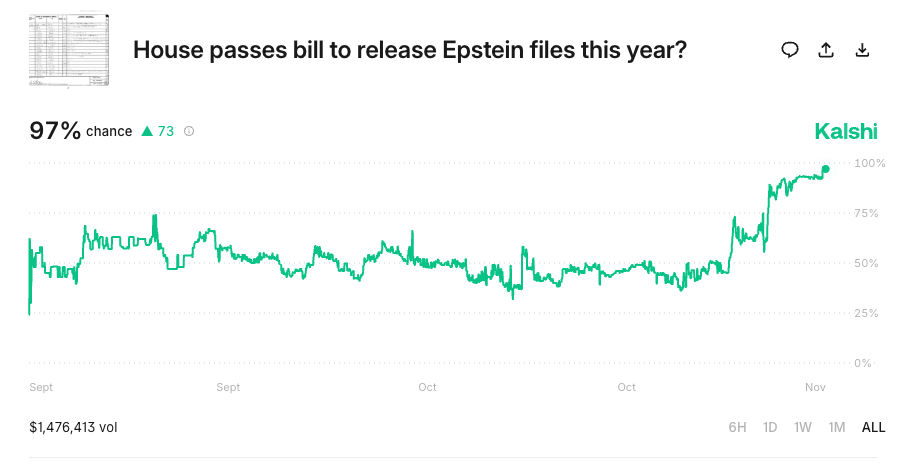

Traders are positioned around a U.S. congressional vote (Nov 18) potentially forcing release of sensitive Epstein-related files, Prediction markets (Kalshi) priced a 93% chance of disclosure, driving demand for censorship-resistant assets.

Source : Kalshi

What does the bill do?

The “Epstein Files Transparency Act” (sponsored by Reps. Thomas Massie and Ro Khanna) would:

Forces the DOJ (Department Of Justice) to release all unclassified Epstein-related materials.

Talking about Epstein Files, these are thousands of government documents currently locked inside federal agencies like the FBI and Department of Justice. They include:

- Investigation records – who was interviewed, what they said, timelines

- Communications – emails between prosecutors, agencies, and Epstein’s lawyers

- Travel and visitor logs – flight records, who visited Epstein’s properties

- Financial documents – money trails, transactions

- Internal memos – what agencies knew and when

The not filter me sing of the vote is:

“Should Congress force a massive, potentially explosive data dump about powerful people connected to Epstein into the public?”

If it passes, it could expose:

Names of high-profile individuals, What authorities knew but didn’t act on & uncomfortable truths about wealth, power, and immunity.

Conclusion

The theory is:

If this passes → Public learns that powerful people were protected or surveilled → Trust in institutions crashes → People fear government power, surveillance, and data misuse → Privacy-focused assets (like privacy coins) become more attractive as a hedge against state overreach.

The current surge in privacy coins we are seeing is just a promo for this over the time with more privacy issues or concerns the focus on these projects will get momentum, hence pumping up the price for really good projects.