Another Depegged Story, on Tuesday, Stream Finance – a Polychain-backed DeFi platform known for “market-neutral” yield strategies, an outside fund manager handling some of their assets lost about $93 million. After that, the platform abruptly suspended all deposits and withdrawals. And to make it worse, their stablecoin $XUSD also depegged 25% making the $XUSD token goes from $1.2 to $0.25 down by 72% in just 1 day!

Source:@StreamDeFI

Let’s try to make sense of all of these. Why this depegged was originated in the first place is that a bug, an oracle error, or more than that!!

Causes of the $93 Million Loss

From research, Stream Finance’s loss did not originate from a simple technical bug or one-off hack – instead, it appears to be the highly leveraged, off-chain strategies that burst out under stress. According to on-chain investigations and security researchers, Stream operated as a recursive looping yield platform. Users would deposit stablecoins (primarily USDC) into Stream in exchange for $XUSD – a yield-bearing token that Stream marketed as a “market-neutral fund” aiming for stable high returns of around 95% APY.

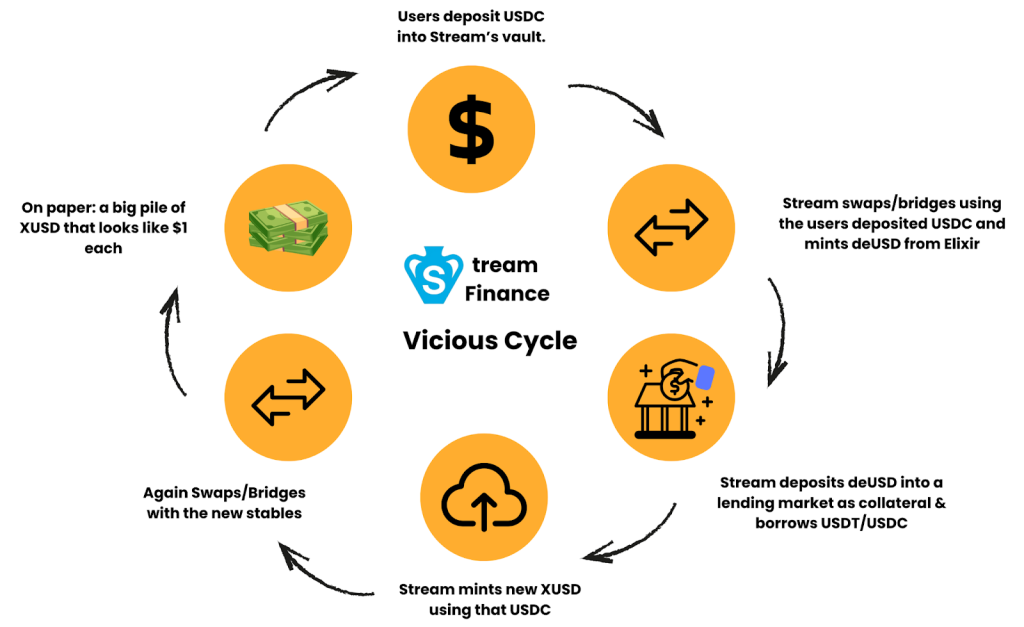

Behind the scenes, however, Stream and its partner protocols engaged in circular lending and minting between multiple “stable” assets, drastically multiplying leverage:

Stablecoin-on-Stablecoin Collateral Loop: Stream’s XUSD was not fully backed 1:1 by reserves; instead, Stream would take user deposits (e.g., USDC), swap or bridge them to acquire Elixir Network’s stablecoin “deUSD”, and then use deUSD as collateral in lending markets to borrow more stablecoins. Those borrowed funds would then be bridged back and used to mint additional XUSD – essentially minting Stream’s own token using borrowed liquidity. This recursive leverage loop meant the same capital was reused multiple times across protocols. In one traced example, roughly $1.9 million in USDC was cycled to mint about $14.5 million XUSD – an astonishing ~7.6× leverage.

Stream’s strategy was intertwined with Elixir’s “deUSD” stablecoin in order to create a perpetual motion machine of borrowing and minting.

Elixir (deUSD) would lend millions of USDC into isolated lending pools that accepted XUSD as collateral, allowing Stream to borrow those USDC against newly minted XUSD and loop again. Essentially, Stream and Elixir were shuffling the same collateral back and forth – For example, on one network (Plasma), Elixir supplied ~$70 million USDC and Stream borrowed over $65 million against XUSD in a Morpho lending market.

This allowed over $14 million XUSD to be created from just < $2 million real capital in a single day’s looping. That’s what leverage means!!

Apart from that, Stream’s on-chain “Proof of Reserves” (PoR) was always “coming soon” , meaning outsiders had little visibility into its true collateralization. The platform reported ~$160–170M in user deposits vs. ~$520–530M in “total assets across strategies,” reflecting ~3–4× leverage. Stream Finance and Elixir Network didn’t just discover yield farming. They discovered financial perpetual motion.

They turned $1.9 million into $14.5 million.

How? By backing a stablecoin with another stablecoin that was backed by the first stablecoin.

So in a way we can say that $14.5M of ‘Stablecoin’ Was just backing itself. Isn’t it??

Source:X

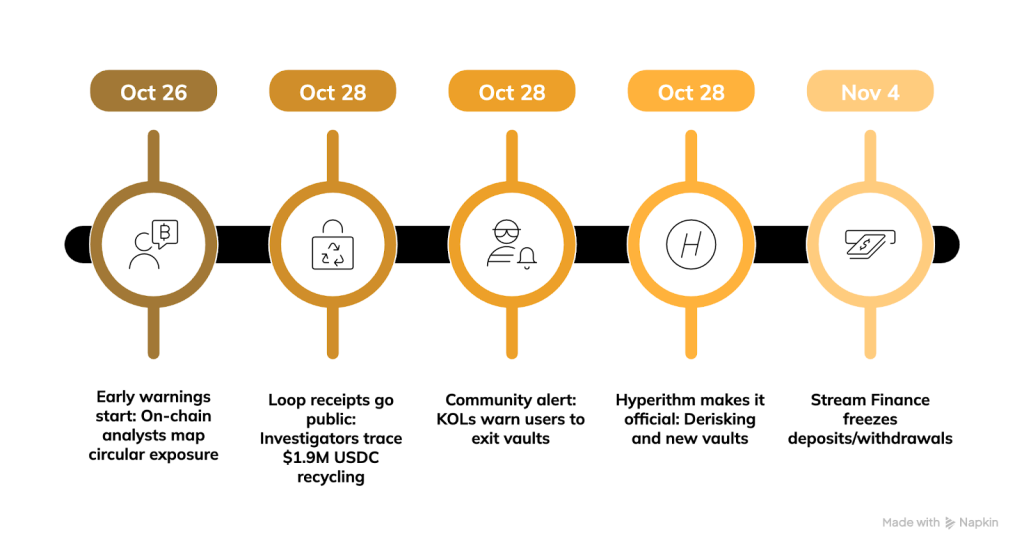

Hyperithm, quietly pulled the Assets!!

The “institutional” yield manager, Hyperithm, quietly pulled $10 million out before all these collapses. They literally released an official post explaining everything and telling we have done the math and we are out of these, within 2 days all the mHYPER liquidity was pulled off from xUSD & yUSD Vaults.

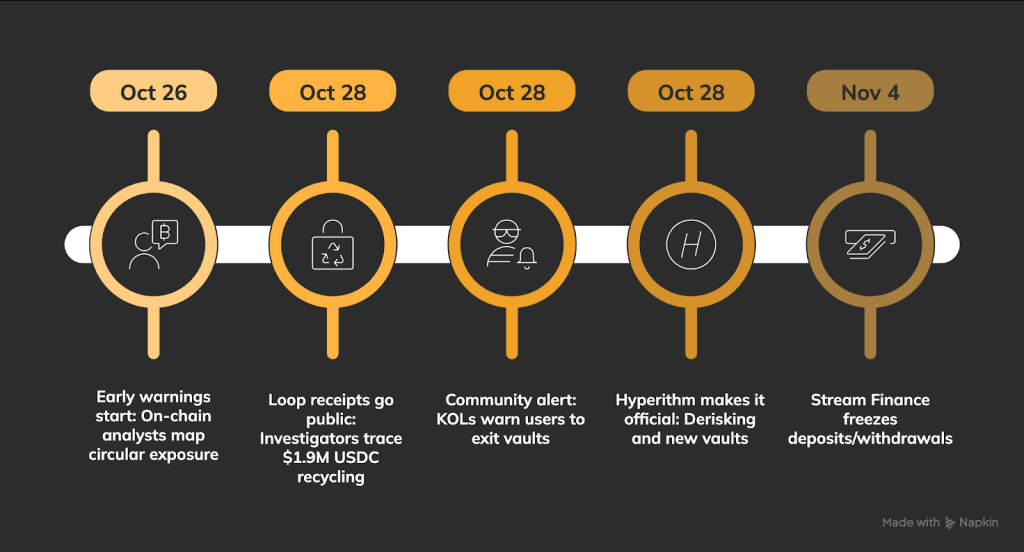

Timeline for Hyperithm Pull Off

The Missed Kill-Switch: That Should’ve Been There

Always in liquidation, or while leveraging any assets, liquidation isn’t a last-minute thing; it’s an always-on discipline. Meaning, we track live equity—assets minus liabilities—and we hard-code a principal floor that cannot be crossed.

If the original capital was $1.9 million in stables, the engine must be wired so that the moment live equity falls above it, the system automatically stops , that was the major precaution they should have taken but stream finance leveraged the stack without enforceable precautions—no binding collateralization bands that auto-delever/stops on volatility cross, no collateralization ratio was mentioned.

These safeguards really matter because leverage makes time your enemy.

Conclusion

The collapse of Stream Finance’s XUSD and the $93 million loss serve as a sharp reminder that there are no free lunches in DeFi.

High yields often come hand-in-hand with hidden risks, and when those risks materialize, they can threaten the stability of many interconnected projects.

Users, Founders & Investors always need to DYOR (Do Your Own Research) >> Over HYPE, Hyperitm did that and saved a major hit to their asset management fund!!

Especially wrapped assets and stablecoins, they are the foundational pillars of the crypto ecosystem, can be particularly vulnerable to such events, as trust and collateral integrity are very important for them.

In this incident, wrapped products like xBTC/xETH proved only as good as their issuer, and exotic stablecoins like XUSD, deUSD, and scUSD crumbled without any solid foundations.

So the next time you see 95% APY

Ask yourself, “Am I earning yield, or am I the yield?”