You Raised in the Wrong Season, Now What?

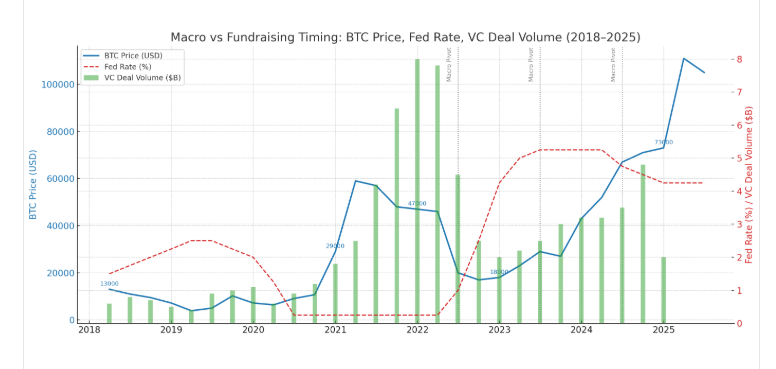

If you were raised in early 2025, you likely walked into a storm without realizing it. Macro looked “stabilized,” BTC hovered near $115K, and LPs were peeking back into the market. But behind the scenes, the Fed was holding tight, liquidity was still expensive, and most VCs were quietly triaging their 2021 vintage. You weren’t late, you were just mistimed.

Fundraising in Web3 doesn’t follow traction; it follows belief. And belief is downstream of macro. In Q1 2023 and again in May 2025, the smartest founders raised not when the Fed cut, but when the market believed the Fed would. Your job isn’t to time the news. It’s to pre-position your round for when sentiment turns. Because when the decks flood VC inboxes, it’s already too late.

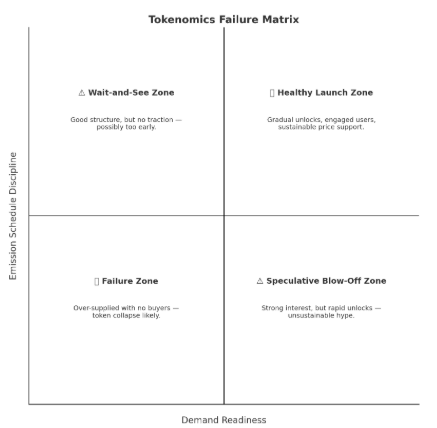

The Tokenomics Trap: When Launch Kills Long-Term Value

2025 taught us that great tech can still die from bad token design. Too many projects launched tokens before utility, rushed emissions to ride market highs, or over-promised staking yields that turned into liabilities.

The worst offenders? Teams that mistook token price for product-market fit. When BTC rallied post-FOMC pause, dozens of teams dropped tokens to catch the wave. Most of them bled out by Q3. Why? Because tokens without usage become sell pressure.

The teams that won took the opposite path. They delayed their TGE, tested incentive designs in closed loops, and aligned token unlocks with user adoption. One DeFi protocol even tied emissions to on-chain usage growth, not arbitrary schedules. Result? 3x user growth and sustained TVL despite market churn.

You Built a Crowd, Not a Community

The 2021 playbook said: get loud, go viral, ship hype. In 2025, that strategy created zombie DAOs. Projects with 200,000 Discord members and no volunteers for governance proposals.

What we learned is that community is not a marketing channel. It’s infrastructure. The most resilient startups treated their community as co-owners, not spectators. They onboarded contributors via quests, rewarded real work (not just tweets), and decentralized decision-making over time.

One NFT project saw a 5x increase in creator retention after moving from top-down curation to community voting. Another ecosystem funded over 40 dev projects through quadratic grants, turning lurkers into builders. Crowds fade. Communities compound.

Decentralized in Name Only?

Governance went from ideal to liability in 2025. The projects that decentralized too early watched whales hijack proposals, token holders sleep through votes, and contributors burn out. Voter apathy wasn’t just a UX issue, it became a strategic risk.

The better approach? Progressive decentralization. Protocols like Optimism introduced dual chambers for technical and public goods funding. Others deployed delegate programs with milestone-based incentives.

The common thread? They earned decentralization. They started centralized to build momentum, then handed over control with care. If your DAO isn’t solving real coordination problems, you don’t need one yet.

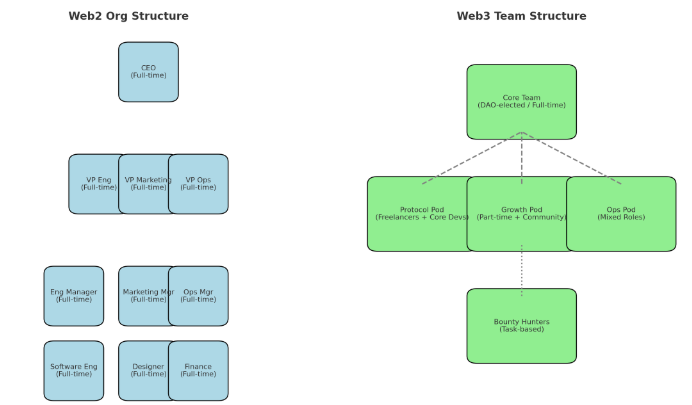

Full-Time Is Dead, Your Team Needs to Be Fluid

2025 proved that Web3 doesn’t scale with fixed org charts. Founders who insisted on traditional hiring watched their burn rates soar and morale plummet. Meanwhile, lean teams tapped the freelance economy to access elite talent, fast.

The winning model? Core pod + fluid contributors. A DAO protocol built a 12-person full-time core, surrounded by 30+ contributors paid via bounties and retroactive grants. This let them scale up during token launches, then downshift in bear phases, without layoffs.

The key shift? Incentive alignment. Projects paid in stables + vested tokens. They used SBTs (soulbound tokens) as contributor credentials. The result? Ownership without overhead.

PMF Is a Moving Target, Stop Building Like It’s 2021

Too many teams still treat product-market fit (PMF) like a one-time milestone. But in Web3, PMF evolves with the market. The dApp that found traction with yield farmers in 2022 couldn’t retain users in 2025 unless it pivoted to real-world utility or gamified stickiness.

The best founders this year ran continuous discovery loops. They didn’t just ship roadmaps. They shipped hypotheses, validated with on-chain data, and iterated fast. One SocialFi app saw retention jump 40% after switching from forum-based engagement to token-curated feeds, based on Nansen wallet segmentation.

PMF in Web3 isn’t static. It’s a moving algorithm of macro, community, and token design. Treat it like a dashboard, not a checkbox.

The Investor Whisperer: Navigating the New VC Psychology

Post-2022, investors stopped chasing hype. By 2025, they were doing what founders should have been doing all along: underwriting risk-adjusted upside. That means PMF, defensible moats, and clear token utility.

The founders who closed rounds weren’t louder. They were sharper. They showed CAC/LTV with on-chain data. They mapped TAM using token velocity. They pre-empted regulatory risk with proactive disclosures. And most importantly, they built trust before asking for capital.

Your data room should open before your deck does. Because in this cycle, conviction closes rounds. But clarity opens doors.

The Best Founders of 2025 Were Macro Traders in Disguise

Building in Web3 in 2025 wasn’t just about the product. It was about reading the rate cycle like a chart, timing your token like a launchpad sniper, and building teams like modular DAOs.

You don’t get to pick the macro. But you do get to pick how your project rides it.

The next cycle won’t reward noise. It’ll reward founders who can build durable systems, for capital, for users, and for contributors.

And if 2025 taught us anything, it’s this: the edge isn’t just in your tech. It’s in your timing.