You all have noticed and seen that most of the agents are launched in Agentic launchpads with tokens, like in Virtuals and Creator Bid, but after evaluating and going through the resources, I believe that still the Agent Utility (means the value that the AI Agent is providing) is not reflected/connected by the price.

Ecosystems have their own emission mechanism, in order to accrue the value, which includes, you know, staking, bidding, buyback, burn.

But how does using an AI agent, which is genuinely good, directly support or increase the price of agentic token under the hood in, let’s say, Creator Bid?

One simple way is establishing a token gateway, meaning you can access the agent via the agentic token only; that will eventually increase the buy pressure, but let’s be real, this will create a lot of friction for non-crypto-native people and hinder the growth.

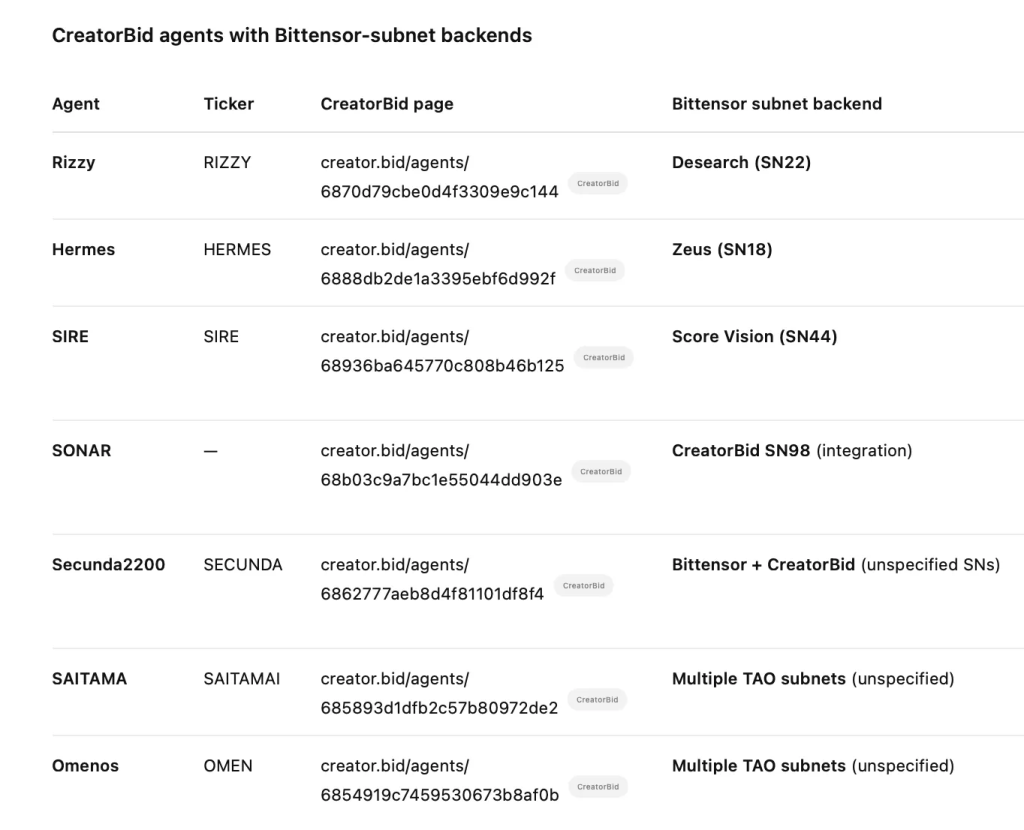

So what’s the way around? Here comes the amazing ecosystem of Bittensor and subnet tokens. If you look, then with the rise of decentralised AI, more and more teams are using Bittensor subnets as a source of data and backend for their agent, like,

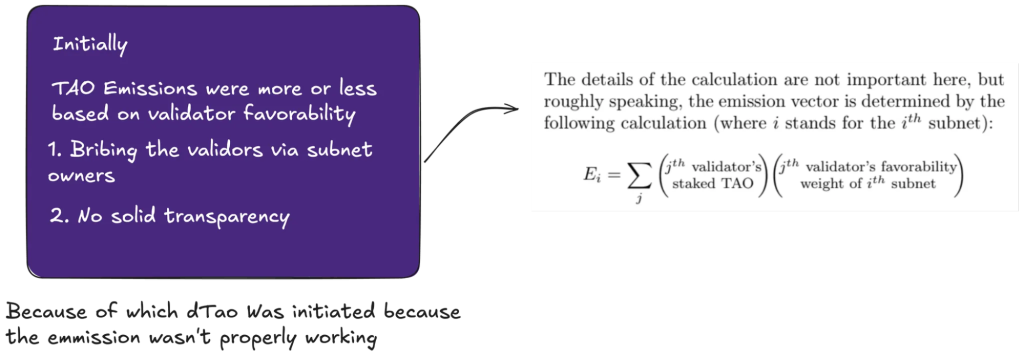

Initially this correlation wasn’t possible but, with the launch of dTAO or subnet tokens this can be possible. First I will quickly explain how dTAO works :

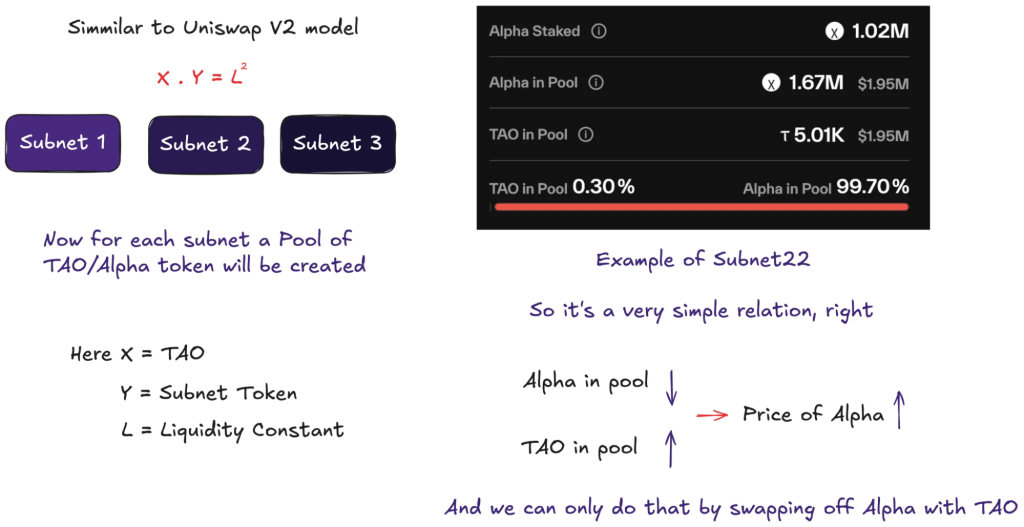

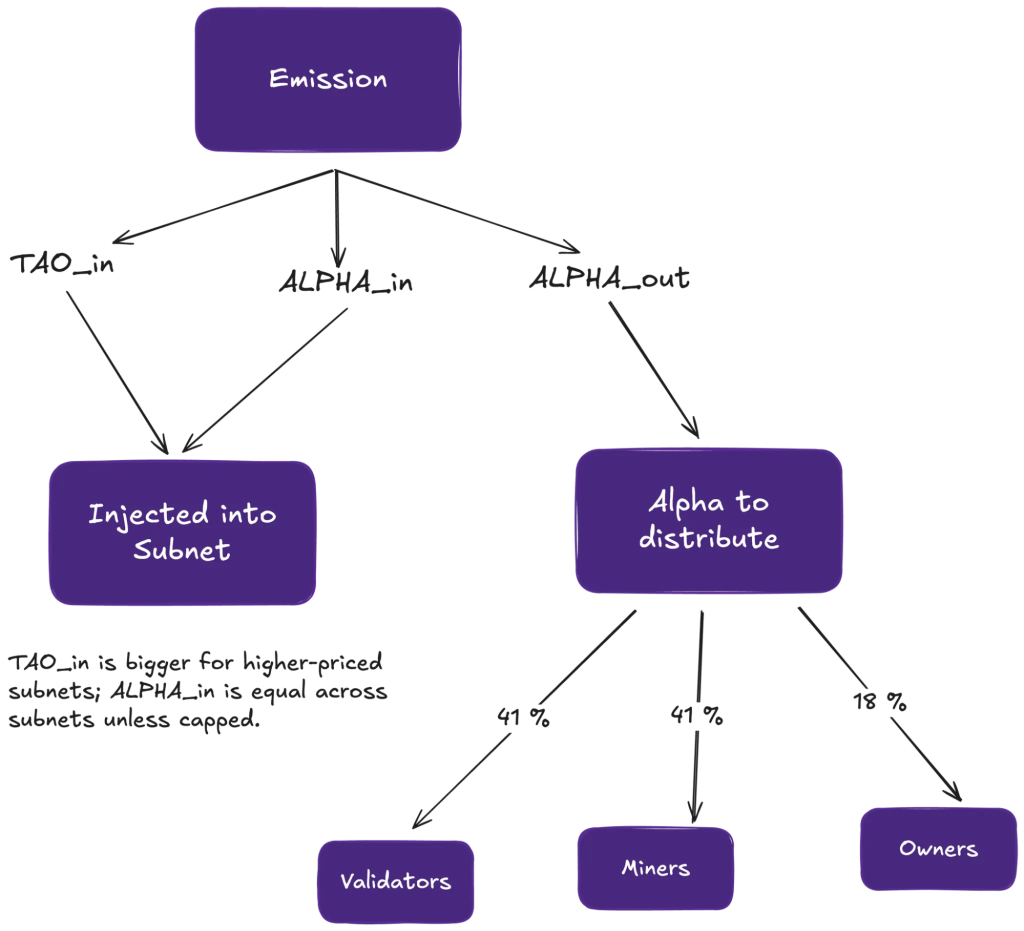

These are the main reason for the dTao release, now every subnet have their own subnet token called dTao or Alpha 1, Alpha 2 …, and every subnet have liquidity pool of TAO/Alpha :

Before dTAO, emissions were set by validator weightings—hard to scale, easy to game (vote your own subnets, side deals), and often apathetic.

With dTAO, emissions track market price (a proxy for perceived utility). Subnets that real users (and investors) want to support get higher p, so they receive more TAO per block,

We can see right this mechanism will eventually increas ethe subnet token price if the subnet is used or operate successfully, full transparency.

Somehow Need to connect this to Agentic Launchpads (like Creator BiD) !!

And since, most of the Agents launched on Creator BID are backed or supported by these Subnet, we should correlate/connect this dTao model with Creator BiD ecosystem !!!

What this will do ??

As discussed before one simple way would be a token gateway, but that’s not feasible in long run. These are some pointers that I can think of to connect this-

(Explaining with RIZZY)

1. Manual hardcoded:

Price Oracle Hooks

Bring Subnet’s EMA price on-chain (Base) via an oracle/attestation, then wire simple rules in Rizzy’s treasury:

- If p_SN22 ↑ week-over-week, increase buyback rate for RIZZY or increase BID rewards to endorsers.

- If p_SN22 ↓, divert more revenue to TAO→Alpha locking (lever #1) until the EMA stabilizes.

Here, p_SN22 = Price of Subnet 22 token,

2. RIZZY ←→ Alpha bonding logic

- In future curated sales/new mints, route a fraction of every raise through TAO→Alpha before any other use.

- Or make RIZZY buybacks scale with p_SN22 (higher SN22 value ⇒ stronger RIZZY buyback), and Alpha locks scale with RIZZY revenue growth (closing the loop both ways).

Quick Sample Calculation

- RIZZY weekly protocol revenue: $36,000

- p_SN22 (7-day EMA) rule:

- If EMA up ≥5% → “Risk-On”

- 20% of revenue → RIZZY buyback & lock/burn

- 15% → TAO→SN22 accumulation (treasury)

- If EMA down → “Support Subnet”

- 10% → RIZZY buyback

- 25% → TAO→SN22 accumulation

3. Treasury Floor backed by Alpha

- Accumulate a basket of SN22 Alpha in the Rizzy treasury. Publish a floor NAV per RIZZY based on treasury Alpha.

- Optional redemption window (time-boxed) where RIZZY can be redeemed pro-rata for Alpha (or TAO proceeds from selling some Alpha). That ties RIZZY’s value to SN22’s value without full pegs.

These are obviously some of the ideas I pointed down need to do more exhaustive research on this to get this done!!

But anyhow it is very important, that utility connects with the agentic token value which is currently missing in most of the launchpads models.