You Were Promised Liquidity. You Got Paper Instead.

For decades, real estate was a wealth-building gospel. IP was an asset class in name, but not in flow. Institutions romanticized illiquidity as a moat. You, the operator, knew better. You saw capital trapped in legal silos, payout cycles measured in quarters, and deal structures that seemed allergic to agility.

2025 marks the pivot. Not because the tech just arrived, Ethereum, stablecoins, oracles, and on-chain compliance modules have existed for years. But because institutional fatigue finally met infrastructure maturity. Tokenization, once a buzzword, is now a financial strategy.

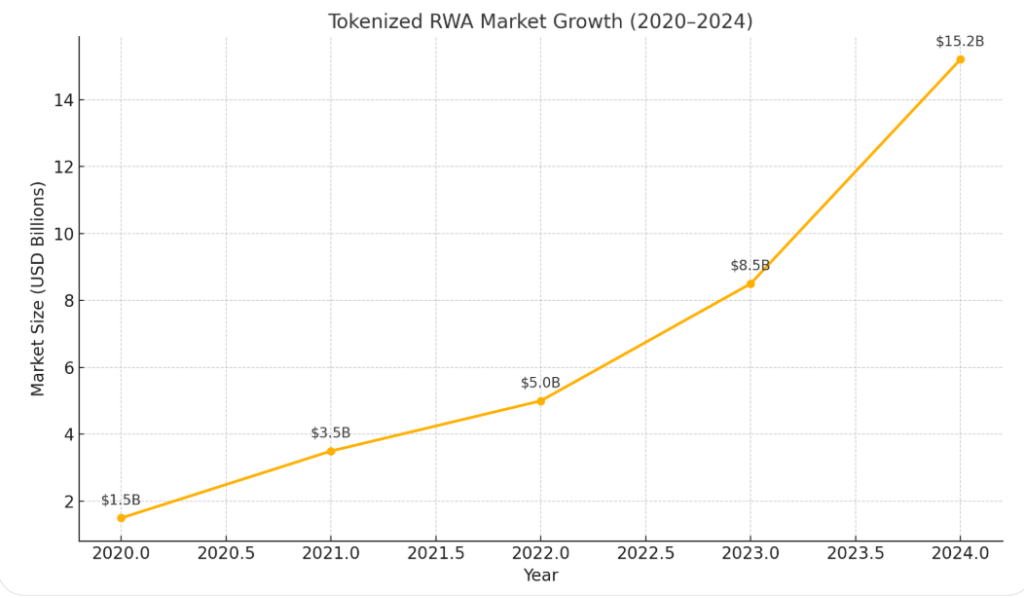

Real-world asset (RWA) tokenization isn’t hypothetical anymore. It’s already pushed over $15.2B in on-chain value (excluding stablecoins), and it’s pulling in everything from Miami duplexes to Korean pop licensing rights.

The question isn’t if RWA tokenization will matter. The question is: who controls the flow?

From Title Deeds to Token Streams: The Real Estate Liquidity Flip

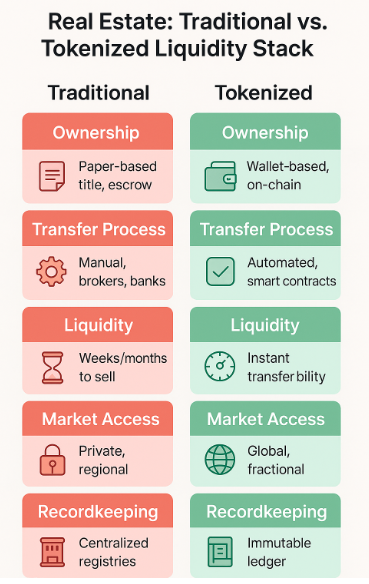

Real estate is the case study the market needs. It’s large, regulated, globally understood, and painfully inefficient. Tokenization is not simply digitizing deeds. It’s restructuring how ownership, yield, and risk are shared.

Fractionalized ownership through tokenization means a $500K apartment can be split into 10,000 tradable shares, each programmable with governance rights or yield distributions. This isn’t equity crowdfunding 2.0. It’s programmable liquidity.

Platforms like RealT and Lofty are already trading tokenized real estate on-chain. Secondary markets are forming. Yields are distributed weekly. And crucially: compliance frameworks are now embedded into smart contracts.

Tokenized real estate isn’t just “faster paperwork.” It’s an entirely new liquidity stack.

For founders building in this space, the implications are massive:

- Cap table flexibility for real estate developers

- New yield primitives for DeFi protocols hungry for stable returns

- A shift from closed-end REITs to open-token ecosystems

Real estate is proving what tokenization can do. But it’s IP that shows us what tokenization can become.

IP, But Make It Liquid: The New Economy of On-Chain Creativity

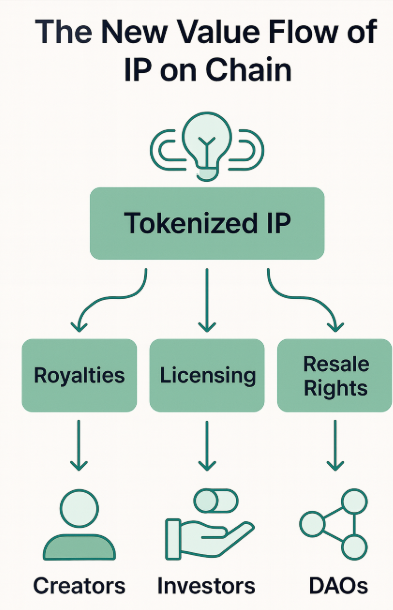

Imagine owning a slice of a movie’s future royalties, or receiving streaming micropayments every time a viral TikTok sound plays. In 2025, this isn’t science fiction. It’s live code.

Tokenizing intellectual property (IP) lets creators monetize their future earnings today, while giving investors exposure to a new class of yield-generating assets. From music catalogs to game assets, the IP token economy is forming fast.

Here’s what changes:

- Revenue Streams Become Programmable: Smart contracts can auto-split income across stakeholders in real-time

- Royalties Become Financial Products: Investors can buy, sell, and leverage IP tokens like they would bonds or equities

- Communities Become Co-Owners: Fans don’t just support artists; they invest in them

Platforms like AnotherBlock (music), Royal.io (royalty sharing), and Shibuya (film) are already building this stack. But the key unlock isn’t just tech, it’s trust.

That’s where the rails come in.

The Rails Beneath the Shift: Why Infrastructure Will Make or Break RWAs

Tokenization isn’t just about assets. It’s about trust, compliance, and composability. This is where infrastructure matters most.

Successful RWA ecosystems require:

- Compliant Token Standards (ERC-1400, ERC-3643)

- Decentralized Identity (DID) for KYC/AML on-chain

- Oracles for pricing, valuation, and real-world event verification

- Custody and Bridging Mechanisms for off-chain assets

The biggest narrative miss in 2022-2023 was ignoring the middleware. In 2025, it’s clear: whoever owns the compliance stack owns the asset flow.

Layer-1s like Ethereum and Avalanche are racing to become RWA-native chains. L2s like Base and zkSync are optimizing for institutional throughput. Projects like Chainlink and Centrifuge are building the data backbone that makes trustless real-world integration possible.

If you’re a founder, your stack is your moat. Your compliance logic is your protocol advantage.

Why DeFi Needs Real-World Assets More Than the Other Way Around

DeFi isn’t scaling on speculation alone anymore. Blue-chip yields have compressed, and user retention has shifted from airdrop hunters to capital allocators. DeFi protocols need RWAs to anchor value and generate stable, real-world returns.

Real-world assets offer:

- Predictable yield flows (e.g., treasury-backed stablecoins)

- Lower volatility collateral for lending protocols

- Narrative alignment with institutional DeFi adoption

Projects like Maple Finance, Goldfinch, and Ondo are leading the charge by integrating real-world debt, bonds, and treasury products directly into DeFi strategies.

This isn’t a concession. It’s graduation. DeFi is maturing into a hybrid market, and RWAs are the bridge.

Founders should ask:

- What asset class can my protocol unlock for users?

- Can I underwrite off-chain risk using on-chain signals?

- Who audits my asset flow, and how often?

The next Uniswap won’t just trade tokens. It will trade tokenized yield, with compliance embedded in every swap.

This Isn’t a Trend. It’s a Trillion-Dollar Redesign.

Tokenization in 2025 is not a sector play. It’s a redesign of how capital moves.

McKinsey projects that asset tokenization could reach $5-10 trillion by 2030. But if you’re a CXO, your timeline is shorter. The winners are being minted now, protocols building the rails, products creating the flows, and platforms earning regulatory trust.

Key signals to watch:

- Regulatory frameworks emerging in Singapore, Dubai, and the EU

- US Treasury-backed stablecoin momentum

- L1s launching native RWA primitives (e.g., tokenized treasuries)

If you’re building in Web3, ask yourself:

- Can I plug into the tokenized asset graph with minimal friction?

- Am I building for compliance, or bypassing it?

- Will my product work when the real-world capital finally shows up?

Because here’s the truth: RWA tokenization isn’t waiting for you. It’s already moving.And in 2025, the flow isn’t coming from crypto to Wall Street.

It’s the other way around.