Hello readers, Crypto is building its own – better – banks, catering the broken payment rails to redefine it.

From EtherFi to Plasma and beyond, teams are working to bridge Onchain assets to real-world spending through cards, savings accounts, and all the financial services we’d expect from a bank.

It makes a lot of sense. As financial services platforms that provide traditional banking features — saving and spending — packaged neatly into digital platforms (most commonly mobile apps), neobanks fit well into crypto’s digitally-native and semi-nomadic user base.

In all of these add the fact that :

- Crypto is a killer on payments.

- Has created a new swarm of people who hold wealth onchain but need ways to use that money offchain, Neobanks is the perfect option for them.

- Stablecoins sees its highest level of adoption in areas without stable banking infrastructure like Nigeria, LATAM & other underdeveloped nations.

Let’s look whether the onchain data is supporting this or not:

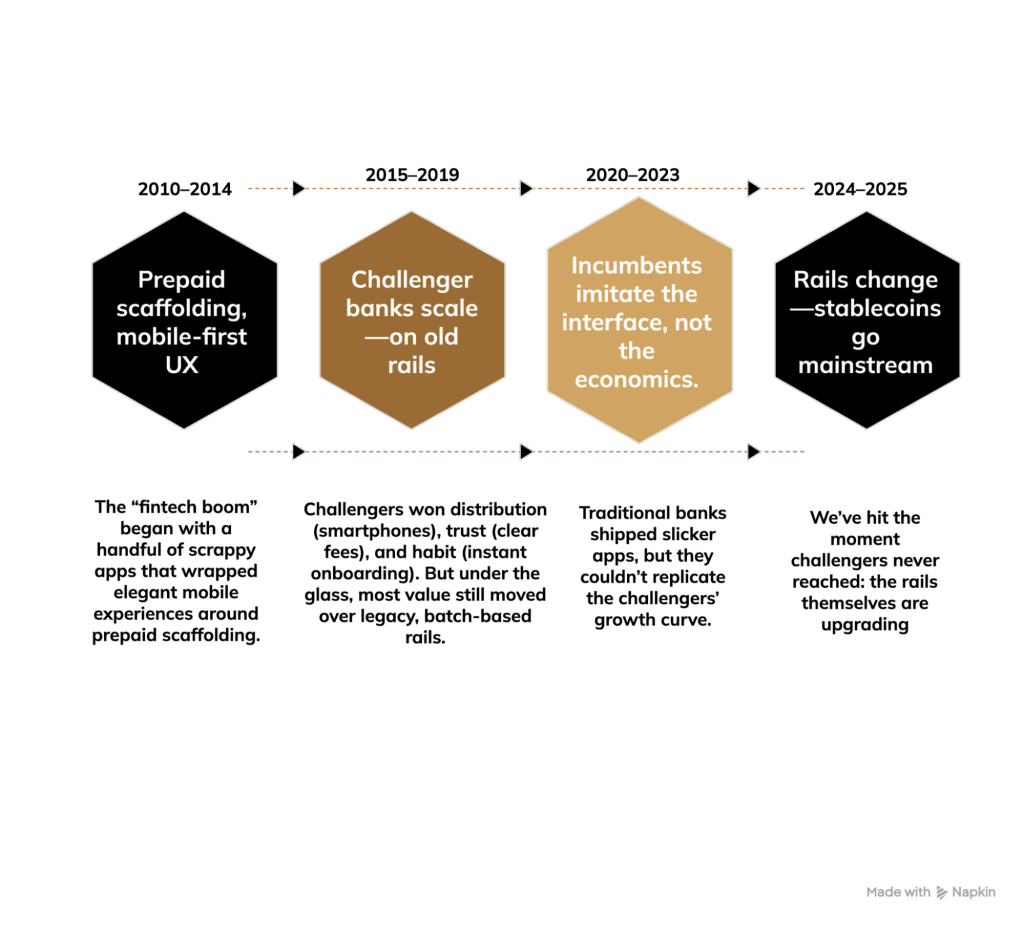

A quick timeline of disruption

Current Major Players

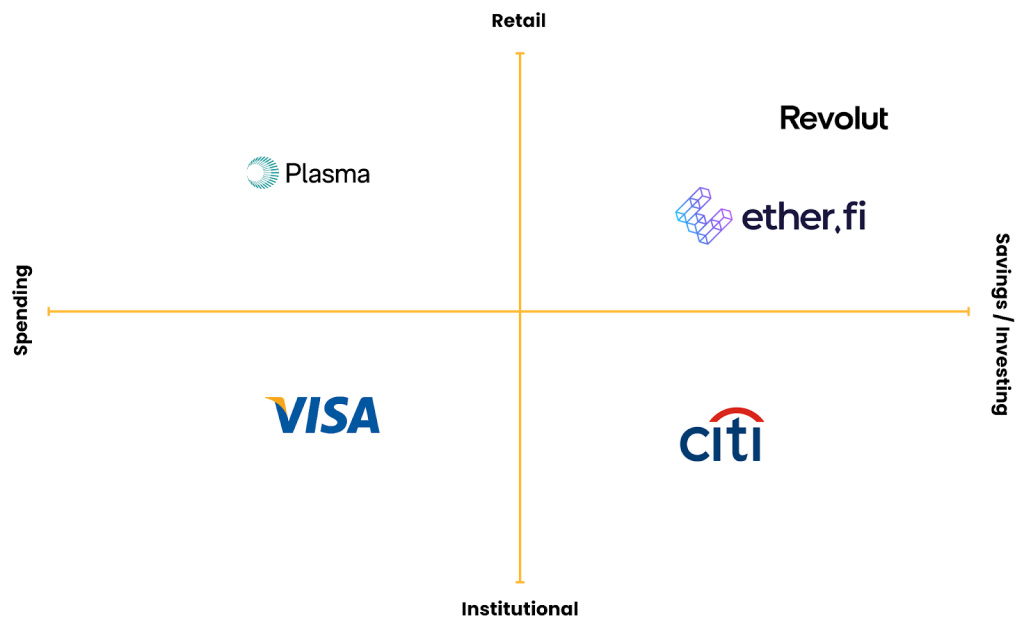

The spectrum separates into 4 different aspects:

- Retail (Top): Projects that focus on everyday people instead of institutions

- Institutional (Bottom): building B2B solutions

- Spending (Left): focused on everyday use (spending), as most crypto cards. (Or infrastructure providers powering payment systems).

- Savings / Investing (Right): with large focus on growing capital and DeFi opportunities

EtherFi

The most reliable “credit card” out of the available options, EtherFi’s Cash feature lets you load from a non-custodial wallet and spend directly from it at 100M locations worldwide, including via Apple Pay or Google Pay. The real perk is that we can borrow against ETH or stablecoins without selling, and yields auto-compound on holdings (though you are at risk of liquidations). Savings rates include up to 10% APY on spendable stablecoins and variable restaking rewards on EtherFi’s derivative ETH and BTC tokens (around 3-5% currently). FX fees are 1% for conversions.

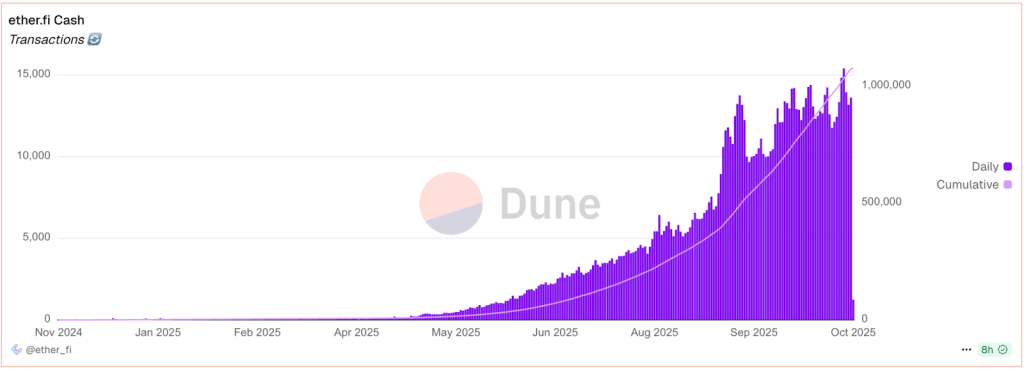

Etherfi on chain data shows touching $1 Mn on spend volume on a daily basis, BTW this is much much lower than what traditional bank and credit card providers provide!!

- Citi Bank processed around $4–5T/day across >100 countries

- Visa process ~639M/day

So there’s still a lot of room to grow.

Plasma (web3 neobank)

A stablecoin-native “neobank” built around self-custody. With Plasma One, we spend directly from our USDT balance while it keeps earning (advertised 10%+ yield), and get up to 4% cashback (tiered, paid in XPL). Instant virtual card, Apple Pay / Google Pay support, and usage anywhere Visa is accepted across 150+ countries. Zero-fee USDT transfers on Plasma route, instant freeze/alert, and off-ramp to bank account.

Some of the cons about web3 Neobanking, Bridging funds can add a step for beginners, the 1% FX fee is higher than some competitors, and top-tier benefits require significant spending to unlock.

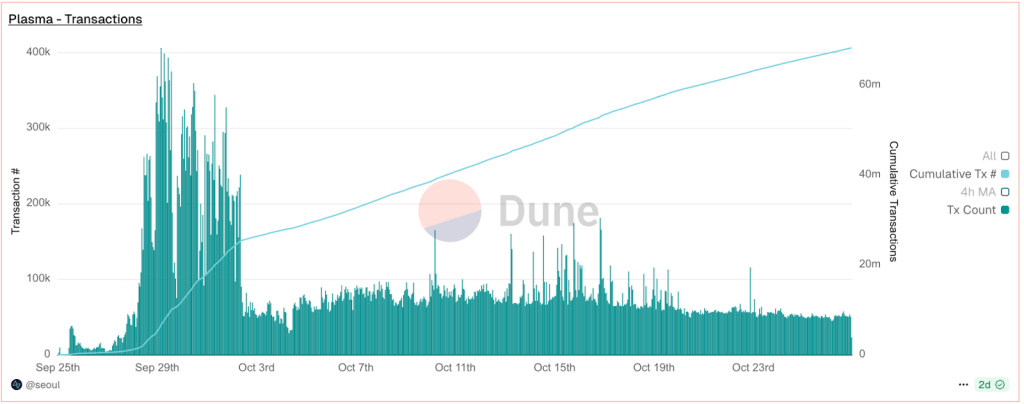

The major spikes visible is the time period when Plasma’s mainnet beta + $XPL token went live, with press and dashboards hitting the same day. So the spikes is mostly genesis effects (token + airdrops + listings + liquidity bootstrapping), which gets normalised afterwards.

The 10x Now Moment

For years, crypto-natives talked about “banking the unbanked” with blockchain technology. Now it’s the moment:

Stablecoins are mature—with a $200B+ market cap, proven stability, and regulatory frameworks in place. Networks are fast and cheap: Solana, Base, Plasma, and Mantle handle thousands of TPS at sub-cent fees. UX is dramatically better thanks to account abstraction, social recovery, and embedded wallets—crypto feels like Venmo now. Regulations are clarified, with hurdles removed by the GENIUS Act (US) and MiCA (EU). And the infrastructure is plug-and-play: Circle/Tether APIs, Fireblocks custody, and Plaid-style onboarding mean we don’t need to reinvent the wheel.

It’s not a better time than now to get involved in this, as a founder, investor and even as normal user.

Conclusion

Despite the momentum, Web3 neobanks remain dramatically undervalued compared to traditional players. Stablewatch recently published a research report comparing Plasma and

EtherFi to traditional neobanks by TVL and market valuation:

Traditional Neobanks:

- Nubank: $70B valuation, 122M users

- Revolut: $75B valuation, 60M users

- SoFi: $31.4B valuation, 18M users

Web3 Neobanks:

- Plasma: ~$3-4B valuation

- EtherFi: ~$600M-1B valuation

If Web3 neobanks capture even 5-10% of the market share that Web2 Neobanks hold, we’re looking at 10-30x valuation upside from current levels. So, it’s safe to say that yes, Neobanks are the new meta for sure!!