1. Builders Are the Smartest Capital in the Room

By the time VCs start tweeting, builders have already moved on.

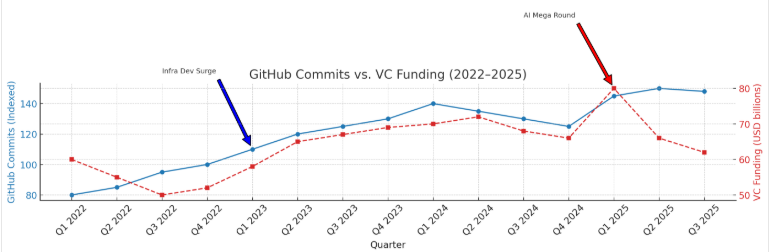

In this cycle, the early signal isn’t coming from Telegram alpha groups or fund press releases. It’s coming from GitHub commits. While investors remain cautious, developer activity on ZK circuits, L2 infrastructure, and embedded DeFi primitives is surging. This is the clearest sign yet: the next wave of value will be built, not bought.

Founders need to stop optimizing for downstream capital flow and start aligning with upstream builder behavior. That means tracking where developers are migrating (e.g., Solana’s comeback, OP Stack adoption), what tools they’re coalescing around (account abstraction, intent-based protocols), and how they collaborate (open source, modular, permissionless).

VCs are no longer the first movers. Builders are.

2. Why Infra Is Having Its Consumer Moment

Infrastructure was once invisible. Today, it’s opinionated, productized, and directly shaping user behavior.

Protocols like Privy, Lit Protocol, or Alchemy aren’t just backend utilities anymore. They’re creating UX standards. They abstract complexity, offer plug-and-play SDKs, and influence what gets built downstream. This isn’t just infra, it’s infra-as-product.

Founders operating at the protocol or middleware level must recognize this shift. You’re no longer pitching dev tools; you’re crafting products that define app-layer possibilities. That means obsessing over onboarding flows, API docs, SDK coverage, and dev support like a B2B SaaS company.

Infra that feels like a product gains adoption faster. Infra that waits to be discovered becomes irrelevant.

3. Tokenless, Yet Traction-Rich: The New Go-To-Market

Gone are the days of launching a token as your GTM. The smartest teams are delaying emissions, not because of regulation alone, but because traction now precedes tokens.

Projects like Farcaster, Lens, and Hyperlane are proving this: you can scale developer and user adoption without needing a token. This gives founders time to refine product-market fit, build real community, and test incentive mechanics without introducing market noise.

Tokenless doesn’t mean value-less. It means you’re building a stronger foundation for token utility later. You earn distribution. You don’t buy it.

For founders, this requires a mindset shift: think of your protocol as a startup. Pre-token traction is your Series A. Launch your token when it compounds, not when you need cash.

4. Follow the Funding, but Zoom Out

The capital stack has changed. Infra-first VCs, L1 ecosystem funds, and DAO grants now outpace traditional equity rounds in early Web3.

But capital is more fragmented than ever. Polygon, Optimism, and Arbitrum collectively disbursed over $300M in grants last year. ZK projects are flooded with ecosystem-specific accelerators. Infra-native VCs (like Variant, 1kx, or Robot Ventures) fund ideas that resemble dev tooling more than DeFi.

Your job isn’t to chase the loudest capital. It’s to design your stack:

- Start with non-dilutive grants to extend runway

- Use token warrants strategically (not as bait)

- Align round timing with macro cues (Fed signals, BTC dominance, ETH volumes)

Builder-aligned funding isn’t scarce. It’s just misread.

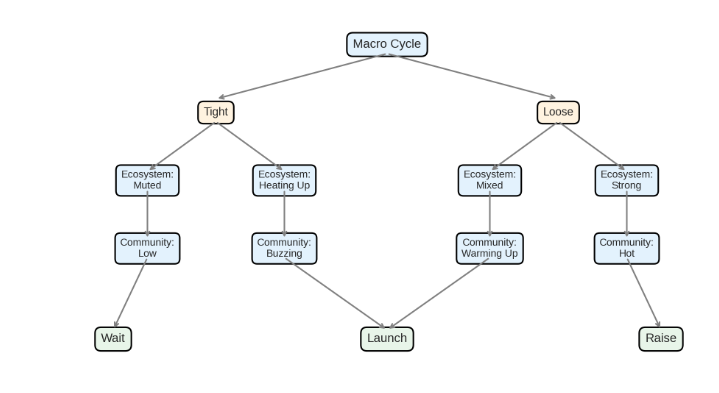

5. Your Product Roadmap Is a Macro Trade

Yes, you’re building a protocol. But you’re also trading macro.

Every token launch, raise, or go-to-market motion is downstream of liquidity conditions. And liquidity is priced in before the Fed speaks.

History tells us that crypto markets bottom before rate cuts. Builders who launched in Q1 2020 or mid-2023 rode liquidity waves. Those who waited for official pivots missed the upside. That means your roadmap can’t just be about features, it needs to price in sentiment, cycle timing, and capital rotation.

Ask:

- Is this a feature season or a funding season?

- Should we optimize for traction or treasury health?

- Will a token today cannibalize trust tomorrow?

In Web3, roadmap timing is capital strategy.

6. If Builders Lead, Founders Must Translate

If you’re building infra, your user is a developer. But your buyer may be a DAO, VC, or institution.

That means founders need to translate builder-led traction into strategic positioning. A GitHub repo with 1,000 stars means little if it doesn’t map to a use case narrative. Developer activity must evolve into adoption stories, integration stats, and proof points that capital and community can understand.

Positioning isn’t marketing. It’s storytelling for the capital allocators, community leaders, and ecosystem partners who move slower than devs but write the big checks later.

You don’t need to be everywhere. You need to be legible where it matters.

The Next Cycle Will Be Built, Not Hyped

The hype cycle is quiet. The builder cycle is not.

Founders who align with what developers are building, not what influencers are tweeting, will own the next wave. That means positioning your project upstream of capital, downstream of developer UX, and at the intersection of infra-product fit.

In Web3, builders don’t follow the market. They front-run it.

Founders should do the same.