Metaplanet Didn’t Just Buy Bitcoin, They Bought a Story

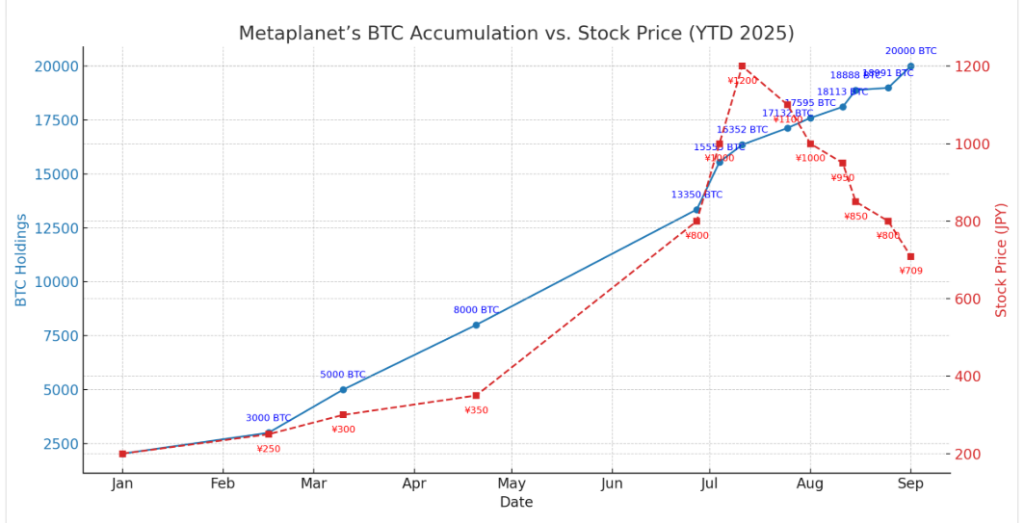

You’re a Web3 founder staring at the runway. Capital is tight, token prices are twitchy, and VCs are asking about your treasury like it’s your product. Then Metaplanet, a small-cap Japanese firm, does something that slices through the noise: they buy Bitcoin, announce it to the world, and watch their stock explode over 500% in months.

This wasn’t just a financial play. It was a narrative strike. And it worked.

In a liquidity-constrained environment, where headlines move faster than term sheets, your balance sheet isn’t just about yield, it’s about story. Metaplanet understood that. So did MicroStrategy. The question is: do you?

Satoshi, Saylor, Now Sakamoto: The Japan Angle

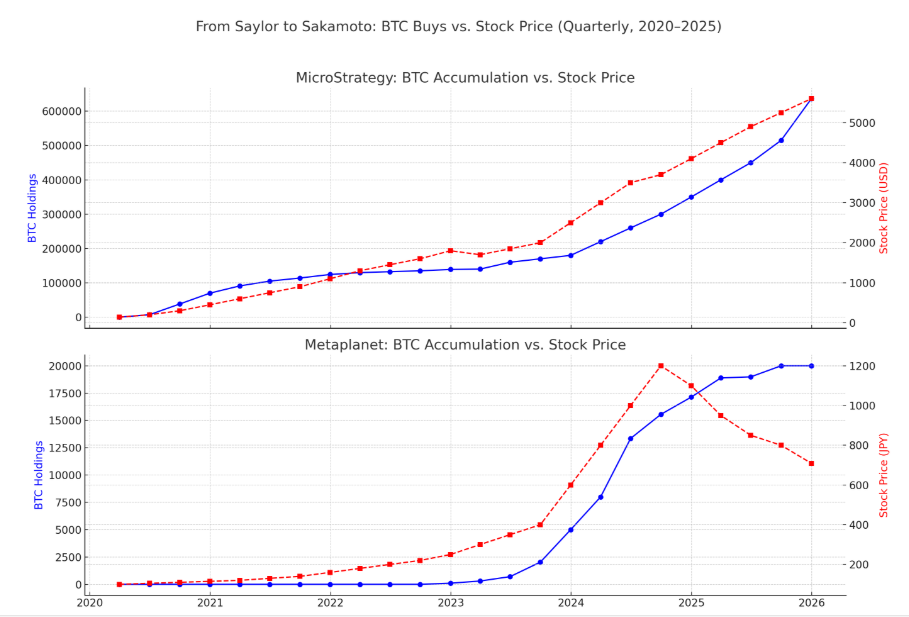

When MicroStrategy started stacking sats in 2020, the move looked insane, until it wasn’t. Michael Saylor turned his software firm into a Bitcoin proxy and rode the wave to global attention and billions in equity appreciation. Metaplanet is now playing a similar game, but with Japanese nuances.

Why does this matter for you as a Web3 founder?

Because it shows a pattern: small, under-the-radar companies using Bitcoin to punch above their weight. In Japan, where negative-yield bonds and yen depreciation are long-standing concerns, BTC isn’t just a hedge, it’s a nationalist counter-narrative.

In Web3, the equivalent is using BTC reserves to signal maturity, macro-readiness, and long-term conviction, especially in an industry drowning in vaporware.

Signal Over Yield: Why Founders Need to Think Like Narrative Investors

Let’s be blunt: your treasury isn’t earning squat in DeFi. Real yields are flat, stablecoins are depegging more often than ever, and ETH staking barely covers ops. But BTC? It’s not about the APY. It’s about signaling alignment with something bigger.

Holding Bitcoin as a Web3 startup is a strategic narrative move. It tells investors:

- You’re playing long cycles, not short hype

- You understand macro risk and fiat dilution

- You’re not naive about stablecoins or wrapped assets

Think of BTC as the digital gold standard for founders. It won’t make you rich on yield, but it might make you credible.

Treasuries Aren’t Just for Survival, They’re for Storytelling

There’s a reason why investors look at what’s on your balance sheet: it tells them what kind of founder you are. Are you hoarding USDC? Chasing LST yield? Sitting in ETH drawdowns?

Each asset carries a narrative:

- Stables = safe, but fragile; screams “short-term ops”

- ETH/LSTs = native, but volatile; suggests tech conviction

- BTC = sovereign, clean, and hedgeable; signals macro maturity

Your treasury isn’t just a runway buffer. It’s a strategic narrative layer. In a bear market, your capital posture is your pitch.

How to Use BTC as a Strategic Asset Without Playing Copycat

Not every startup needs to ape into Bitcoin like Metaplanet. But there’s a middle path:

- Reserve Allocation: Park a portion of idle stablecoin runway in BTC to diversify long-tail risk.

- Tokenomics Narrative: Anchor part of your treasury in BTC to signal long-termism in your whitepaper or pitch deck.

- Community Perception: Communicate your BTC reserve publicly to build trust among retail users and institutions.

The key? Don’t copy the play. Adapt the principle. Use Bitcoin not as a meme, but as a message.

The Market Moves Before the charts Do, and Before You Raise

In every cycle, conviction gets priced before liquidity flows. Metaplanet’s strategy worked because they acted ahead of consensus. Web3 founders must do the same.

If BTC goes on another macro run, projects with Bitcoin-based treasury signaling will look prescient. Those still rotating between stables and yield farms? Not so much.

Narratives shape capital flows before fundamentals do. In that world, Bitcoin is more than an asset. It’s a positioning tool. Use it wisely.